Canada's canola production is no longer expected to recover in 2021-22, with the market already pricing in estimates below official projections in response to dry and hot conditions.

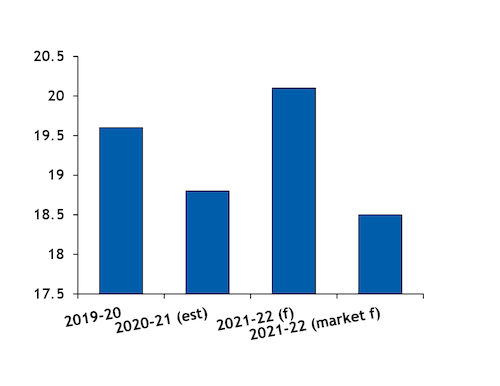

Market participants see canola production in the next marketing year (August-July) in a range of 18mn-19mn t, down from the 20.05mn t projected by government department Agriculture and Agri-Food Canada (AAFC) and 20.2mn t by the US Department of Agriculture (USDA). The range is also below AAFC 18.72mn t estimate for 2020-21, USDA's 19mn t estimate, and actual production of 19.61mn t in 2019-20 (see chart).

USDA and AAFC initially expected a recovery, as farmers expanded canola acreage at the expense of wheat. The AAFC recently forecast the harvested canola area at 8.66mn hectares (ha) for 2021-22, up from 8.32mn ha for 2020-21, while USDA put 2021-22 acreage at 9mn ha.

AAFC was also anticipating a return to more typical yields — 2.32 t/ha for 2021-22, up from 2.25 t/ha in 2020-21 — but warned in its mid-June outlook that its estimates carry "a significant downside risk if normal summer precipitation fails to materialise".

But Canada is having one of its hottest summers on record, with rainfall well below long-term averages. Saskatchewan, which accounts for more than half of Canada's canola output, has received less than 40pc of average precipitation since mid-June, according to AAFC. Neighbouring Alberta and Manitoba, which jointly harvest around 46pc of the country's canola, have seen similar conditions.

Saskatchewan's government reported "significant damage" to crops in a report last week. And 23pc of planted canola areas were rated as in "poor to very poor conditions", according to the latest available data from the end of June.

Strong exports earlier this year and low output had already been weighing on Canada's canola stocks, which are expected to end the season at just 700,000t, implying a stock-to-use ratio of less than 4pc.

This suggests additional pressure on canola supply for exports — Canada is the world's largest supplier of canola-rapeseed. Both AAFC and USDA already expected Canada's canola exports to fall by 4-8pc to 10mn-10.1mn t in 2021-22.

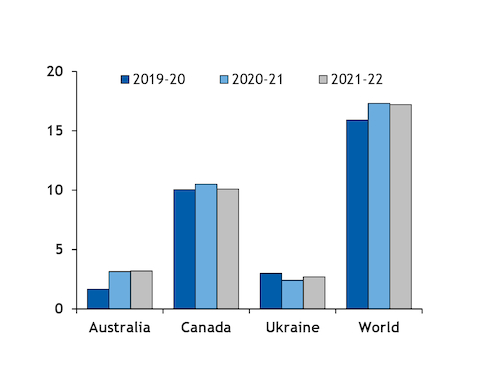

Importers have limited alternatives for rapeseed supply, with Canada accounting for nearly 60pc of global exports. Australia and Ukraine — the second and third-largest exporters of the crop — ship around a combined 5mn t/yr (see chart).

Supply concerns pushed the primary Canadian canola futures contract on the ICE exchange to a record $916.80/t on 13 July, up from $727.60/t a month earlier and $492.70/t a year earlier.

Tightening global supply has also supported rapeseed prices in Europe. Argus most recently assessed fob Dutch mill rapeseed oil at €1,210/t ($1,429/t), down from €1,264/t a month earlier but well above €770/t a year earlier.