Gas stocks at sites operated by Italy's largest storage firm, Stogit, could fall short of the 1 May minimum target for peak and flat capacity.

Inventories — excluding stocks held by system operator Snam for its balancing service — were 2.48bn m³ this morning, well down from the three-year average for the date of 3.16bn m³ although still above the 2.26bn m³ in 2018.

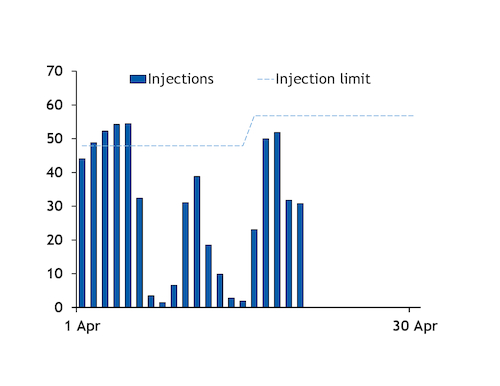

Aggregate injections stepped up to 37.5mn m³/d on 16-20 April from an average of 26.7mn m³/d on 1-15 April, as weaker consumption freed up more supply to add to storage. But injections were still well short of the three-year average for the entire month of 56.1mn m³/d (see graph). Unseasonably cool weather following low consumption over the Easter holiday period has bolstered demand this month, while power sector gas burn has also risen, leaving less supply available for injections.

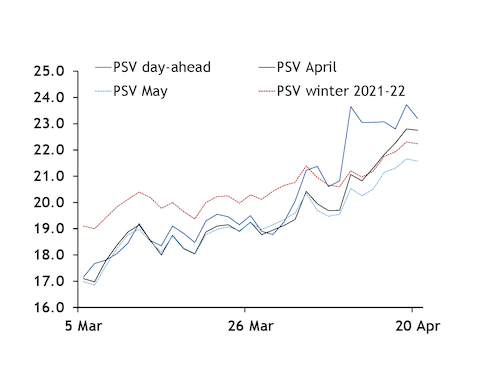

PSV prompt prices held above the winter 2021-22 price on all but one day on 7-20 April, discouraging especially quick injections.

But the prospect of incurring penalties for missing the minimum stock target for the end of this month — 3.3bn m³ — has encouraged firms to maintain injections, unlike in other European markets where persistent cold weather has prolonged the stockdraw.

Besides limitations to daily commercial injection capacity, Stogit sets monthly minimum and maximum stock targets which are intended to ensure that the stockbuild is distributed roughly evenly over the injection season (see Stogit data & download). Capacity holders would have to pay fines of around €0.50/MWh if their individual inventories fall below minimum targets. This would be in addition to variable costs levied by the operator on stock movements (see tariffs data & download).

The PSV balance-of-April price was €0.515/MWh above the front-winter contract, and €1.175/MWh above the May price, at yesterday's close (see graph). This suggests a limited incentive for firms to inject strongly over the rest of the month to make up for the shortfall.

If stocks enter May at a significant deficit to the lower end of the target firms would need to inject quickly next month to reach the minimum target for 1 June of 4.56bn m³.

Stogit may choose to adjust the limit — as it did in 2017. The operator also has the option of using an out-of-bound flexibility service to allow firms to reduce their stock requirements.

In any case, warmer weather over the rest of April could leave more supply available to add to storage.

Overnight temperatures in Milan were today forecast to fall to 2.8°C tomorrow from the 4.6°C expected today, before rising to an average of 7.3°C on 23-30 April, just below the seasonal norm for those dates of 8°C.