An unseasonably warm outlook in northeast Asia and tight supply of high-calorific value (CV) coal supported South Korean prices this week.

Strong Chinese demand for Russian and Indonesian coal continues to constrain availability, while low stocks in South Africa and rail disruption affecting Cerrejon in Colombia have also squeezed high-CV supply globally.

Loadings from Newcastle have shown signs of recovery but remain lower than pre-pandemic levels. Around 450,000 t/d loaded on 1-10 May, according to shipping data collated by Argus, up from 423,000 t/d a year earlier, but down from 550,000 t/d in 2019.

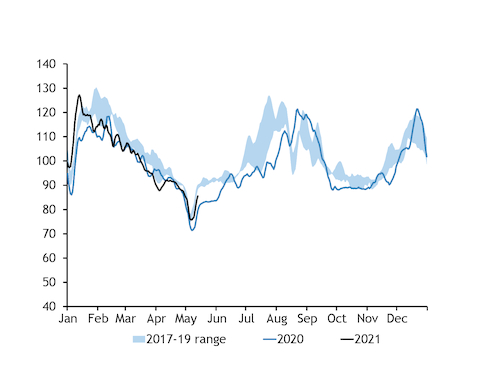

Supply is tight at a time of strong power demand in South Korea and ahead of an expected rise in seasonal power demand and coal-fired generation in the coming weeks and months. Seven-day average daily peak power demand of 62-63GW is up from 58.5GW a year earlier and above the 2016-19 range, reflecting above-average temperatures and recovering economic output.

The Korea Meteorological Administration has said there is a 40pc and 70pc chance of above-average temperatures in June and July, respectively, which could give a further boost to overall power demand for cooling. This would come at a time of lower nuclear availability on the year and minimal restrictions on coal plants, while gas prices are also rising, which should make coal increasingly competitive for power generation.

Coal-fired generation is already likely to be ramping up, with fewer capacity restrictions enabling utilities to dispatch coal to meet stronger demand.

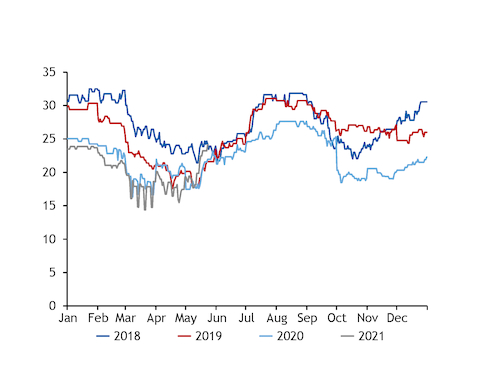

Korea Power Exchange data show that 11.9GW of Kepco coal capacity will be unavailable on 15-23 May, down from 14.5GW a week earlier. This includes the 500MW Boryeong 1 and 2 units and 560MW Samcheonpo 1 and 2 units, which have been permanently retired.

Of the remaining 9.8GW unavailable next week, 1.2GW can be attributed to voluntary suspensions among state-owned Kepco's utilities, down from 2.6GW this week.

A number of tender awards were also made this week. State-run Korea East-West Power bought a NAR 5,800 kcal/kg July-loading Capesize shipment at $89-90/t fob Newcastle on a NAR 6,080 kcal/kg basis and a NAR 5,700 kcal/kg Capesize cargo at $91/t fob Gladstone on the same basis.

Korea Midland Power was understood to have awarded two July and August-loading Capesize cargoes of NAR 5,800 kcal/kg coal at $83-84/t on a fob Newcastle NAR 6,080 kcal/kg basis.

Japan

Strong Asian fob coal prices and freight rates also boosted Argus' Japanese net-forward prices this week.

The demand outlook for the spring shoulder months looks a little weaker than in South Korea, with 15.6GW of coal-fired capacity scheduled to be unavailable this month and 10GW in June because of planned stoppages.

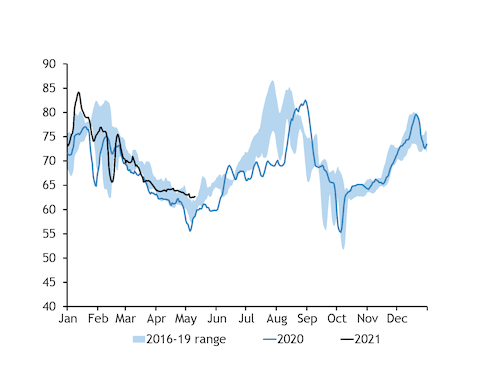

And overall power demand has not grown on the year as it has done in South Korea in recent weeks, creating further headwinds for coal demand.

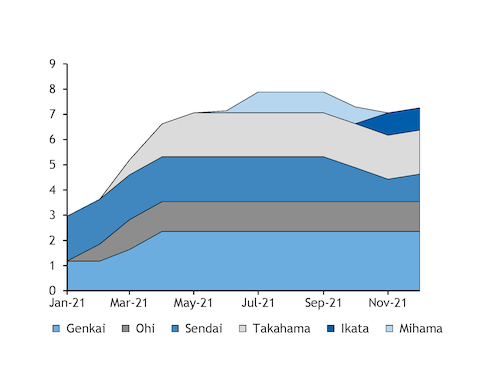

Nuclear availability is also expected to be much higher this summer than last, with the planned restart of Kansai Electric Power's Mihama 3 reactor at the end of June creating additional downside risk for fuels demand. Availability of 7.9GW over July-August will be up from less than 5GW in the same months of 2020.

But the outlook for a warm summer still means there is a need to restock, especially following a spell of strong coal-fired generation over the winter, which left stocks around 1mn t lower on the year at the end of January at 7.2mn t.