The South Korean coal market rebounded this week owing to strength in regional coal prices and firmer freight rates. But the outlook for coal burn remains weak amid the ongoing voluntary restrictions on state-owned coal plants.

Argus assessed NAR 5,800 kcal/kg coal $1.41/t higher on the week at $89.14/t cfr South Korea, which equates to $93.44/t on a NAR 6,080 kcal/kg basis. But the equivalent fob Newcastle assessment edged lower by 66¢/t on the week to $71.65/t, as Australian prices remain under particular pressure from the China embargo and weakening Indian demand.

Most coal prices in the Asia-Pacific market, especially Russian fob prices, strengthened this week, while firmer freight rates lent additional support to delivered South Korean prices.

Dry bulk freight from Newcastle to China's Zhoushan was last assessed at $18.90/t on 29 April, up by $2.25/t on the week. Higher freight costs also supported India-delivered prices, despite the ongoing lockdowns and second wave of Covid-19 in India.

In South Korea, ongoing voluntary restrictions on the use of the five Kepco utilities' coal plants may continue to limit coal-fired power generation this spring. The utilities have been set individual targets to cut their annual coal output by 18.0-23.8pc compared with the 2017-19 average, which may reduce Kepco's coal-fired generation by 3.8TWh or 2.2mn t of NAR 5,800 kcal/kg-equivalent coal burn on the year in 2021 if enacted, according to Argus analysis.

And recent strength in oil prices is set to lift oil-linked LNG import costs as the year wears on, which could incentivise utilities to minimise coal burn during the spring and profile more generation over the summer and autumn, when coal is likely to be most competitive with gas. One source familiar with the matter told Argus that one of the utilities that was assigned a relatively large reduction target will concentrate their restrictions during the April-June period.

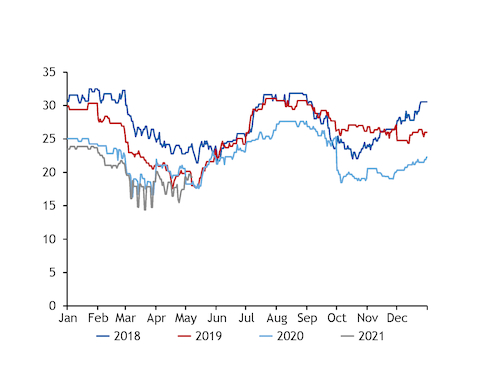

The latest maintenance schedule published by the Korea Power Exchange (KPX) shows that voluntary restrictions will average 3.55GW during 1-7 May, compared with 2.29GW a week earlier.

An unseasonably warm spring forecast in South Korea could also weigh on power demand and coal-fired generation in the short-term, although peak power demand is trending higher than a year earlier as the economy recovers from the impact of the pandemic.

KPX says there is around a 70pc chance that May temperatures will be above the 17.0-17.4°C long-term seasonal average, according to its monthly power forecast report.

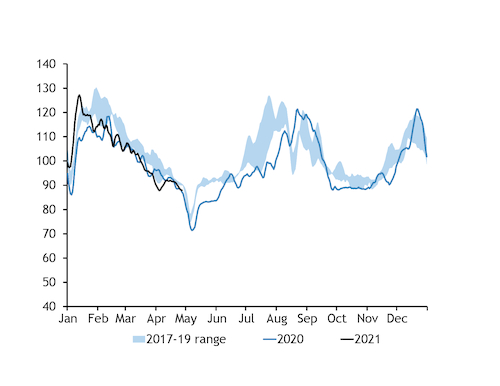

The report also shows that daily peak power demand in South Korea will increase by 6.8pc on the year to around 70.2GW next month as last year's power demand was dented by the pandemic. But this will still be lower compared with the 2017-19 average of 71.6GW.

South Korean peak power demand typically ramps up to its seasonal summer high over June-July, and this year the rise will coincide with weaker nuclear availability, which could boost power-sector coal burn towards the end of the second quarter.

Japanese outlook weak

Japanese-delivered coal prices were mixed this week, with netforwards from Australia weakening but costs from Russia, Indonesia and South Africa all rising.

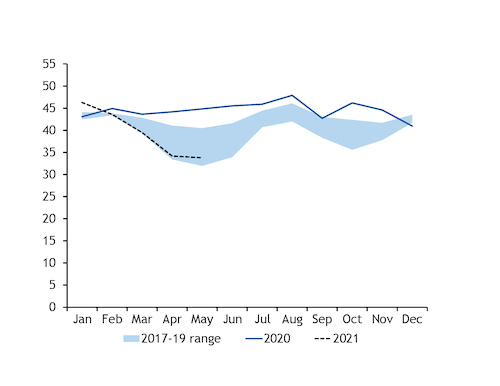

Coal-fired generation is likely to be capped by weak seasonal power demand, firmer nuclear availability and an increase in coal-fired capacity restrictions in the coming weeks.

Since spiking in January amid freezing conditions, national power demand has trended in line or lower than last year's historic low, with economic restrictions to curb the spread of Covid-19 still in place. And demand will drop further to its seasonal low early in May due to the Golden Week holiday.

The return of the Takahama 4 nuclear reactor earlier this month now means only two of Japan's nine reactors are off line, with nuclear generation set to reach a 15-month high in May.

And capacity availability across the Japanese coal fleet is scheduled to rise sharply on the year and be more in line with 2017-19 next month, which should further limit upside for coal-fired generation.