South Korea's nuclear safety commission will tomorrow decide whether to grant an operational permit for the country's new Shin Hanul 1 reactor.

The 1.4GW reactor is already several years delayed, but operator Korea Hydro and Nuclear Power (KHNP) had expected it to be completed this month.

The start-up of Shin Hanul 1 now seems likely to be further postponed, even if approval is granted tomorrow. Local South Korean media outlets reported that the reactor would start at the end of March 2022 if an operational permit is granted on 9 July, but this could not be confirmed by Argus.

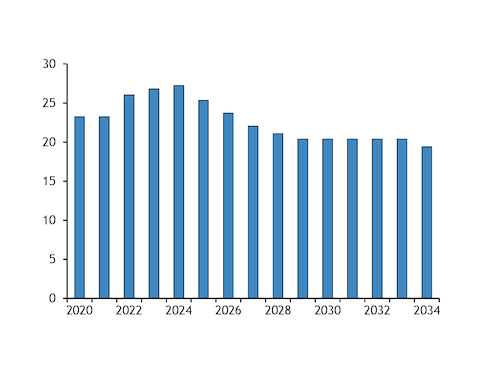

South Korea has 23.25GW of installed nuclear capacity, which would rise to 24.65GW when Shin Hanul 1 starts. In addition, the 1.4GW Shin Hanul 2 reactor currently has a completion date of May 2022, although the potential delay to Shin Hanul 1 has cast uncertainty over this timeline.

South Korea is also constructing two more 1.4GW reactors, Shin Kori 5 and 6, which are currently expected to be completed in March 2023 and June 2024, according to the KHNP website.

But the country is also planning to decommission 11 reactors with a combined capacity of 9.45GW over 2023-34. The first of these are expected to be the 650MW Kori 2 and 950MW Kori 3 reactors in April 2023 and September 2024, respectively.

Short-term outlook uncertain

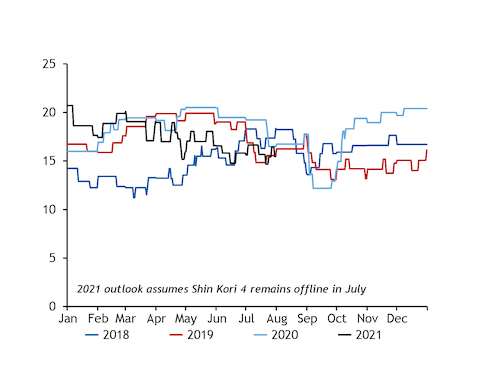

The short-term outlook for South Korean nuclear availability remains clouded by an unplanned outage at the 1.4GW Shin Kori 4 reactor, which tripped on 29 May and is still off line.

Excluding Shin Kori 4, four nuclear reactors are already scheduled to be off line for all of July, with shorter outages planned at another six reactors. This will reduce the country's nuclear availability to 15.5GW for the month of July, assuming Shin Kori 4 remains off line, which would be down by 2.5GW on the year from actual generation of 18.4GW in July 2020.

The shortfall in nuclear availability will compound an expected rise in power demand, meaning more fossil fuels will be drawn into the mix this month compared with a year earlier. The Korea Power Exchange (KPX) predicted a 6pc year-on-year increase in power demand this month, which would equate to an additional 3.8GW in overall power generation.

Combined generation from coal and gas could therefore grow by around 5.7GW on the year, according to Argus analysis, from 39.2GW (25.2GW coal and 14GW gas) in July 2020.

Capacity restrictions across the state-owned Kepco coal-fired fleet may ease this month compared with July 2020, and average load factors are likely to increase amid stronger power demand and from last year's low base during the pandemic. Two new private coal-fired units have also started operations in recent months, potentially boosting available coal capacity for the peak cooling period.

But the upside for coal could be tempered by stronger gas-fired generation, as domestic gas prices are currently more competitive with coal for power than they were a year earlier.