Russian authorities have approved an increase in ferrous scrap export duty, with the bill signed by prime minister Mikhail Mishustin on 27 November and published by the government today.

Duty on exports to outside the Eurasian Economic Union (EAEU) will rise to 5pc but not less than €100/t ($113.45/t) for 180 days starting from 1 January.

The current duty is 5pc but not less than €70/t, effective since 1 August.

The approval followed recommendations from the ministry of industry and trade, articulated by deputy minister Victor Yevtukhov at the beginning of this month, and a resolution of the tariff regulation sub-committee from mid-November.

"Both largely ignored the position of the scrap industry and, which is far worse, common sense, as domestic prices have continued to rise, and this trend has nothing to do with exports," a market participant said.

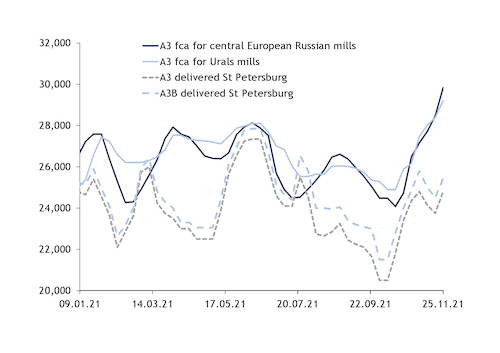

Russian export activity — in the northwest and south — was curbed by the €70/t duty, but the restrictions also impacted domestic deliveries to steelmakers and overall Russian scrap collection. As a result, mills' purchasing prices kept rising in August and, after a month-long break, began rising again in mid-October, with the upward movement still continuing (see graph).

Driving scrap prices is a railcar shortage in Russia. This has pushed up transportation costs and disruptions to scrap deliveries in September–November.

Additionally, the policy of many steelmakers to pay unofficial premiums above officially listed scrap buying prices has encouraged scrap suppliers to take a wait-and-see approach and withdraw stocked material from sale in the expectation of higher indications.

The onset of freezing winter weather in most scrap supplying territories of Russia has further restricted domestic flows over the past two weeks, during which domestic scrap prices have reached new multi-year highs, with a new record likely to be set this week.

Most mills in European Russia are paying 29,500–30,200 roubles/t ($393.43–402.76/t) for rail deliveries of A3 grade material today, up from Rbs29,000–30,100/t last week. Prices in the Urals were also heard higher on the week, at Rbs29,100–30,000/t, up from Rbs29,000–29,600/t.

"This decision [to raise the export duty to €100/t] is a perfect example of busywork, because it pursues interests of certain steel producers, turning a blind eye to the real problems the Russian scrap market is actually encountering," a market participant said.