Higher-than-average rainfall forecast for Thailand and Vietnam will likely boost their fertilizer demand and consumption during the main application season between May and September. But high domestic fertilizer prices and low cash flow among some farmers may curtail their fertilizer spending.

Thailand will see 70-210mm of rainfall in April, according to the country's meteorological agency, which is 20pc above the 30-year average for 1981-2010. The southeast Asian country is expected to see 140-370mm of rainfall in May, 10-20pc above the 30-year average. The largest rice-producing region of Ubon Ratchathani province in the northeastern part of Thailand is expected to receive up to 250mm of rainfall in May, up from the 30-year average of 178.1mm.

Similarly in Vietnam, rainfall is expected to be 10-20pc higher than average between March and August 2021 in the northern and northern-central regions, according to reports from the country's national centre for hydro-meteorological forecasting. In the southern region, where the Mekong delta is located and paddy is grown, total rainfall is expected to be 5-15pc higher than average during March-May.

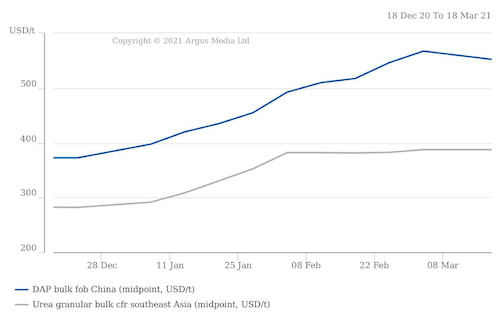

Thai fertilizer importers are positive that the favourable rain forecast will support agricultural activity and boost domestic fertilizer consumption during the main application season. But high fertilizer prices owing to the increase in international prices of phosphates and urea over the past few months, coupled with weak crop prices, may dampen domestic sales among farmers, local market participants said. China's DAP prices have risen by $180/t to an average of $552.50/t fob in mid-March from $372.50/t fob in mid-December 2020, while urea prices have surged to an average of $387.50/t cfr southeast Asia from $282.50/t cfr over the same period.

In the case of Vietnam, salt salinity issues in the Mekong delta region have been less severe this year, boosting agricultural activity and increasing farmer incomes in the first quarter. Recent export prices for 5pc broken rice have increased to $500/t in March 2021 from a quarterly average of $451.90/t during October-December 2020, latest World Bank statistics show. This has given farmers more cash flow, local market participants said. This will also likely further equip farmers with more cash flow for fertilizer spending during the upcoming main application season. But local fruit and vegetable demand, especially from hotels and restaurants, has decreased because the Covid-19 pandemic has affected these businesses since last year, impacting farmer incomes. As a result, NPK demand among fruit and vegetable farmers is expected to take a hit during the main application season.

These southeast Asian countries experienced severe drought-like conditions in 2019, which heavily impacted their agricultural activity and fertilizer consumption that year. Restrictions put in place last year to curb the spread of Covid-19 had also curtailed consumption, albeit to a lesser extent compared with 2019 because of more ample rainfall in the region during the monsoon season between May and September 2020.