Declining North Sea benchmark crude production is exacerbating concerns over the global crude marker's liquidity and future pricing.

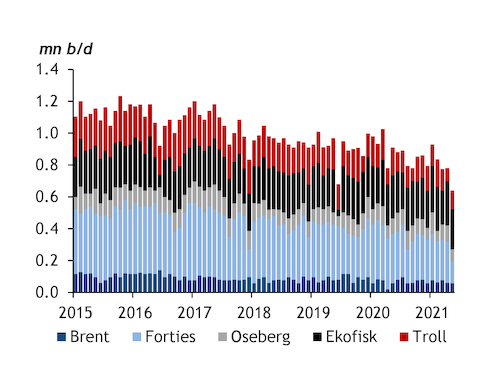

Combined output of Brent, Forties, Oseberg, Ekofisk and Troll — the five grades that underpin the North Sea Dated marker — fell to around 870,000 b/d last year, down by nearly a quarter since 2015 (see graph). Argus included Troll in the basket of benchmark crudes in June 2017. But the five grades' overall production slide shows no sign of abating. Benchmark crude loadings were scheduled at just over 845,000 b/d in the first quarter of this year, 14pc lower than during the same period last year.

Production of Forties, the largest benchmark grade, has been slipping for some time and is likely to continue to do so. Unstabilised Forties output dropped to under 355,000 b/d last year, down by a quarter since 2015, data from Forties Pipeline System (FPS) operator Ineos show. And the rate of decline is likely to accelerate this year. Unstabilised Forties output will average around 250,000 b/d in the first half of this year, Ineos forecasts, more than 35pc lower than a year earlier, partly because of declining production at mature fields but also because of a heavy maintenance programme. Ineos shut the Graben Area Export Line on 27 March for 8-10 days, affecting fields that feed into the stream. And a full FPS shutdown will run from 27 May-16 June.

The Forties decline is expected to continue in the second half of this year, with the Covid-19 pandemic weighing on North Sea investment. The start-up of the second development phase of the Buzzard field, the largest field on the FPS, has yet to begin, after it was delayed from the second half of 2020 until this year because of lower oil prices. Field operator CNOOC has not yet given a production start date for the development, and further delays are possible in the current climate. The project is expected to add 37,000 b/d, insufficient to offset the declines at other fields that feed into Forties this year.

Liquidity concerns

The volume of North Sea crude trade is still sufficient for price discovery, although market participants have voiced concerns over the future accuracy of price reporting agency Platts' Dated Brent benchmark and its Argus equivalent North Sea Dated, owing to the decline in the amount of crude underpinning the marker. This has prompted discussions around finding more robust pricing systems for light sweet crude in the region. Platts surprised the industry in February by announcing that it was converting Dated Brent into a delivered Rotterdam benchmark, incorporating US crude WTI, from July 2022. The announcement met enough opposition that Platts scrapped the plan two weeks later.

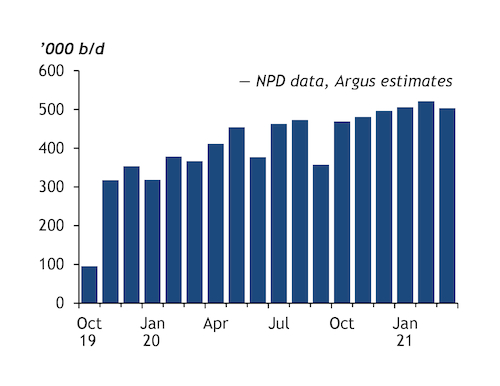

Some North Sea crude traders favour the inclusion of Norway's Johan Sverdrup into the basket of benchmark crudes. Johan Sverdrup is the only asset produced locally that is likely to be able to offset declines at other streams. Output was over 420,000 b/d in 2020, data from the Norwegian Petroleum Directorate show. And production is poised to climb after Norway's Equinor and its partners unveiled plans to increase the field's phase 1 capacity to 535,000 b/d by the middle of this year. Phase 2 of the development, which will lift capacity to 720,000 b/d, is due on stream in the fourth quarter of 2022.

But a key concern regarding the addition of Johan Sverdrup is quality. The grade is considered medium sour, with its gravity standing at 28°API and sulphur at 0.8pc. Some market participants say including a sour grade such as Johan Sverdrup in a basket of mainly light sweet crudes is likely to mean that Dated will no longer be a light sweet benchmark.