US refiners harried by hurricanes, arctic storms and the Covid-19 pandemic are hoping that consumers return to the roads for a fuel-guzzling summer.

Refiners have been raising throughput rates closer to pre-pandemic levels to supply gasoline and jet fuel to travellers escaping a cloistered 2020. "Because people have felt trapped in their home for a year now, they will spend more of their discretionary income on experiences like vacations, rather than things," Valero chief commercial officer Gary Simmons says. "Everything domestically on the gasoline front looks good."

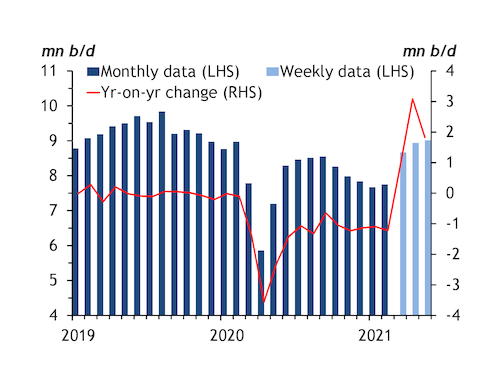

Hopes that gasoline demand would rise over the summer last year fizzled as crowded beaches at the start of the driving season gave way to rising case counts. But progress on vaccinations — 60pc of adults have received at least one shot, and 48pc are fully vaccinated — has fuelled confidence for this season. Gasoline demand climbed to 9.2mn b/d in the week to 14 May, within 2.2pc of 2019 volumes. Consumption in the same week last year was 28pc down on 2019.

Winter storms helped drain midcontinent gasoline stocks ahead of the summer season. US Gulf coast gasoline stockpiles refilled with this month's Colonial Pipeline shutdown because of a ransomware attack that cut off a key outlet for the region's refiners. But rising Covid-19 cases in Latin America have not reduced US gasoline exports to that region.

Still, refiners cannot set their plans around a summer surge, Marathon Petroleum warns. A new normal for office commutes, air travel and global transport demand lies on the horizon. "We are excited that it continues to get better but we are also cautious as to what it is going to mean, once we get to the other side of this," Marathon Petroleum chief executive Mike Hennigan says. "How much of it is robust, to stay long term, and how much of it is just short term for people trying to get out from under lockdown conditions?"

Cap and trade

US crude refining capacity has fallen by 840,000 b/d compared with before the pandemic and reductions will approach 1mn b/d in 2024. The refineries that have halted operations over this period imported on average 290,000 b/d in 2019, before measures imposed to limit the spread of Covid-19 distorted demand. That included just over 90,000 b/d of Saudi imports.

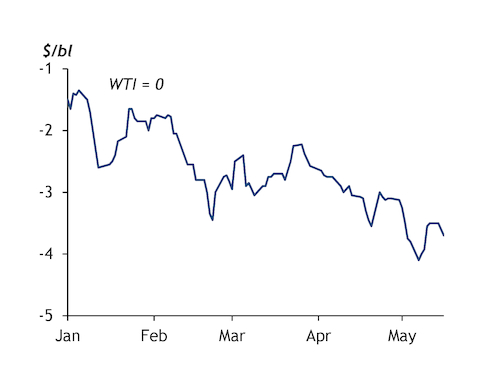

Complex refiners that are still operating are hoping that a demand rebound this summer will help revive sour crude imports, leading to an increase in supply that will widen sour crude discounts in the second half of the year. Discounts for Canadian WCS heavy crude in Houston have widened steadily against Nymex WTI this year, reaching about $3.60/bl this month. Production shut-ins because of falling demand helped narrow the discount to about $1.90/bl on average at the beginning of this year (see graph).

Federal fuel mandate decisions could lead to the closure of more domestic refining capacity. The cost to refiners and importers of complying with the Renewable Fuel Standard has soared above 22¢/USG — 10 times the prices recorded two years ago. Uncertainty over how President Joe Biden's administration will apply the requirements to blend minimum volumes of renewables into the gasoline and diesel pools has helped push prices for credits used to prove compliance with the law to record highs.

Biden's administration made clear earlier this year that it expects far fewer waivers of those requirements granted to small refineries than under former president Donald Trump. Marginal operators lacking the scale to blend fuels or pass costs on to customers will face new pressure.