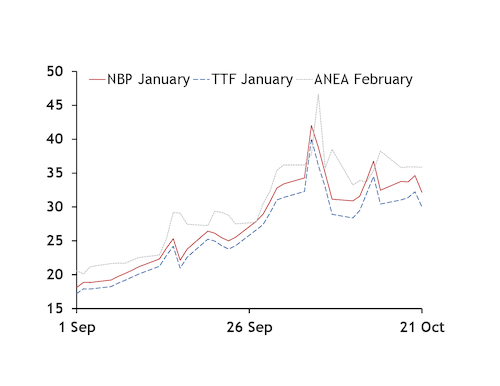

Gas prices at the UK's NBP hub for delivery in the core winter months are at their steepest premium to nearby markets in 15 years, reflecting heightened supply security concerns.

European gas prices have hit all-time highs this autumn, soaring enough to force some industrial firms to curtail or halt output in order to balance the market(see industrial demand graph).

With Europe's gas supply-demand outlook tightly balanced for this winter, regional prices have diverged, reflecting an uneven geographic distribution of risks.

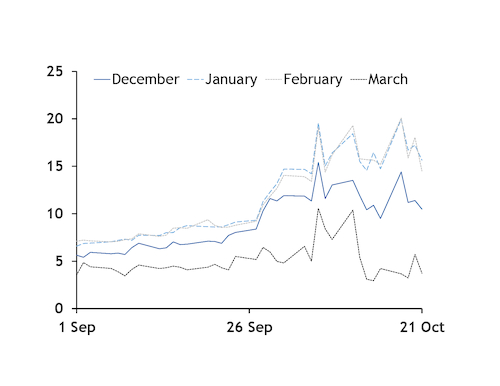

The regional split has been most pronounced across the Channel. The premiums held by the NBP December-February markets to the Dutch TTF gas hub are the largest of any forward monthly contract since the 2005-06 winter, which was particularly cold.

The NBP February market's premium to the Dutch TTF briefly surpassed 20p/th at the start of this week, more than doubling in less than three weeks (see NBP-TTF differentials graph). Before this autumn, an NBP forward contract for delivery in the following six months had last closed at more than 10p/th above the TTF on 12 December 2017 — after UK-based petrochemicals and energy firm Ineos announced the unplanned closure of the Forties Pipeline System.

The NBP is normally among the highest-priced European gas markets in winter, as the UK needs to attract imports from the continent throughout the heating season, given its limited storage capacity relative to demand following the closure of the Rough facility in 2017.

This EU import dependency means that overarching European security of supply concerns for this winter are magnified for the UK — particularly as there is a risk, however small, of the EU deciding to implement its solidarity mechanism in the event of a gas emergency, which could cut a key source of the UK's marginal supply.

While firms could bring in LNG cargoes to help meet any spikes in demand, if the weather is freezing across Asia and Europe at the same time, then Asian buyers may be willing to pay whatever premium required to secure cargoes at short notice (see NBP vs ANEA graph).

And even assuming an uninterrupted availability of EU imports, a substantial NBP premium to nearby markets is required just to cover the costs of shipping gas between the markets.

The BBL gas pipeline operator has already sold all available capacity to the UK from the Netherlands on a first-come, first-served basis for December-February, meaning that the NBP's premium to the TTF has continued to grow beyond the costs of using this link.

There is still plenty of available capacity on the UK-Belgium Interconnector. But the basis market may need to be particularly wide to overcome the costs of importing gas through this route.

Firms may have to factor in not only the costs of shipping gas to the UK from Belgium — more than 7.3p/th for December-February, using an estimate for the pipeline commodity charge, which varies daily — but also fees for bringing gas to Belgium from Germany.

Belgium has no gas production of its own, so filling the Interconnector means either diverting Norwegian gas making its way to France or destined for Belgium, or pricing on imports from Germany at Eynatten through the rTr line. And France may opt to keep its Norwegian gas if it imports little LNG given high northeast Asian LNG prices. The cost of bringing gas to Belgium from Germany and then on to the UK through the Interconnector could amount to more than 10p/th for the next couple of months.

But Interconnector bookings still have yet to be maximised despite the NBP December-February contracts' premiums to the Germany VTP already being large enough to offset these costs.

Shippers' hesitancy to commit to additional Interconnector capacity may be due in part to the need to price in the possibility of some of these fees being hiked further at short notice.

Interconnector operator INT recently increased its capacity fees in response to "market conditions", while Interconnector fuel costs are fully exposed to price volatility as they fluctuate daily based on NBP day-ahead price movements. And National Grid reserves the right to raise its capacity-based charges to make up for a shortfall in revenues, as it did in the 2020-21 gas year.