Spot differentials for Brazilian medium sweet crude looks increasingly attractive versus competing grades in the delivered China market. But independent refiners — stung by a new tax audit, narrowing refining margins and uncertainty over import quotas — remain wary about committing to 2022 cargo purchases.

January-arriving Tupi is trading at $4.40/bl over Ice March Brent, unchanged on the week, while the competing Norwegian grade has moved up to that level with the advent of trade in January-arriving cargoes.

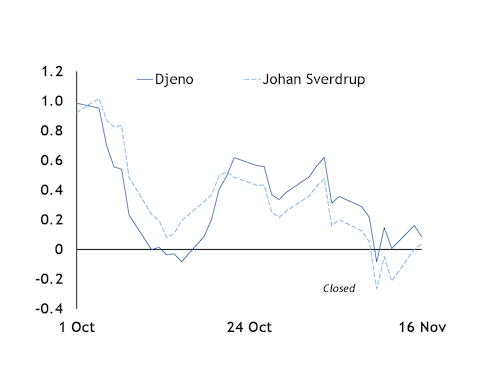

High freight costs, the strength of Ice Brent futures to Dubai swaps — the EFS — and the persistent premium of prompt to forward crude futures contracts are making it far less attractive to sell Johan Sverdrup to China (see graph: Delivered China arbitrage). The resulting strength of Johan Sverdrup premiums has encouraged refiners to shift back towards Brazilian grades. The latter are sweeter and typically have a higher gross product worth but were, for much of this year, snapped up by state-owned firms such as Sinopec.

Brazilian oil accounts for slightly over 50pc of all the crude that independent Chinese refiners have so far purchased in November. The cost of sending a 2mn bl very large crude carriers (VLCC) to China from Brazil is around $2.07/bl, compared with a northwest Europe-China cost of $2.75/bl. And there are several cargoes of Brazilian crude still available for sale to China in January, including potentially 3mn bl of Tupi.

Oversupply risks

Global oil inventories, "using the metric of the OECD stocks", could begin to build before the end of this year, Opec secretary-general Mohammed Barkindo said on 16 November. "[Oversupply] is further evidence why we should be very cautious" about increasing supply to the market, he added.

Crude futures prices have started to retreat from their recent highs, with front month Ice Brent down by 88¢/bl to $81/bl since 11 November. Chinese independents appear inclined to wait and hope that premiums also start to come down.

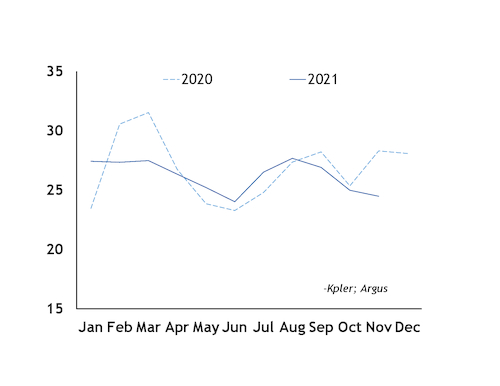

But crude stocks in China are still falling, rather than rising. The country's independent refiners have, so far, bought far fewer January-arriving cargoes than is usual for the time of year — just a third of the amount traded on the delivered ex-ship (des) market by this point in 2019 and two thirds of what they had purchased by mid-November 2019. This suggests that refiners may be running out of time to secure sufficient feedstock to meet January requirements from the long-haul crude markets, as their own operating inventories already appear low (see graph: Independent refiner crude stocks).

Defer or desist

Refiners are also reluctant to pay the prevailing premium for Russian ESPO Blend which, at $4.60/bl over Ice March Brent for January cargoes, is the priciest of Argus' five grades assessed on a des basis. Russian producers have begun to market January cargoes but, so far, only one of these has been bought by a Shandong refiner.

The lack of clarity over next year's crude import quotas remains a key deterrent to buying crude for future delivery, and the ministry of commerce may not confirm individual refiners' quotas until mid-December. Shandong's local government has also launched a sweeping new audit of refiners' payments of consumption taxes on gasoline and diesel, something refiners fear may have far-reaching effects.

Those opting to defer long-haul purchases may opt to buy crude from onshore bonded tanks to sustain crude runs. Much of this is likely to be Iranian crude, often shipped to China on small vessels. Iranian Light, with similar distillation yields to Oman Export Blend, is trading on the Chinese market at discounts of more than $5/bl to Ice January Brent.