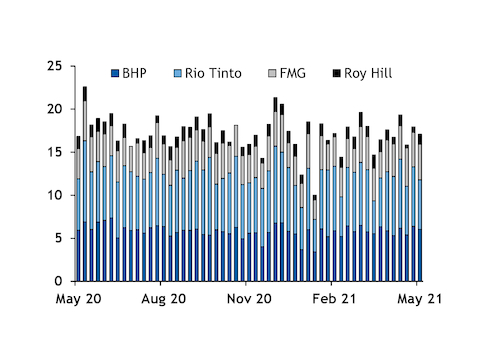

Port problems at Australian iron ore producers Rio Tinto and BHP moderated total shipments from the four largest iron ore producers in the Pilbara region of Western Australia (WA) in the week to 29 May.

The four largest WA producers — Rio Tinto, BHP, Fortescue Metals and Roy Hill — loaded vessels with a combined total of 17.09mn deadweight tonnes (dwt) of capacity in the latest week, down from 17.93mn dwt in the week ending 22 May. Loadings were 1pc below the average of 17.25mn dwt/week over the past year, with Rio Tinto not shipping anything from its East Intercourse Island (EII) berths at Dampier and BHP experiencing problems at its Nelson Point terminal at Port Hedland.

The deadweight tonnage is the maximum capacity of the vessel and overestimates actual shipments by around 5pc.

Rio Tinto loaded vessels with 5.77mn dwt capacity in the week to 29 May, down from 6.91mn dwt the previous week and 14pc below its annual rolling average of 6.72mn dwt/week. The firm has loaded no iron ore at its 45mn t/yr EII terminal since 20 May. EII took a break for 10 days from loading ships in March, after a fire broke out in the screening house for the berth. The firm took the opportunity during the closure to undertake maintenance with a view to catching up on lost exports, but the terminal is now closed again. Rio Tinto declined to comment.

BHP shipped 3pc above average in the most recent week at 6.02mn dwt, down from 6.38mn dwt the previous week, despite its usual ramp-up ahead of the end of its financial year on 30 June. BHP did not ship from its Nelson Point A berth between 23 May and 1 June. The firm did not comment, but it has been working on upgrades to port facilities to increase its operational flexibility.

Roy Hill shipped 1.19mn dwt, up from 622,000 dwt in the week to 22 May and 4pc above its rolling average of 1.15mn dwt. Roy Hill returned to normal exports after its major quarterly maintenance programme finished last week.

Fortescue continued its six-week run of above-average exports at 4.11mn dwt, up from 4.02mn dwt the previous week and 16pc above its weekly average of 3.56mn dwt. Fortescue has had a very strong May and is likely to continue to push exports ahead of the end of its fiscal year on 30 June.

China was listed as the destination for 70pc of shipments in the latest week, down from 84pc a week earlier. After including shipments with unconfirmed destinations — most of which are probably headed to China — the percentage was 77pc, down from 86pc a week earlier and below the average of around 82pc.

Argus assessed the ICX iron ore price at $209.30/dmt cfr Qingdao on a 62pc Fe basis yesterday, up from $188.55/dmt on 27 May but down from a high of $235.55/dmt on 12 May. Over the medium term, this was up from $167.45/t on 1 April and $159.90/t on 31 December.