US president Joe Biden is showing himself to be a political pragmatist when it comes to oil and gas infrastructure, supporting tougher environmental reviews for new pipeline plans, but stepping in to prevent actions that could drive up energy prices — and invite political blowback — in the near term.

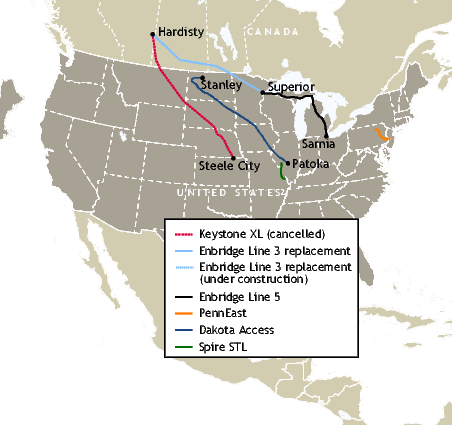

His administration at the end of June began the court defence of a permit that would allow Canadian midstream firm Enbridge to replace its 760,000 b/d Line 3 crude pipeline, a conduit for Canadian oil sands that Washingtonsays is "dangerously deteriorating". In the same week, a separate court threw out the remainder of a lawsuit attempting to close the 570,000 b/d Dakota Access pipeline, after the White House opposed shuttering the line despite flaws with a key easement.

The administration has also aligned with the gas industry in a case before the US Supreme Court, which last week prevented states from using their land holdings as an effective "veto" against the construction of natural gas pipelines. The court's 5:4 decision removes one permitting hurdle for the $1.1bn PennEast pipeline and other projects cutting through states — such as New York and New Jersey — that oppose new gas infrastructure.

Such actions should ease industry concerns that Biden would align himself too closely with climate activists who have waged a years-long legal campaign targeting the closure of midstream infrastructure. They also show that after the gasoline shortages and negative headlines caused by May's ransomware attack on the 2.5mn b/d Colonial Pipeline, the pressure to keep energy prices affordable that has guided White House policy for decades is alive and well. Biden has already devoted considerable political capital to blocking increases in gasoline taxes as part of negotiations on infrastructure spending. "There is no gas tax," he says. "Working families have already paid enough."

But energy price considerations, and the risk of being blamed by Republicans for price shocks, are less of an issue for pipelines still at the planning stage or not yet operational. That has freed Biden to deliver on campaign promises to apply more scrutiny on new lines designed to operate well past 2050 — the year when he says the US economy should be achieving net zero carbon emissions.

Biden blocked the 830,000 b/d Keystone XL crude pipeline on his first day in office, and is starting to pursue more extensive federal reviews of other planned lines.

Tunnel vision

Enbridge's plan to build an underwater tunnel in Michigan for a rerouted section of its existing 540,000 b/d Line 5 crude and natural gas liquids pipeline will be subject to greater scrutiny. The US Army Corps of Engineers says the project will require the most extensive type of review under environmental law Nepa, following requests from tribes and state officials. Enbridge says this will delay permitting for the project, which is meant to address safety concerns by replacing sections that lie exposed on the bottom of the Great Lakes.

Separately, a federal court recently offered more support for pipeline regulator Ferc to revise a 1999 policy governing natural gas pipeline approvals. The DC Circuit Court of Appeals last month threw out the agency's 2018 approval of the $220mn Spire STL gas pipeline now serving customers in Missouri. The court said the agency failed to "look behind" the single long-term gas contract supporting construction of the project, which Spire STL struck with an affiliated utility company. Ferc chairman Richard Glick, a Democrat, is citing the decision to support a proposed new Ferc policy for assessing the public's "need" to approve pipelines, ahead of proposed changes floated earlier this year.