Higher steel prices driven by seasonal demand in Russia have rekindled Moscow's consideration of stricter restrictions on ferrous scrap exports. But scrap market participants warn that any further restrictions will devastate the country's scrap export industry.

Moscow's plans

Russia's ministry of industry and trade late last week announced a set of "short and long-term measures to stabilise steel prices" in response to a renewed increase in domestic prices — particularly for long products — in March-April after a significant rise in November-January.

The ministry said it may impose a €90/t ($108.50/t) duty on ferrous scrap exports, up from a 5pc levy or a minimum of €45/t now. Other options such as reinstating export quotas, an export licensing system or measures to reduce the incentive to export could also be introduced.

All proposed measures, including those "long-term systematic measures", may directly impact the Russian steel market, as they could be combined with government moves to ban exports of certain steel products, direct volumes to state-run projects, or tax steelmakers based on indicative domestic selling prices.

The ministry describes the measures as "suggestions" and said it remains in favour of using market tools to solve any problems. It is also considering a ferrous scrap export duty that is proportionately aligned to global scrap prices, market participants said.

The sharp steel price increase in November-January drove buyers to file multiple complaints through industry associations and unions, resulting in the government trebling its ferrous scrap export duty to €45/t for six months.

Scrap suppliers hit back

Russian scrap market participants argue that the government's approach to the matter is inconsistent and overly influenced by lobbying by steelmakers, who they claim use incomplete or incorrect data to reflect the domestic ferrous market.

"There is little connection between exporters' dockside prices and domestic steel prices," a scrap trader said. "This was totally proven when they tripled the export duty. The new duty that has been imposed already for three months was supposed to limit any rise in domestic scrap prices, which was suggested as one of the reasons why steel prices spiked. But what we have now is a collapsed export market and yet still high domestic scrap and steel prices."

Russian scrap export sales fell by almost a quarter on the year in January-March. Exports were 55pc higher on the year in January, but subsequently fell because of the increased export duty.

Steelmakers' scrap receipts rose in the first quarter but slowed in February and March (see table). The fall in deliveries was a result of attempts by mills to reduce prices in the first three weeks of February and moves by suppliers in late February-March to hold back from making offers on expectation of a rise in prices.

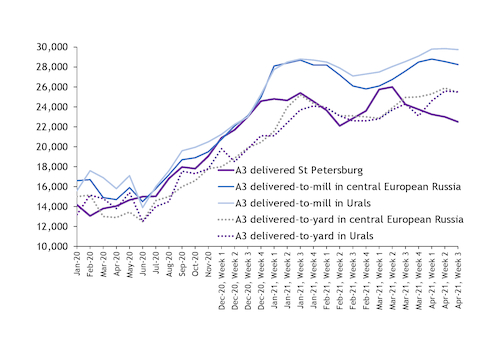

The spread between St Petersburg exporters' bids and steelmakers' domestic scrap purchase prices widened as mill prices rose to fresh multi-year highs on 1 April.

"Higher prices obviously helped to keep scrap flows stable," a scrap exporter said. "But there was no reason to lift prices as much as mills did. They raised steel prices and blamed — in a retrospective way — scrap prices and exporters. But this is nonsense — we have nothing to do with domestic rebar or hot-rolled coil prices."

Russia's federal anti-monopoly watchdog FAS yesterday opened three investigations against major vertically integrated steelmakers Severstal, MMK and NLMK over concerns that they have settled and deliberately maintained high prices for hot-rolled products. "The rise in prices occurred at a faster pace than the increase in prices for raw materials required for steel production," FAS said.

This followed the opening of a FAS investigation last week into several large construction steel and flat steel traders on suspicion that they made cartel agreements and unreasonably raised spot prices in the fourth quarter of 2020.

Any increase in Russia's ferrous scrap export duty — either to €90/t or so that it is linked to global scrap prices — will inevitably lead to a contraction in scrap collection throughout the country, but particularly in regions that have sporadic or minimal-to-no demand for scrap from steelmakers, scrap industry association Ruslom said.

"In other words, it will pretty much guarantee to devastate the scrap industry to a great extent. But it undoubtedly will not help to curb domestic steel prices," the association told Argus.

| Russian ferrous scrap shipments | 000t | |||||||

| Jan-21 | ±% Jan 20 | Feb-21 | ±% Feb 20 | Mar 21 | ±% Mar 20 | 1Q21 | ±% 1Q20 | |

| Collection | 1,858.0 | 79.9 | 1,763.0 | 22.3 | 1,819.0 | 4.4 | 5,440.0 | 29.0 |

| Consumption | 1,393.0 | 32.2 | 1,662.0 | 9.3 | 1,823.0 | 4.6 | 4,878.0 | 13.0 |

| Exports | 485.0 | 55.0 | 121.0 | -36.3 | 58.3 | -548.9 | 664.3 | -24.6 |

| — Ruslom | ||||||||