The freight differential between the US Gulf to east coast India and China Supramax dry bulk routes has widened to record highs, further limiting petroleum coke sellers' interest in offering US cargoes to China.

The US Gulf-to-China 45,000-50,000t petroleum coke freight rate leapt by $5/t on the week to a new record high of $75/t as of the last assessment on 11 August, up by almost $10/t on the month and almost double year-earlier levels. The US Gulf-to-east coast India freight rate is also at record highs, but it has remained steadier over the last few months, at $60/t as of the latest week after peaking at $61/t on 23 June.

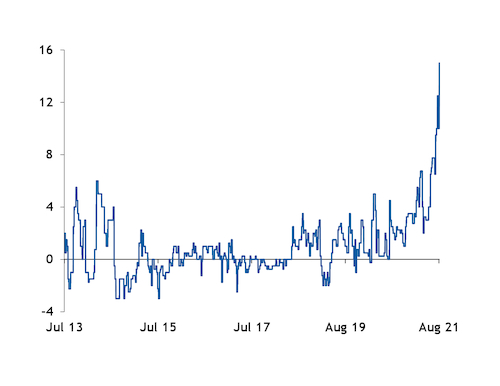

That puts the spread between the two key Asia-Pacific coke destinations at $15/t, the highest in Argus assessments going back to July 2013 and widening from just $2/t as recently as 7 April. The average premium for the China route to the India route over the assessment history from July 2013-December 2019 was only 38¢/t, as the China voyage is sometimes at a discount despite its longer sailing time.

Some of the premium is because of higher bunker costs to travel to China compared with India. But on top of this, persistent congestion and extended wait times at the Panama Canal over the past month have put additional upward pressure on the US Gulf coast-to-China rate. Supramaxes carrying cargoes on the route typically transit the canal, while Supramaxes carrying cargoes to India out of the US Gulf coast typically transit the Suez Canal.

Additionally, a recent resurgence in Covid-19 cases is contributing to port congestion in China, as Chinese officials adopt stricter quarantine measures. This is adding increased uncertainty on total freight costs as long wait times can run up high demurrage. Many Chinese ports are requiring ships to wait to berth until at least 14 days have passed from their last port of call. At least one terminal is requiring a quarantine of 28 days. And China's second-largest container port, Ningbo-Zhoushan, was forced to close one of its terminals on 11 August after a worker tested positive.

There was already severe congestion at Chinese ports in recent months as a lack of space to unload cargoes has led to low discharge rates. Demurrage costs are now averaging around $55,000 compared with around $35,000 in June, one trader said. Delays are averaging around five days, with some shippers unloading at other ports to avoid congestion at the key petroleum coke import ports of Fangchenggang and Rizhao.

Shipowners are reluctant to accept China-bound voyages because of the risk of having their ship quarantined at sea. This is in contrast to three months ago, when shipowners were particularly reluctant to accept India voyages because of the risk of potential port delays or quarantining of their vessels because of the country's Covid-19 surge. India is now a preferred destination for vessel owners because of the ability to pick up profitable grain cargoes for their next voyage after discharging.

China had been the largest destination for US coke exports from December 2020-May 2021. But by June, increasing freight costs had begun to make the route uneconomic, particularly as an increase in demand from nearer destinations like Brazil kept fob Gulf prices rising. No US Gulf high-sulphur coke cargoes have been sold to China since mid-June, market participants say, as sellers have raised offers higher and higher in order to cover netforward costs. With the recent jump in freight and the US Gulf 6.5pc sulphur fob price at $111.50/t, a seller booking a cargo on a spot basis would need a cfr price of at least $186.50/t to cover costs, before considering potential demurrage. But importers are only bidding in the $160s/t or below on a cfr basis.

The spread between bids and asks in India has been unusually wide for months, as buyers there have preferred US or Australian coal, domestic coal or domestic coke over the ever-costlier US coke. But buyers' and sellers' price ideas are coming closer together in recent weeks, with enquiries for seaborne coke beginning to rise, market participants said. With freight costs remaining relatively level since mid-June, US Northern Appalachian coal prices rising and cement demand expected to rise after the monsoon ends next month, some traders expect Indian buyers to begin concluding more coke cargoes in the coming weeks.