Minor metal prices in Europe and the US face further upside risk as a global container shortage and high freight rates coupled with seaborne and inland bottlenecks lead to a worsening of Chinese shipment delays and tighter spot supply.

China's industrial revival since December has severely constrained the availability of shipping containers to transport goods from Asia to Europe and the US, directly pushing up costs for metals including manganese flake and tungsten (APT). Overall, freight rates have risen to $6,957.44 on 17 June, from $3,500 on 3 December, according to the Drewry's World Container Index.

European manganese flake traders currently peg container freight costs at around $8,000/unit, equating to almost $300/t of flake, up from around $200/t a month ago. And container freight costs for tungsten have increased to around $10,000/unit for exports from China, according to one European trader, while another trader noted quotes as high as $12,800/unit compared with $2,200/unit in November 2020.

Another supplier of high-temperature metals to the superalloy market said container costs — which hovered at around $500 for some time — have now jumped to $10,000/unit for metals transport from east to west. Routes from the EU to the US or Asia-Pacific remain largely unaffected.

Some buyers have even requested that certain metals be air freighted for immediate consumption, which would incur a premium to spot market prices.

Congestion in China's southern ports, including Yantian, and dwindling availability of shipping vessels are further straining flake exports to Europe, market participants said. While most of the problems initially were about container availability, finding a vessel is also now an issue, they said.

"We had 11 vessels a day ago that we were supposed to catch. But now [material for export] is sitting in containers in the loading port in China and there is no vessel," a trader said.

Some market participants are exploring alternative options to move material to northern ports in China, such as Tianjin, keen to avoid worsening congestion in the south. But this is increasing lead times and delaying shipments to Europe.

Furthermore, the US is facing a shortage of trucks and drivers in the wake of Covid-19 restrictions, hampering inland transportation of metals. This bottleneck coupled with the global container shortage is delaying some metal shipments from China by around three months, a trader said.

Shifting risk: fob versus cif

Climbing freight rates and delays are causing shifts in trading behaviours, with sellers of some metals increasingly wanting to offer on a fob basis rather than cif.

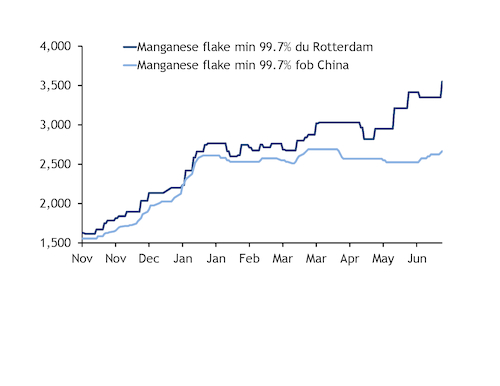

"Most are offering fob, as they do not want to take freight risk now, so push it onto the buyer," one trader said, when asked if offers were on a cif or fob basis to Europe. Cif offers have also risen sharply, with most participants quoting manganese flake at $3,100/t, up from $2,900/t two weeks ago.

There is "reluctance" to offer APT on a cif basis and many suppliers are only offering on a fob basis, which shifts the risk onto the buyer, another trader confirmed, warning that this is likely to push up spot prices for tungsten intermediates in the short term.

So far, the delays have already pushed up European prices for 99.7pc grade manganese flake, with offers currently hitting $3,100/t cif, up from $2,900/t two weeks ago. The European market is already very tight, with supplies hit earlier in the year because of delayed shipments from China and the Suez Canal blockage. Prices on a prompt basis were assessed at $3,500-3,600/t duty unpaid Rotterdam on 17 June, up from $2,990-3,070/t at the beginning of the second quarter.

Overall, metals trade has been widely hit by supply shortages, resulting in lower spot liquidity and sparse trading activity in recent weeks. Some traders have been unwilling to sell because Chinese supply has been disrupted for the past few months, fearing that if they do sell they might then be compelled to purchase fresh material at higher prices to cover their long-term contract commitments. "Nobody wants to be the one caught out in the European market right now," a manganese flake trader said.