Retail price inflation helped spark protests in Kazakhstan, eliciting a swift government response, with some Russian help, writes John Gawthrop

Anyone hazarding a guess as to where Russian "peacekeepers" might be heading at the start of 2022 would probably not have picked Kazakhstan. But Russian airborne troops have landed in the country after a wave of unrest swept the oil-rich central Asian state in the first week of the new year, resulting in significant loss of life and ending three decades of relative stability.

The Russian forces are part of a contingent dispatched at Kazakhstan's request by the Collective Security Treaty Organisation, an alliance of six former Soviet states, to help stabilise the country. Their arrival follows an outpouring of popular anger against the government, with widespread demonstrations, attacks on government buildings and looting. A virtual news blackout makes it difficult to verify what is happening in Kazakhstan. But the authorities appear to have clamped down hard, with dozens of protesters killed in an "anti-terrorist" operation in Almaty, and significant casualties among the security forces.

The protests appear to reflect pent-up anger at economic inequality and political repression. Predictably, the Kazakh government blames international "terrorist gangs" trained "abroad", a line backed by Russia's foreign ministry, which describes events in Kazakhstan as "inspired from outside".

The energy sector has not gone unaffected. Production at the country's largest oil field, Tengiz, continues, operating consortium leader Chevron says, although there has been a temporary adjustment to output because of logistics. "Tengizchevroil (TCO) can confirm that a number of contractor employees are gathered at the Tengiz field in support of protests taking place across Kazakhstan," Chevron says. "TCO and business partner industrial relations teams continue to work together to resolve this situation as soon as possible." The Caspian Pipeline Consortium (CPC), operator of Kazakhstan's main crude export route, says operations continue as normal.

Public unrest had hitherto been rare in Kazakhstan. For most of the three decades since independence, the country appeared largely stable, under the iron rule of first president Nursultan Nazarbayev, who stepped down in 2019 to be replaced by hand-picked successor Kassym-Jomart Tokayev.

Big three

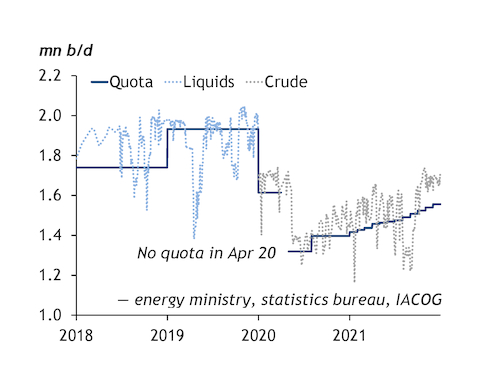

Under Nazarbayev, Kazakhstan attracted tens of billions of dollars of energy-sector investment. Much of this went to the three largest oil fields — Tengiz, Kashagan and Karachaganak — which are being developed with international investors under production-sharing agreements. These have turned Kazakhstan into the former Soviet Union's second-largest producer and exporter of crude and condensate, with production of 1.77mn b/d in January-November last year, and the second-largest non-Opec producer in the Opec+ group. As well as moving though the CPC system, oil is exported through Russia's Transneft pipeline network and by pipeline to China.

A project to add 260,000 b/d of capacity at Tengiz, which produced around 565,000 b/d in January-November, is due to be completed in 2023, and there are plans to further develop Kashagan. The Kazakh government also plans an initial public offering — originally scheduled for 2020 — of shares in state-owned oil and gas company Kazmunaigaz this year.

With a nationwide state of emergency now in place, the government is taking measures "to stabilise the socio-economic situation". These include a 180-day retail price freeze for LPG, gasoline and diesel, speeding up preparations to build a new gas processing plant in the Mangistau region to produce LPG and a 180-day freeze on household utility bills.