Europe's temperature-adjusted gas consumption could partly rebound early this summer from a year earlier, although slower-than-hoped-for Covid-19 vaccination programmes in much of the EU have led governments to maintain or increase restrictions on public movement.

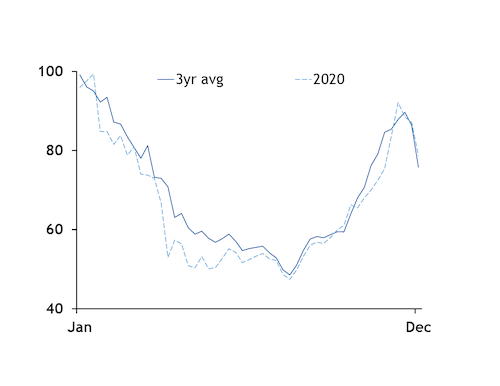

In a worst-case scenario, a further acceleration in the pace of infections, particularly involving one of the the new, more concerning strains of the Covid-19 virus, could lead to the re-imposition of lockdowns as stringent as in April 2020 — which could result in temperature-adjusted demand as low as last spring. But this is an unlikely outcome, as better precautions and greater familiarity with the virus have so far allowed lighter lockdowns than those of early 2020. These less stringent restrictions have allowed temperature-adjusted demand to remain stronger during the winter's lockdowns than it was during the spring of 2020.

Spring 2020 lockdowns slash demand

The first lockdowns, beginning in March-April last year, sharply curtailed people's movement and with it economic activity, which pared industry's overall energy consumption.

Power-sector gas demand was curbed across much of Europe by the overall decline in energy demand and high renewable output during an unusually sunny spring. Gas demand from refiners was hit particularly hard, as a sharp reduction in car usage left refined products storage brimming, forcing refinery shutdowns.

Overall, gas demand from industry and generators in Europe's six largest gas consuming countries fell in the second quarter of 2020 by nearly 5.9bn m³ on the year and 3.2bn m³ from the previous three-year average.

The largest declines were in power-sector gas demand in the UK and Italy, where deliveries to generators fell by 1.6bn m³ and 940mn m³, respectively, from a year earlier. Gas deliveries to Spanish generators were also down heavily from a year earlier, although they were broadly in line with the three-year average.

Spanish conventional gas demand was also down heavily, by about 1.05bn m³ from a year earlier. Spain's system operator combines industrial with space heating demand in its conventional measure, but separately publishes figures that indicate falling demand from industry accounted for 832mn m³ of this decline. One of the largest declines in the industrial sector was in refining, where demand fell by 160mn m³ from a year earlier in the second quarter.

Mixed picture for spring

Extended lockdowns across much of Europe continue to act as a drag on economic activity, but many industries have taken precautions against the pandemic that have allowed them to operate to a greater extent than during the first wave of the pandemic.

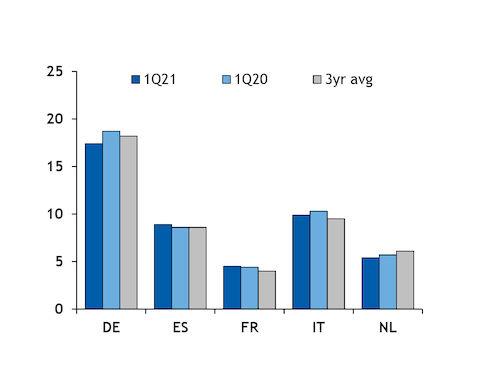

Where separate data is available, industrial demand has stepped slightly higher in the first quarter of this year from 2020 in several of Europe's largest economies. But this has been more than offset by weaker demand from the power sector, as higher gas prices during a much colder winter made gas-fired generation less profitable.

Gas deliveries to generators in the UK fell by 2.8bn m³ in the first quarter of 2021 from a year earlier. But aggregate demand from industry and the power sector in Europe's six largest economies was only 1.2bn m³ lower. Industrial demand in most countries remains below the three-year average, as economic activity remains below the pre-pandemic trend.

How demand evolves through the second quarter will depend on when countries feel able to relax their restrictions on personal movement. Many EU countries have not been able to vaccinate their populations at the pace they had previously hoped for, which may make them reluctant to ease lockdowns significantly until well into the summer. But some researchers have noted a robust correlation between higher summer temperatures and lower transmissibility of the virus, which may give some politicians the confidence to give their voters a break from the lockdown restrictions after a long winter.

By Matt Drinkwater

| Second quarter industrial demand | bn m³ | ||

| 2Q20 | +/- vs 2Q19 | +/- vs 3yr avg | |

| DE industry + generators | 11.63 | -0.36 | 0.04 |

| ES conventional | 4.87 | -1.05 | -0.82 |

| ES generators | 1.67 | -0.78 | 0.01 |

| FR generators | 0.55 | -0.23 | -0.03 |

| FR industry | 2.52 | -0.37 | -0.20 |

| IT generators | 4.69 | -0.94 | -0.52 |

| IT industry | 2.92 | -0.56 | -0.55 |

| NL industry + generators | 4.47 | -0.04 | 0.35 |

| UK generators | 3.32 | -1.61 | -1.56 |

| UK industry | 0.96 | 0.05 | 0.09 |

| Total | 37.60 | -5.90 | -3.19 |

| First quarter industrial demand | bn m³ | ||

| 1Q21 | +/- 1Q20 | +/- 3yr avg | |

| DE industry + generators | 17.42 | 1.32 | 0.80 |

| ES conventional | 7.71 | 0.08 | -0.12 |

| ES generators | 1.23 | -0.38 | -0.15 |

| FR generators | 1.11 | -0.04 | -0.22 |

| FR industry | 3.40 | -0.13 | -0.31 |

| IT generators | 6.32 | 0.28 | -0.20 |

| IT industry | 3.63 | 0.11 | -0.19 |

| NL industry + generators | 5.40 | 0.34 | 0.67 |

| UK generators | 1.34 | -2.76 | -4.34 |

| UK industry | 0.98 | -0.03 | -0.06 |

| Total | 48.55 | -1.22 | -4.12 |