Italy's LNG receipts have fallen sharply since the start of the 2020-21 gas year, displaced by brisk Algerian pipeline take.

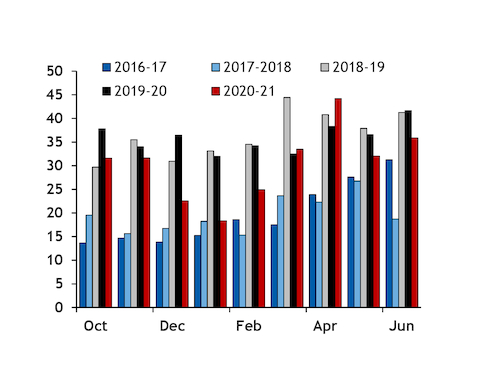

Italy received 108 cargoes in October 2020-June 2021, with sendout of 30.5mn m³/d making up 15.8pc of total pipeline and LNG imports. This was well down from 137 in 2019-20 when sendout accounted for 19.9pc of supply, and 132 in 2018-19 when the share was 18.8pc (see sendout graph). Use of Italy's LNG terminals was much lower until an auction-based allocation mechanism was introduced in April 2018.

Italian firms have had little need to outbid northeast Asian and northwest European buyers for cargoes this gas year, as the quickest stockdraw in recent years in addition to brisk Algerian deliveries lifted supply availability.

Algerian gas is mostly supplied to Italy under hybrid hub and oil-indexed long-term contracts with Algerian state-owned Sonatrach. Pipeline flows to Italy were 59.8mn m³/d — or a cumulative 16.33bn m³ — in October 2020-June 2021, close to double the 30.7mn m³/d — or 8.38bn m³ — in the previous two years. They were even above 2016-2018 when contractual take-or-pay volumes were higher.

Italian PSV prompt and near-curve prices have extended their premiums to oil-indexed supply costs in recent months, bolstering the incentive for strong Algerian take for longer than previously expected.

An increase in Algerian spot sales to Italian firms — as well as make-up volumes following reduced take in 2019-20 — could also partly account for the large increase in imports.

Azeri deliveries to Italy through the 10bn m³/yr Trans-Adriatic pipeline (Tap) have also reduced the need for northwest European imports at Passo Gries since flows began on 31 December 2020. Contracts for Tap supply are entirely indexed to the PSV rather than oil prices, managing director Luca Schieppati has said.

LNG receipts may ramp up only in early 2022

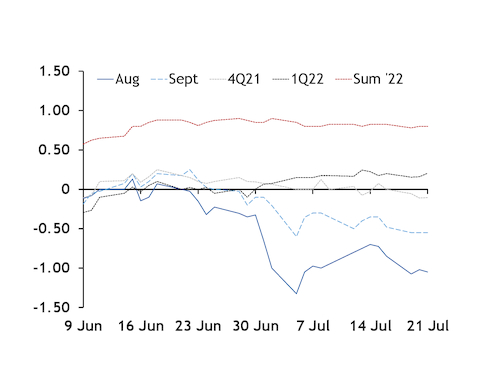

PSV prices at a discount to the Dutch TTF — and northeast Asian LNG prices — for delivery periods up to the end of the year suggest a sustained weaker incentive for firms to bring cargoes to Italy.

Strong demand from Asian and Latin American markets has been drawing LNG away from Europe, lifting offers for European buyers above corresponding TTF prices. And with PSV prices at a discount to TTF, Italian firms have even less scope than their European peers to match offers from suppliers (see PSV-TTF basis graph). This likely triggered the July-August cancellations at Italian terminals, as even firms that had already secured regasification slots and could view that cost as sunk had no incentive to bring cargoes to Italy.

The country may remain an unattractive destination for spot LNG cargoes in the coming months. The criteria used to set the reserve price at auctions for regasification capacity are designed to maximise returns for the terminal operator when price spreads are higher than a minimum value, which varies according to the amount of capacity requested and its duration. But with price spreads into negative territory for the coming months, firms have little incentive to secure capacity at the minimum fixed value.

PSV forward prices only fall back in line with the oil curve at the start of the second quarter of 2022, which could limit the incentive for strong Algerian take next summer and boost the need for supply from elsewhere, including LNG. This partly explains why contracts for delivery in the second and third quarter of 2022 have held well above the TTF in recent months, market participants said.

The role of LNG in Italy has shifted in recent years, with spot LNG imports becoming a more important component of the country's supply mix. This was largely the result of an influx of new liquefaction capacity additions boosting LNG liquidity in the Atlantic basin, which allowed European buyers to secure supply at competitive prices. But with more limited LNG production capacity additions expected in the near term, particularly in the Asia-Pacific basin, fast-growing demand from Asian markets is set to increasingly draw supply away from Europe. And should PSV contracts continue to change hands predominantly at a discount to other European markets, Italy could remain at the back of the queue for spot LNG supply.