Mexico's government is throwing state-owned Pemex another financial lifeline with a further cut in upstream royalties, but the firm's record spending plans are raising doubts and further support could increase the country's sovereign debt risk.

President Andres Manuel Lopez Obrador has put heavily indebted Pemex's financial recovery at the front and centre of his administration, cutting the firm's fiscal burden sharply, providing regular capital injections and committing not to raise company debt following years of heavy borrowing. Unlike Brazilian state-controlled Petrobras and Colombian state-controlled Ecopetrol — which also have to answer to private-sector shareholders — Pemex has historically been used as the government's money pot, paying out a massive 86pc of its 1 trillion peso ($50bn) primary balance in 2019 in taxes.

But while Mexico has cut Pemex's profit-sharing duty over the past two years, from 65pc in 2019 to 54pc this year, the firm has still struggled to deliver a consistent profit, amid heavy spending on its lossmaking downstream division at the expense of its core exploration and production business. The government plans to reduce the duty further to 40pc, in a bid to reduce Pemex's fiscal burden, according to the budget submitted to congress on 8 September. But while the tax cut is welcome, the rate remains high relative to its regional peers — production-sharing contracts in Brazil attract a royalty of 15pc.

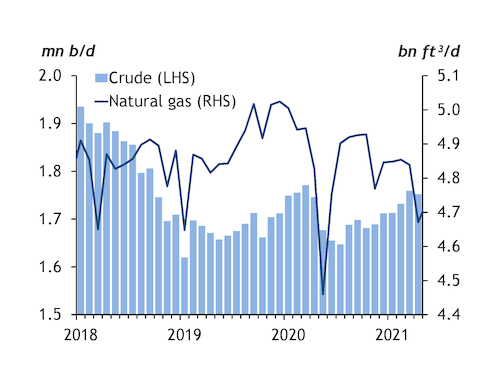

Pemex's proposed budget for next year is the largest in its history at Ps636bn, 13pc above this year. About 57pc, or Ps364bn, will be assigned to exploration and production. The firm's 2022 output targets of 1.9mn b/d of crude and 5.25bn cf/d (54bn m³/yr) of natural gas mark a considerable increase from the 1.68mn b/d and 4.65bn cf/d produced this July. Despite plans to raise investment in shallow-water production, Pemex has failed to reverse an almost two-decade decline in crude output since Lopez Obrador took office in 2018. And big-ticket investments in the 340,000 b/d Dos Bocas refinery and upgrades to Mexico's existing refineries will continue to drag on the firm's finances, analysts warn.

The government has also already committed to paying Pemex's $5bn in maturing debt this year — out of total financial debt of $115bn — although analysts warn that any further assistance could strain Mexico's sovereign credit rating. "Following the fiscal reduction for 2022, the government should not provide any more capital injections or debt repayments," Mexican bank Banco Base's director of economic analysis, Gabriela Siller, says. "Otherwise, it will put public finances and Mexico's sovereign debt at risk." Credit ratings agency Moody's agrees. It cites continued support for Pemex as one of three main fiscal pressures on the government's sovereign credit rating for the remainder of Lopez Obrador's administration.

Would you credit it?

While Pemex has kept to its commitment not to seek fresh credit, it has periodically looked to the bond market and lenders for refinancing over the past three years and the government is working on a new refinancing package, Lopez Obrador said this month. He has even hinted at using IMF funds to refinance Pemex's debt, although Mexico's central bank, among others, has argued that this would require legislative changes. The IMF in August granted Mexico $12.1bn in special drawing rights as part of a global $650bn package to boost liquidity because of Covid-19 and the related economic downturn. "In Mexico, by law, international reserve assets cannot be used to pay debt," Mexican central bank board member Gerardo Esquivel says. The finance ministry would have to buy the rights from the central bank, although it says it is working on ways to allow the government to use the funds to pay down debt.