European gasoline exports were steady on the month in May, as lower transatlantic demand was offset by a rise in shipments to west Africa and destinations east of the Suez Canal.

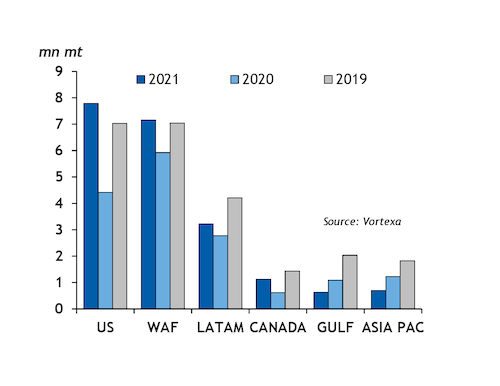

Approximately 4.6mn t of European gasoline was exported last month, compared with 4.5mn t in April, according to Vortexa data. May's shipments were up by over 70pc from the same time last year during the height of the Covid-19 pandemic but they were 13pc below May 2019 levels.

Exports to the US fell to a three-month low of 1.6mn t in May, down by 7pc on the previous month but flat on the same period in 2019. Transatlantic demand for European gasoline hit year-to-date highs in March and April, helped by an arctic storm dramatically curtailing US supply. But US gasoline output has steadily increased since then, reaching a Covid-era high of just under 16mn b/d in the first week of June, according to the latest EIA data. The US looks well-supplied this month, with domestic gasoline stocks rising by 3pc to a near four-month high of 241mn bl in the week to 4 June, 2.6pc higher than in the same week of 2019.

Meanwhile, European exports to Latin America fell by 29pc on the month to around 550,000t in May, but this was 10pc higher than the same time in 2019. Shipments to Canada followed the opposite path, up by 30pc from April but 36pc lower than May 2019 at nearly 310,000t,

The month-on-month fall in transatlantic demand was offset by a rebound in shipments to west Africa to 1.2mn t. Although this was nearly half the volume shipped to the region in the same period two years ago, it was 19pc higher than April's nine-month low of 1mn t. Rising margins for European gasoline has capped west African demand in recent months. Benchmark Eurobob oxy gasoline averaged a $9/bl premium to front-month Ice Brent crude futures in both April and May, the widest monthly average since August 2019. Relatively low exports to the region pushed gasoline inventories in major importer Nigeria to a nine-month low of 1.34mn t as of 1 June, according to figures from the country's Petroleum Products Pricing Regulatory Agency (PPPRA).

European gasoline exports to destinations east of Suez were also higher in May than the previous month. Departures to the Mideast Gulf reached a four-month high of just over 180,000t, while shipments to Asia-Pacific hit a three-month high of 160,000t. Firm demand from Indonesia, Asia-Pacific's largest gasoline buyer, and a decline in Chinese exports have helped to drive light distillate stocks in Singapore, which mainly comprise gasoline, to a five-week low this week. China is expected to reduce its exports further this month on the back of higher domestic prices.

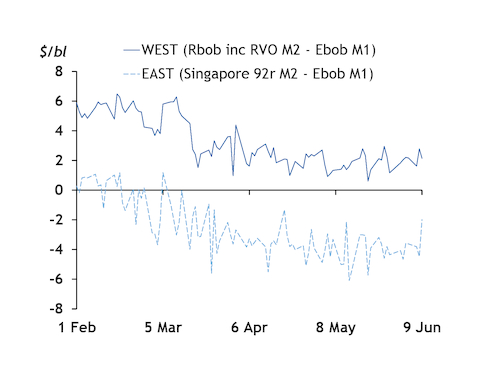

The unplanned shutdown of a fluid catalytic cracker at Reliance Industries' 580,000 b/d export-oriented refinery at Jamnagar in India and a 127,000 b/d residual fluid catalytic cracker at Abu Dhabi state-owned Adnoc's 417,000 b/d Ruwais 2 refinery complex should keep gasoline supply east of Suez relatively tight this month. The eastbound arbitrage has been closed on paper since March. The Singapore 92 Ron gasoline swap averaged a $4/bl discount to Eurobob oxy swaps last month, the widest discount since August 2019. But the spread has since tapered to a $1.98/bl discount yesterday, the narrowest in about two months.