ConocoPhillips hopes to show that bigger is better in the world's top shale patch, after snapping up Shell's Permian basin holdings for $9.5bn.

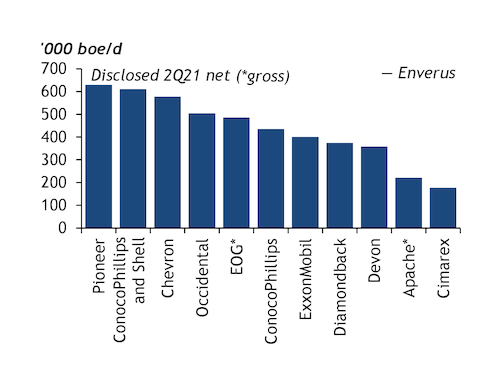

The leading US independent is acquiring 225,000 net acres (910km²) in west Texas — with estimated production of 200,000 b/d of oil equivalent next year — that were under-exploited by Shell and will complement its existing acreage. "One of the issues in making the Permian profitable for Shell was the lack of scale in its position, which is only 50pc operated," data provider Enverus' senior mergers and acquisitions analyst, Andrew Dittmar, says. The Shell assets — which will make ConocoPhillips the second-largest Permian producer after Pioneer Natural Resources —should make for a better fit with the US firm, which already has a large footprint in the shale play thanks to its $9.7bn acquisition of Concho Resources last year.

ConocoPhillips was quick to announce a 7pc increase in its quarterly dividend at the same time as the Shell deal, in keeping with the new industry mantra of investor returns over the previous growth-at-all-costs approach.

Pioneer chief executive Scott Sheffield, who has built his firm into the Permian's biggest producer through a recent series of acquisitions, agrees that size and scale are key for this new investor model (see chart). He also cites low breakeven prices and operating costs, as well as a strong balance sheet. "The Permian is going to be the place to be, it always has been — it's over 50pc of the US rig count — and it will continue to be," Sheffield told the Rystad Energy Week 2021 conference. The Permian will continue to see modest growth while other shale basins enter decline, he predicts.

The latest deal highlights the growing divide between the European majors — which face more pressure to shift focus towards a lower-carbon future — and US firms, which are able to continue to pursue oil and gas opportunities paired with more modest efforts on curbing emissions.

As recently as May, Shell listed the Permian as one of the nine core assets generating about 80pc of its upstream operating cash flow, and highlighted the fact that it had reduced its greenhouse gas and methane intensity, as well as flaring, in the basin by around 80pc since 2017. But the firm has since come under increased pressure to accelerate its net zero strategy after a Dutch court ruled in May that it must cut its carbon emissions by a net 45pc by 2030, compared with 2019.

Many happier returns

Shell has appealed that ruling, but the ConocoPhillips deal also supports the company's priorities of growing shareholder distributions and reducing debt while keeping capital expenditure in check. Shell will return almost 75pc of the cash proceeds from its Permian sale to shareholders, in addition to payouts already disclosed, with the remainder to be used to further strengthen its balance sheet. While investors focused on environmental, social and governance issues would prefer to see the billions invested in the renewables sector, Shell is still working to increase shareholder dividends — which remain well below pre-Covid levels after 2020's historic cut — alongside its share price after last year's beating.

ConocoPhillips is not facing as much pressure as Shell from shareholders on the financial or environmental front. But the company still takes pains to point out that the Permian deal adds "cleaner, more climate-friendly barrels into the mix", because the newly acquired assets have a lower greenhouse gas intensity — thanks to Shell's efforts on that front — than the ConocoPhillips' average. But what remains to be seen is whether the US firm can pull off the balancing act between financial and environmental demands — or whether it may be let off the green hook by its shareholders more easily in the future.

| Top Permian acreage holders | 000 |

| Operator | Net acreage — Midland and Delaware basins |

| Chevron | 1,688 |

| Pioneer | 1,009 |

| ConocoPhillips + Shell | 925 |

| Occidental | 867 |

| ExxonMobil | 772 |

| ConocoPhillips | 700 |

| Apache | 476 |

| Diamondback | 420 |

| Devon | 400 |

| EOG | 391 |

| Endeavor | 378 |

| — Enverus | |