South Korean coal prices firmed this week amid new tender awards and continuing strength in Asia-Pacific markets.

In the tender market, independent power producer SGC Energy awarded two 80,000t cargoes of Australian NAR 5,500 kcal/kg coal for delivery in October and December. The awards were at around $137/t cif and $138/t, respectively, sources said.

State-owned Kepco utility Korea East-West Power was also reported to have awarded 140,000t of Australian NAR 5,500 kcal/kg coal in the high $110s/t for November loading from Gladstone.

Fellow Kepco utilities Korea Midland Power (Komipo) and Korea Western Power (Kowepo) issued long-term tenders for high-CV coal closing on 6 and 8 September, respectively. Kowepo also issued a request for proposal to buy low-CV coal in a NAR 3,800-6,000 kcal/kg range, which closes on 6 September.

The extent to which coal and gas are competing on cost for power may come into sharper focus this month, as generation from fossil fuels overall is set to weaken on both the month and year, meaning one or both of the fuels will be partly displaced from the mix.

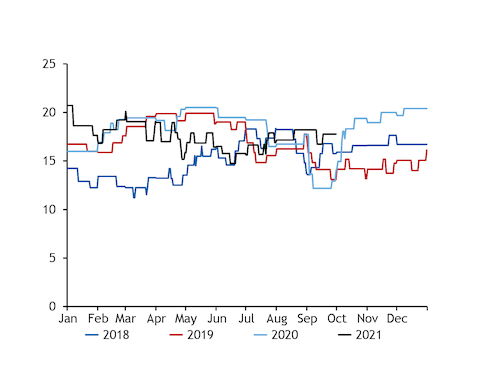

The Korea Power Exchange has forecast only a 1pc annual increase in power demand this month, suggesting less than 1GW growth in overall power generation will be needed. But nuclear generation could climb by nearly 5GW on the year, based on current availability schedules, meaning fossil fuel generation is likely to be down by around 4GW compared with September last year.

There should be little pressure on the state-owned Kepco utilities to reduce coal burn on the year this autumn to abide by voluntary caps that the government requested of them, because coal-fired generation is already on course to abide by the limits following steep annual declines in the first half of the year.

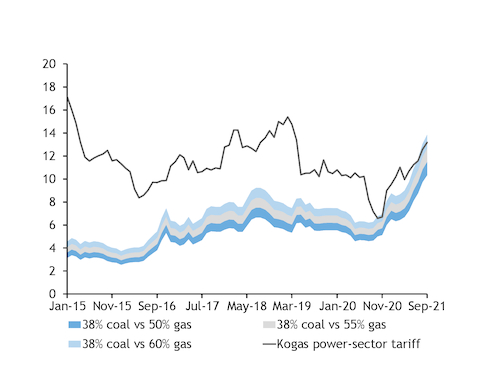

But the recent strength in seaborne coal prices means that domestic gas prices in South Korea — which have also recovered this year — remain more cost-competitive with spot coal than in previous years. This could encourage utilities to limit running hours at coal-fired plants more than at gas-fired plants to accommodate the recovery in nuclear generation this month and avoid having to turn to the seaborne market for extra supply.

State gas supplier Kogas set its domestic tariff for the power sector at $13.17/mn Btu this month, which is up 84pc on the year and a 29-month high, but still slightly below the implied coal-switching price at which generation costs for 60pc-efficient gas-fired plants and 38pc coal-fired units are at parity. This time last year, Kogas' tariff was around $0.90/mn Btu above the coal-switch price, although it did slip below it for October-November.

In the first half of 2021, coal-fired generation fell by around 1GW on the year, while gas-fired generation rose by around 3.7GW.

Japanese coal burn faces headwind

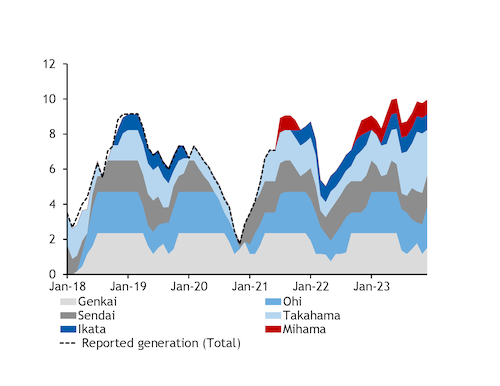

Recovering nuclear availability could also drag on Japanese generation from fossil fuels through the remainder of the year, with increasingly competitive oil-linked LNG imports a potential threat to coal's share of the fuel mix.

In May, the latest date for which granular data are available, coal-fired generation fell by 1.3pc to 22.3GW, while gas-fired generation rose by 8.3pc to 26.6GW. The trend may partly be the result of cost-driven switching, although a busy coal-fired maintenance schedule was likely the key driver.

Some 21.5GW of coal-fired capacity was unavailable in May according to Argus analysis, leaving an implied 28.7GW available — down from 37.3GW a year earlier — which was run at a 78pc average load.

Restrictions eased to 9.8GW in July and 5.4GW in August, however, allowing for potentially stronger coal burn over the peak cooling period.

Landed coal prices in Japan continued to strengthen this week on the back of gains in Australian and Russian high-CV coal prices, with firm Chinese and Indian demand keeping the regional supply-demand balance tight.

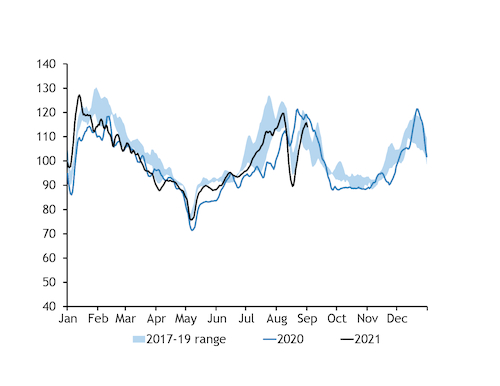

Some demand could also come from Japanese utilities seeking to restock, with inventories earlier in the year reported lower following a period of weak imports. Government data released today pegged aggregate utility stocks at 8.5mn t at the end of May, down from 9.9mn t a year earlier and a 2017-19 seasonal average of 8.7mn t.