EU wheat exports so far this marketing year are likely to have reached their highest for the period amid strong milling wheat demand from north Africa and rising feed wheat purchases from Asian buyers.

EU-27 soft wheat exports totalled 8.99mn t on 1 July-24 October, up from 7.23mn t a year earlier, according to preliminary European Commission data. But only some data from France — one of the EU's largest wheat exporters — has been logged, so overall exports might have been higher.

EU wheat shipments might already have reached 12mn-12.5mn t, including France's own foreign trade figures for August and preliminary ship line-ups from September-October, according to estimates made by Argus' agriculture consulting arm, Agritel.

French soft wheat shipments to non-EU countries totalled 859,000t in August, up from 345,300t in July and 685,000t a year earlier, French customs data show. Some 380,000t shipped in August headed to Algeria, and 78,000t to Ivory Coast.

And France shipped 806,500t of wheat to non-EU countries in September, preliminary line-up data show. China then overtook Algeria in receipts of French crop last month — France shipped 255,000t to China, compared with 202,800t to Algeria.

This implies that France exported at least 2.01mn t of wheat to non-EU countries in July-September alone, compared with just 742,000t officially logged by the European Commission.

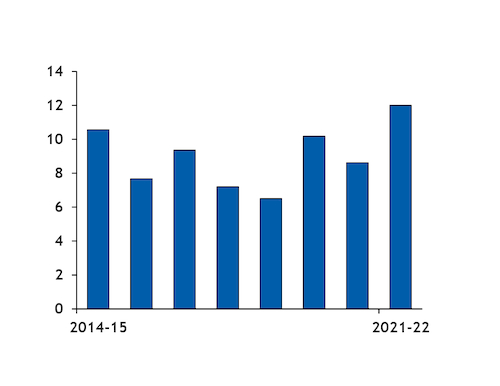

This would also put EU exports at a new high, with soft wheat shipments having previously peaked at 10.56mn t in July-October of the 2014-15 marketing year (see chart).

Reduced and high-priced shipments from Russia pushed some buyers in north Africa and the Middle East to the EU. EU-27 exports to Egypt have totalled 1.01mn t so far in 2021-22, up from zero a year earlier, according to the European Commission.

South Korea and Vietnam have emerged as two of the EU's key buyers this year as excess supply domestically made the bloc's feed wheat competitive in global markets. South Korea has this year imported 823,000t from the EU — its third largest supplier after Algeria and Egypt.

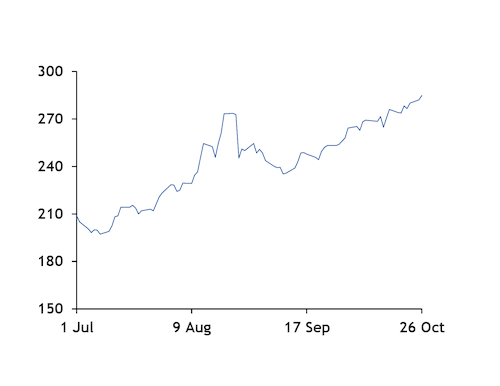

Increased interest in EU wheat has supported wheat futures on Europe's Euronext exchange. The December milling wheat contract was most recently at €285.50/t, up from €209/t at the start of the 2021-22 marketing year in July and only €5/t below its previous record in March 2008 (see chart).