A price cap placed on domestic coal prices in China, and more favourable generation economics for gas-fired units running on oil-linked LNG versus coal-fired plants across northeast Asia, weighed strongly on delivered prices to South Korea and Japan this week.

China's national economic planning agency, the NDRC, set a price cap on domestic NAR 5,500 kcal/kg coal of 1,200 yuan/t ($187.60/t) on 27 October, with prices for other calorific values being calculated relative to this level.

This precipitated a sharp drop in coal prices across Asia-Pacific, while the South Korean government's decision to cut its tax on LNG imports — albeit by a small amount — may also have affected sentiment.

Inflation concerns amid the strength in the wider global commodity complex prompted the government to temporarily cut import tariffs on oil and gas on 28 October, with the levy on LNG imports cut from 2pc to zero.

The ministry said the change will be reflected in state gas incumbent Kogas' power-sector tariff from December, which should push gas prices further into coal-gas fuel-switching territory in South Korea. Based on Kogas' October power-sector gas tariff and Argus' NAR 5,800 kcal/kg cfr South Korea month-to-date average coal assessment, the implied tax-inclusive generation cost for a 55pc-efficient gas-fired unit now holds a discount of about $15.01/MWh to the equivalent cost for a 38pc-efficient coal-fired unit, under Argus analysis.

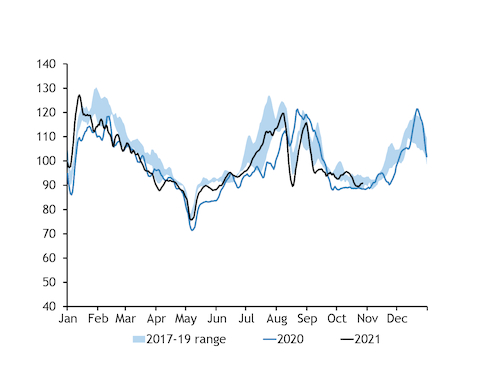

Argus assessed NAR 5,800 kcal/kg coal at $198.05/t cfr South Korea and $169.33/t fob Newcastle, down by $25.69/t and $16.50/t on the week, respectively.

Tender, procurement news

South Korean independent power producer GS Donghae Electric Power was scheduled to close a three-year term tender on 27 October, but this was postponed as the utilities are anticipating a further price drop over the coming weeks, sources told Argus.

Offers were reportedly made in a range of $139-206/t on a NAR 6,080 kcal/kg basis, with 60,000t of NAR 5,700 kcal/kg coal with 1pc sulphur content for delivery during the first-quarter of 2022 being offered at $139/t fob Newcastle.

But South Korean state-owned utility Korea South-East Power (Koen) reportedly procured a December-loading Capesize cargo of NAR 5,900 kcal/kg coal at $218/t fob Newcastle on a NAR 6,080 kcal/kg basis through private negotiations this week. One source at Koen told Argus that this was more for the purposes of security of supply, to ensure stock stability during the peak heating period, rather than because of immediate need.

The concern may have sprung from the expectation of a power surge amid the increasingly likely return of La Nina weather across northeast Asia this winter. The Korea Meteorological Administration forecasts a 40-50pc chance of below-average temperatures across the South Korean peninsula from 8 November-5 December, according to the latest forecast on 28 October. The Korea Power Exchange (KPX) predicts that daily peak and average power demand will increase by 3.7pc and 4pc on the year to 80.3GW and 63.4GW in November, respectively, according to the latest power forecast report.

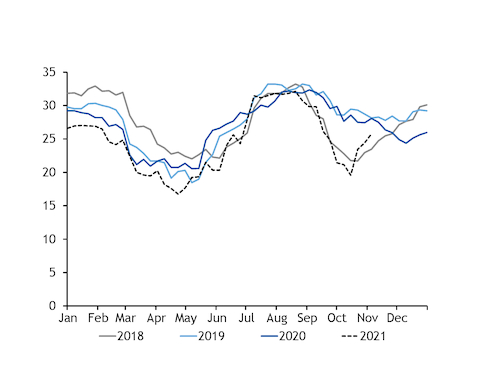

State-owned Kepco utilities' coal-fired generation availability is scheduled to average 21.17GW and 26.21GW in October and November, under Argus calculations based on KPX's latest maintenance schedule. Assuming a flat load factor year on year, Kepco's coal-fired output would average 13.01GW and 17.02GW in October and November, down by 4.5GW and 1.77GW on the year, respectively.

La Nina risk for Japanese power

Plunging coal prices across Asia-Pacific also weighed on implied landed prices for Japan this week.

But the Japanese power market remains tight amid a high chance of La Nina returning, coupled with lower-than-expected nuclear availability owing to an extended closure at Shikoku power's 890MW Ikata No 3 nuclear reactor.

The Japan Meteorological Agency predicts a 40pc chance of below-normal temperatures across the Kanto, Chubu, Kansai, Chugoku, Shikoku, Kyushu and Okinawa regions during November-January, according to the latest forecast released on 25 October. These regions house the biggest cities and populations such as Tokyo, Osaka, Kyoto and Nagoya, which means heating demand could rise in case of an unusually cold winter.

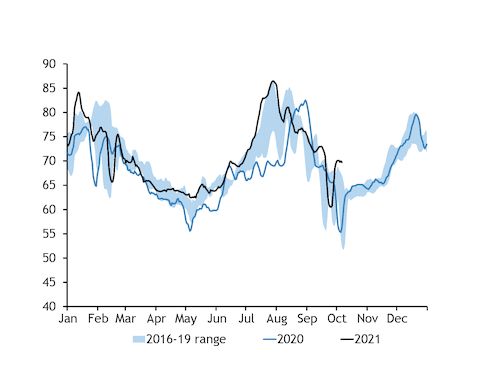

Wholesale day-ahead power prices on the Japan Electric Power Exchange (Jepx) reached a nine-month high of ¥16.92/kWh ($149.60/MWh) on 24 October and averaged ¥13.60/kWh during the 23-29 October period, up by 13.3pc on the week.

Higher power prices and lower spot fuel prices improved generation economics for thermal plants in Japan this week, with the average theoretical margin for a 44pc-efficient coal-fired unit nearly tripling on the week to ¥4,200/MWh ($36.83/MWh) over 22-28 October.

Forward prices suggest gas should remain in fuel-switching territory over the winter, with gas' competitiveness peaking during October-November.

Higher fuel-switching potential will be also supported by ample LNG stocks in Japan, which increased to a five-year high of 2.3mn t for the time of year on 15 October, the latest data released by the trade and industry ministry (Meti) show.