India's oil products exports rose on the month in August as domestic diesel demand remained low and jet fuel use held below pre-pandemic levels, while crude imports increased, preliminary data from Vortexa show.

Products exports totalled 1.42mn b/d last month, up from 1.22mn b/d in July. Exports of clean petroleum products — including gasoil, gasoline, naphtha and jet fuel — were 1.33mn b/d in August, up from July's 1.12mn b/d, while exports of dirty products such as bitumen and fuel oil fell to 83,000 b/d from 96,000 b/d over the same period.

Shipments of diesel/gasoil rose to 613,000 b/d in August from 520,000 b/d in July, while finished gasoline exports were largely unchanged at 227,000 b/d.

Gasoline exports were steady despite higher domestic demand, which has surpassed pre-pandemic levels in 2019. But diesel consumption fell on the month in August and was below pre-covid levels, according to demand figures from state-run refiners, which account for around 90pc of the country's fuel sales.

Exports of jet fuel fell to 65,000 b/d in August from 81,000 b/d in July, the Vortexa data show. That comes on the back of higher domestic demand last month, according to the refiners' data, although consumption is still way below pre-pandemic levels.

Jet fuel is the transport fuel that has been most affected by the coronavirus pandemic, which grounded all international and domestic Indian flights last year. As many as 21 countries have either banned flights or issued guidelines for passengers travelling from India, according to an advisory by India's Bureau of Immigration issued in early June.

India is the world's third-biggest energy consumer, importing about 84pc of its crude needs but is a net exporter of oil products.

Crude and condensate imports averaged 4.08mn b/d in August, up from 3.31mn b/d in July, the Vortexa data showed. July's ship-ins were at 3.60mn b/d, according to data from the oil ministry, which is yet to release the figures for last month.

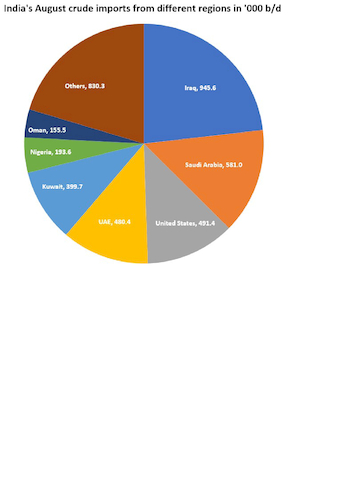

Of the total crude imports, 64pc or 2.59mn b/d came from the Middle East, the data showed, compared to 2.14mn b/d in July. The Americas supplied 681,000 b/d, up from 445,000 b/d, while African crude accounted for about 11pc of the total or 466,000 b/d, down from 514,000 b/d in July.

Sikka port on India's west coast, where private-sector Reliance Industries operates the 1.24mn b/d Jamnagar refinery complex, saw the single-largest quantity of crude discharge last month at 1.32mn b/d, up from 980,000 b/d in July.

The second-largest quantity of about 684,000 b/d was delivered to Vadinar port, where Russian-owned Nayara Energy operates a 400,000 b/d refinery. That was up from July's 658,000 b/d.

Paradip port on the east coast, home to state-controlled IOC's 300,000 b/d refinery, took the third highest intake at 586,000 b/d in August, up from July's 393,000 b/d.

India's state-controlled refiners are planning to increase their processing capacity to maximum levels between September and November. At least three of four state-run refiners are getting their requested September term crude volumes from Saudi Arabia's state-run Saudi Aramco.