UK exports of deep-sea ferrous scrap bulk cargoes to Egypt have risen sharply this year, with the country becoming the main destination for large scrap shipments in August.

The UK exported an estimated 1.03mn t of ferrous scrap to Egypt via deep-sea shipment in January-August, an increase of 45.5pc on the year and already in excess of the estimated 975,000t exported in the whole of 2020, vessel tracking data collected by Argus indicate.

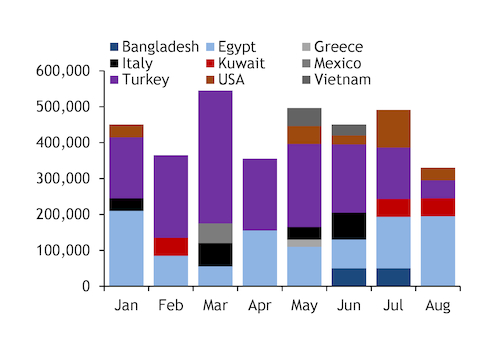

An estimated 190,000t of deep-sea scrap was dispatched to Egypt in August, 59pc of all large UK bulk shipments for the month. Egypt accounted for 29.7pc of all deep-sea exports tracked in January-August, up from 27.6pc in the same period last year.

One of the main drivers for the increase in UK exports to Egypt is a diversification in the number of UK suppliers and locations that are selling to the country. Egypt has long been the second-largest UK deep-sea export destination after Turkey, but sales were previously dominated by two exporters selling primarily out of Liverpool and Southampton.

This year, deep-sea scrap cargoes have been dispatched to Egypt by at least four exporters, with multiple shipments from Avonmouth, Immingham, Sheerness, Tilbury and Hull, in addition to the existing mainstay ports.

The rise in deep-sea exports to Egypt has been accompanied by a slowdown in shipments to Turkey, with a drop of 4.5pc on the year to 1.58mn t in January-August.

In August, an estimated 50,000t was shipped to Turkey, the lowest monthly total since May 2020, when all UK exports were frozen for most of the month because of disruption caused by the first wave of Covid-19.

Overall, UK deep-sea exports in August fell by 32.8pc from July amid the traditional summer slowdown in shipping activity. But an estimated 330,000t was tracked to have been dispatched, which is still a 46.7pc increase on August 2020.

Turkey's share of tracked UK January-August deep-sea exports fell to 45.5pc in January-August, from 64.4pc in the whole of 2020.

This is reflected in the fact that estimated January-August deep-sea exports were up by 35.1pc on the year at 3.48mn t, despite the fall in shipments to Turkey.

Aside from increased trade with Egypt, the increase has also been driven by a significant uptick in exports to five other countries — Italy, Kuwait, the US, Vietnam and Bangladesh (see chart).

Italy emerged as a destination for UK deep-sea exports during the first wave of the pandemic in spring 2020, when collection activity was severely disrupted by lockdown restrictions.

The winter wave of Covid again significantly dented Italian scrap flows in the first half of this year, causing consumers to once more turn to the UK, where the scrap industry more effectively adapted to ramp up processing capability in lockdown conditions through the second half of 2020. No UK exports to Italy have been recorded since June, indicating that the window may have closed in the same manner as it did last year.

Increased UK exports to the US this year were primarily for prime grade scrap, driven by extremely tight availability and voracious appetite for high-quality material.

Bangladeshi buyers have returned to purchasing deep-sea UK cargoes after being virtually absent from this market in 2020. This has partially been driven by a sizeable fall in scrap exports to Bangladesh from Japan and the US.

Japan emerged as a major supplier to Bangladesh in 2020 but has become a much less attractive source for the country's steel mills because of persistently high prices for Japanese scrap this year. Japanese exports of ferrous scrap to Bangladesh fell by 31.7pc in January-July to 293,000t, according to official trade data.

The other driver for increased Bangladeshi purchases of larger deep-sea bulk cargoes has been the global tightness in availability of seaborne containerised scrap as a result of persistent container shortages in key exporting regions, particularly the US west coast.