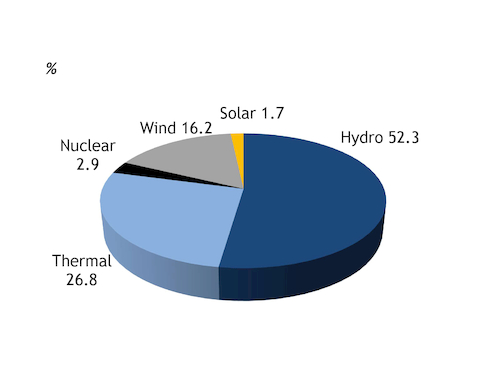

The energy and capacity tender is intended to offset instability created by increasing use of intermittent renewable generation

Brazilian electricity regulator Aneel has approved a first combined energy-only/capacity-only auction, a new model aimed at reducing power shortage risks.

The auction, scheduled for 21 December, aims to contract supply for 15 years from new and existing thermal power plants from 2026. It will have a price cap of 600 reals/MWh ($107/MWh) and a 30pc guaranteed dispatch rate.

The tender will introduce new elements to the traditional auction model, including taking bids for actual supply and access to a power plant's capacity to provide firm, non-interruptible generation.

The capacity component will be a key addition to Brazil's power framework, defining the cost of power stability by stimulating capacity purchases by power consumers, both regulated and those under bilateral contracts. This can reduce the risks of power shortages resulting from increased intermittent renewable generation by sharing reliability costs among all consumers. Currently, only consumers receiving power through local distribution firms pay for the reliability attribute.

The December auction will also be the first time that industrial consumers will be able to bid for supply directly, something previously only allowed for power distribution companies. The bilateral contract market has incentives for consumers to buy wind power, a less expensive source that does not provide the same level of reliability offered by more expensive thermal generation.

"Almost all the expansion of the country's free market power relies on intermittent renewable energy," the president of electricity resellers association Abraceel, Reginaldo Medeiros, says. "We need to steady this energy to hold our supply, by having thermoelectric capacity with costs shared to all consumers."

Trading firm Thymos Energia's managing director of energy, Alexandre Viana, expects the capacity market to attract the most attention. "The energy product will be less attractive, as its inflexibility is indexed to the government's IPCA inflation index, making it vulnerable to currency fluctuations," he says.