Liquidity on the shared Germany VTP (Trading Hub Europe) is likely to increase following the merger of the country's two existing market areas, outpacing the UK's NBP, European Federation of Energy Traders' (Efet) Germany director Barbara Lempp told Argus.

Efet expects the new market's liquidity to rise from current combined liquidity at Germany's Gaspool and NCG market areas following their scheduled 1 October merger, as the number of buyers and sellers will increase, Lempp said.

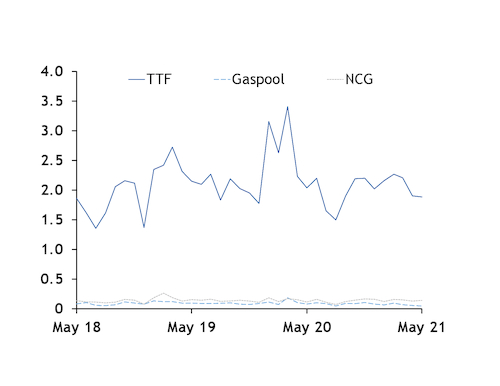

The Germany VTP will be able to compete with the Dutch TTF — by far Europe's most liquid hub — and will not be perceived as its "tiny little brother", she said (see TTF liquidity graph)

"There is no LNG terminal in Germany yet, but the market will be huge and is connected to so many other markets, putting it in a good position to become a very liquid hub," Lempp said.

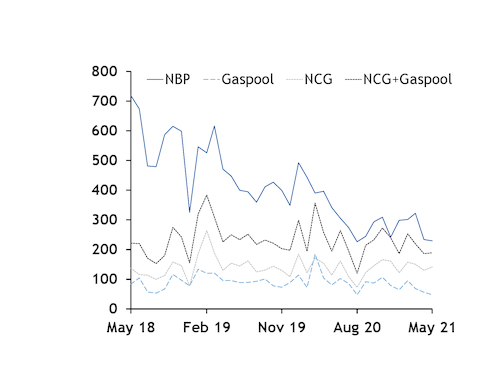

And Germany's liquidity could outpace the UK's, as it represents a larger and better connected market than NBP. "But it's not a zero-sum game. We hope liquidity will improve on all hubs," Lempp added.

NBP liquidity has dropped in recent years, with traded volumes rising sharply at the TTF. But liquidity at NCG and Gaspool have remained broadly unchanged (see NBP liquidity graph).

Better connections with neighbouring countries and an increase in participating traders from abroad, mostly from central and eastern Europe, will drive higher German liquidity, according to Efet.

And increasing German gas demand could further boost liquidity, as the country's nuclear and coal phase-outs progress and lift the call on gas-fired generation, Efet said.

That said, some market participants have expressed doubts about increased liquidity at the Germany VTP, with some preferring to rely on the dominant TTF for its liquidity. Trading opportunities between NCG and Gaspool will also dry up following the merger.

No change to storage needed

Efet does not expect the merger to have any fundamental effect on the business case for storage use or changes to utilisation of storage.

All sites have been assigned to different congestion zones, even though some are currently connected to both Gaspool and NCG. And the majority of market participants polled by Efet do not see any opportunities for storage fee redesign. The association does not expect any impact on storages in countries neighbouring Germany.

"Theoretically, grid fees at the border could rise and that would of course hit trading. But in practice we have not seen such a rise yet," Lempp said. German capacity fees are to increase in October-December, but will fall again from January 2022, between current NCG and Gaspool capacity fees.

There are currently no plans to discontinue or mothball German storage sites, although some are planned to be converted to high-calorie gas from low-calorie gas in the coming years. That said, the development of a hydrogen market could change these plans.

Some work remains

Most of the work required to complete the merger has already been carried out, Lempp said.

The new market area's manager now allows shippers to transfer balancing accounts from those at the NCG and Gaspool into the new Germany VTP system, Lempp said. NCG and Gaspool balancing codes will be discontinued following the merger, with only the new balancing codes active from 1 October. Some minor doubts remain around the precise definitions of constraint management and balancing products, but these will be clarified in the coming weeks, according to Efet.

"In trading you never have 100pc certainty, and we are familiar with the risks. But traders have 90-95pc certainty about the merger," Lempp said.

The merger has been a complex undertaking, and it will result in some bottlenecks within the new market. "One of the tools to manage these bottlenecks is for the market area manager to tap into locational flexibility through market-based instruments," Lempp said.

The introduced market measures and an overbooking and buyback system are intended to offset a sharp drop in the firm, freely allocable entry capacity into the German grid.

"Operators, market participants, regulators and shippers have found very good solutions to these challenges, but it shows how complex such projects can be," Lempp said.

The introduction of some virtual interconnection points (VIPs) for the new market area has been postponed until 1 April 2022 because of the complexity of setting up the new VIPs.