Margins for refined oil products in northwest Europe are being squeezed as the return of Covid-19 restrictions in some parts of the region weighs heavily on the outlook for transport fuel demand.

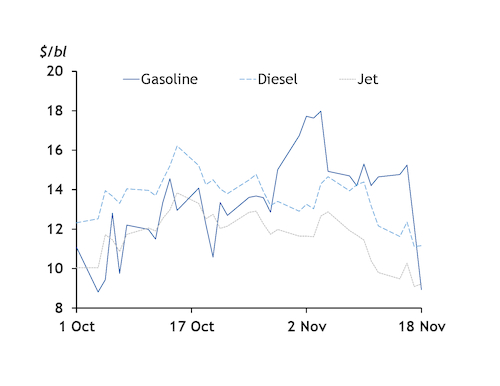

Gasoline has led the decline in recent days, with benchmark Eurobob oxy's notional premium to Atlantic basin crude benchmark North Sea Dated falling by $4.88/bl in the space of a week to $8.93/bl at yesterday's close. Gasoline cracks have nearly halved from the four-year high of $17.71/bl reached on 4 November. This has dragged the margin for gasoline feedstock naphtha down by $1.12/bl over the same period to just 27¢/bl above Dated, the lowest since early September.

Cash premiums for gasoline have tumbled in recent days amid reports of higher prompt supply and waning demand. Eurobob oxy gasoline barges changed hands as low as $8/t above the Eurobob December swap earlier today, compared with $75/t a week ago.

Middle distillate cracks have been pushed back to levels last seen in September. Northwest European diesel's premium to North Sea Dated has dropped by $2.02/bl over the last week to $11.16/bl at yesterday's close. And jet fuel's premium is down by $1.17/bl to $9.23/bl over the same timeframe.

The outlook for transport fuel demand in Europe has deteriorated amid a return of Covid-19 restrictions as several countries brace for a fourth wave of infections. Despite relatively high vaccination rates, governments across the region have announced fresh lockdowns of varying degrees this week, including the Netherlands, Ireland, Slovakia and the Czech Republic. Germany is introducing tighter Covid-19 curbs on unvaccinated citizens, with chancellor Angela Merkel saying a "brake" is needed to combat record cases in the continent's largest economy. Belgium is imposing a four-day work-from-home rule and Austria is going into a full national lockdown, both beginning on 22 November.

European road fuel demand has been contracting since the summer. France, Italy, Spain and Sweden have all released data in the last two weeks showing a fall in consumption. In the diesel market, the drop in demand is being compounded by increased loadings at the Russian port of Primorsk this month. The port mainly serves northwest Europe.

European jet fuel demand has only just begun to draw support from the reopening of US travel to vaccinated passengers, but that demand boost may be capped by the new lockdowns. Shipping fixtures have shown Europe-bound jet cargoes from east of Suez diverting to US destinations in the last few days.

Energy crunch

Record high natural gas and electricity prices are also contributing to the squeeze on refining margins in Europe. The cost of hydrogen — widely used in hydrocrackers and hydroteaters in the production of road fuels — has surged on the back of the gas price spike. And according to some reports, the impact of these higher costs and lower margins has trimmed 10pc off European run rates in the last week or so.

European refinery throughput had only just returned to the bottom end of the typical range when rising hydrogen and electricity costs combined with the autumn maintenance season to slow down operations. The latest Euroilstock data suggest refinery utilisation was around 76pc in the EU-15 plus Norway last month.

More and more of the continent's refineries are being squeezed out of the market altogether, as the Covid crisis drags on and refining capacity in the Mideast Gulf and Asia-Pacific continues to expand. Nearly 900,000 b/d of European refining capacity has been permanently closed or earmarked for closure since the onset of the pandemic last year.