ITM chief executive says green hydrogen is the only realistic solution for decarbonising, writes Killian Staines

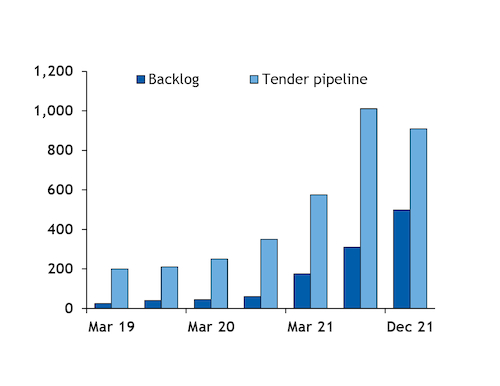

UK electrolyser manufacturer ITM Power has seen exponential growth in recent years — its order backlog rose by 61pc between September and December alone to 499MW — and chief executive Graham Cooley believes it is just getting started.

More than 200GW of hydrogen projects have been announced worldwide, Cooley says. "My opinion is that almost all of those projects will happen. These are all large energy players that know they have to do an energy transition." The only question is "when and under what circumstances" will these projects be developed. "There has been a lot of policy development in Europe and governments now need to pull the trigger on these CfD [contract for difference] schemes."

The demand for electrolysers has much further to go beyond announced projects, Cooley says. The entry point will be replacing grey hydrogen, a huge market in and of itself, which would require 600GW of electrolysis capacity. In total, the IEA says around 3,500GW will be needed for a net zero global economy.

Cooley believes ITM is well placed to take advantage of this. It recently announced plans to build a second gigafactory at its home in Sheffield, and another international factory. ITM will be able to export its electrolysers around the world, Cooley says, but for now, Europe remains by far the largest market.

Economies of scale will cut costs — ITM says the full system prices to the customer for its 10MW electrolyser systems are around €800,000/MW ($905,000/MW), and it is targeting around €500,000/MW in the mid-2020s for 100MW systems.

The EU proposal on additionality — requiring electrolysers to be built alongside new renewable plants for hydrogen to be considered renewable — "is a genuine mistake", Cooley argues. Instead, every new piece of renewable energy should be required to be deployed alongside long-duration energy storage, to overcome issues of undersupply and oversupply caused by variable wind and solar generation.

If such a requirement were in place, the market would always pick green hydrogen, Cooley says. He sees long-duration storage as one of the most promising use cases for hydrogen. Scalable power storage of electricity has long been the holy grail of decarbonisation, but "the answer has been under our noses this whole time", Cooley says.

Stranded asset blues

Perhaps unsurprisingly for an electrolyser manufacturer, ITM is sceptical of the potential of blue hydrogen. Proponents tend to argue that blue is cheaper and can bring on large supplies of low-carbon hydrogen while green scales up. But the reality is that green hydrogen can be deployed incrementally, whereas any blue project requires huge investments and takes years to come on line, Cooley says.

And the cost argument for blue has fallen apart amid the massive spike in gas and emissions allowance prices, he says.

"You also have to look at the capital cost required to establish a technology which hasn't been fully proven and cannot be deployed until the late 2020s. There will not be a single blue hydrogen plant that, once opened, is not a stranded asset," Cooley says. And if one includes the upstream methane emissions, "no well-informed objective person would ever invest in blue hydrogen".

Cooley notes there is talk of carbon capture rates of over 80pc for steam methane reforming and 90pc for autothermal reforming, but "nobody has ever achieved anything like those capture rates. People say the technology is mature, but it isn't".

Oil and gas will play a vital role in the energy transition, Cooley says, "but let's get rid of the idea we can just use the old approach of importing natural gas and basing everything on a methane system… everyone with gas pipes needs something that is net zero to put through those pipes or else they are finished".