The Andean States are struggling to balance their need for oil revenue with global climate goals, writes Patricia Garip

Growing climate sensitivity and environmental, social and governance (ESG) criteria for investment are emboldening environmental and indigenous land campaigns in commodity-dependent Andean countries. Caught between the need to address fiscal imbalances aggravated by the Covid-19 pandemic and the pressure to accelerate the energy transition, fragile governments in the resource-rich region could swiftly destabilise if they lurch too far in either direction.

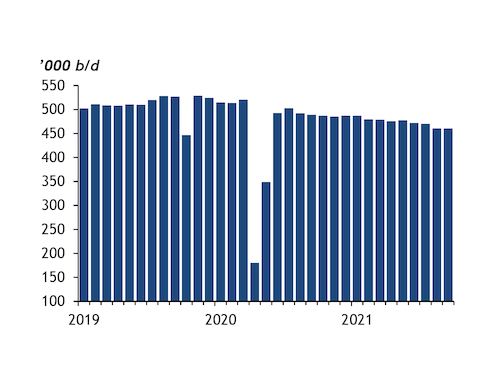

Ground zero is Ecuador. President Guillermo Lasso's conservative administration took office in May vowing to double oil output to 1mn b/d. Decree 95, issued in July, created a framework to boost output "in a rational and environmentally sustainable way" with foreign investment, transparency and competition. But indigenous groups sued the government on 18 October, for allegedly violating their right to prior consent. Their next target is a mining-promotion decree issued in August.

As the legal battle unfolds, Spain's Repsol plans to divest its assets in the country as part of a global shift from fossil fuels, leaving more room for Chinese state-owned CNPC and Sinopec — already Ecuador's top foreign oil producers, with little apparent regard for ESG. State-owned PetroEcuador recently awarded a contract to a Sinopec subsidiary to boost production at Sacha, its leading oil field. Western independents such as GeoPark, Gran Tierra and New Stratus Energy are marching into Ecuador, but their reach could be limited by growing financing constraints.

Amazon crime?

Getting oil to market is another concern for Quito, after environmental groups Amazon Watch and Stand.earth persuaded some EU banks to stop financing oil trade originating in Ecuador's Amazon region. Decrying a selective "boycott", PetroEcuador now allows buyers to pre-pay for cargoes to bypass banks' reluctance to issue letters of credit, a move typically associated with sanctioned countries. In a spot sale tender for fuel oil applying the new terms, trading firm Trafigura issued a 23¢/bl discount on its normal offer for advance payment, exposing the cost of circumventing normal trade finance channels. Sinopec's trading arm, Unipec, another regular Ecuadorean oil buyer, won the tender on the traditional terms.

Ecuador's indigenous movement is spearheaded by powerful confederation Conaie. The group is demanding that recent gasoline and diesel price hikes be reversed. The Lasso administration increased and then froze fuel prices on 22 October in response to renewed turmoil as international oil prices spiked, ending a programme of monthly gasoline and diesel price adjustments tied to WTI crude that it initiated last year, when the pandemic pummelled the international oil market.

Fiscally strapped, commodity-dependent developing countries such as Ecuador argue that they need to produce as much oil as they can — while the world is still using it — to underwrite social spending, tackle energy poverty and ultimately decarbonise. This is the mantra of Colombia, an oil and coal exporter that is no stranger to social conflict. But unlike Quito, Bogota is jumping on the ESG bandwagon. State-controlled Ecopetrol plans to export a "carbon-compensated" cargo of Castilla Blend crude, offset by tree-planting and renewable energy.

The risk of disregarding ESG is evident in Peru, where a new government faces a resurgence of indigenous protests that have forced state-owned PetroPeru to repeatedly shut its 100,000 b/d oil pipeline. Peru's indigenous campaign is driven more by demands for basic services such as electricity and water than anti-extractive sentiment, revealing the region's entrenched structural inequities that governments say require commodity income to remedy. But their limited success on wealth redistribution — even at the apex of commodity price cycles — offers little to support this assertion.