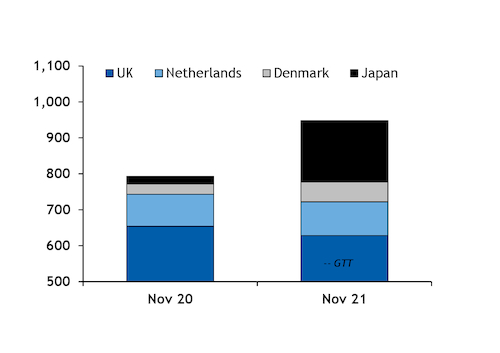

Wood pellet shipments out of the US and Canada rose on the year in November, mostly because of quicker deliveries to the UK and northern Asia.

North American wood pellet exports rose to 1.1mn t in November from 904,000t a year earlier. Deliveries to Denmark also rose to 55,000t, up from 28,794t a year earlier.

US exports rose to 764,000t from 660,000t a year earlier, with the UK making up the lion's share at 609,000t, up from 514,000t, as a result of stronger biomass-fired generation and a drop in Canadian pellet exports to the UK.

UK biomass-fired generation rose to 2.5GW in November from 2.3GW a year earlier, data from the national grid show, which bolstered demand for US pellets.

A sharp drop in Canadian deliveries to the UK during the same month — to 19,000t from 141,000t in November 2020 — also likely encouraged shipments from the US. Deliveries out of Vancouver halted operations from mid-November until late December, as flooding in November heavily damaged rail and road infrastructure.

And US exports to the Netherlands more than doubled to 94,000t, likely because of stronger generation at major co-fired plants with coal. German utility RWE doubled its co-firing allowance by 225MW at its 1.5GW Eemshaven Dutch plant, effective from November, while the plant had been off line in May-November 2020 following technical issues. Pellet-fired generation at Eemshaven and RWE's 630MW Amer 9 plant increased in the period January-September and was expected to remain high until the end of 2021.

The US seems to have taken a significant share from Canada for the Dutch market, with a yearly increase of 1mn in January-November in US exports having more than offset a 219,000t drop in Canadian deliveries to the Netherlands for the same period.

US exports to France also rose to 32,000t in November from zero a year earlier, broadly in line with a yearly increase of just under 78,000t earlier in the year. While there were no Canadian deliveries to the country in November, overall exports had increased slightly earlier in the year.

The US lost some ground to Canada in the Danish market in November, with US exports slightly lower on the year at 28,000t, while Canadian exports were also 28,000t from zero in November 2020. Danish biomass burn for power increased significantly throughout 2021, with the trend maintained in November when generation rose to 750MW from 474MW, Entsoe data on plants of 100MW or larger show.

Quicker US deliveries to other countries in Europe more than offset a drop in exports to Belgium to zero in November, from 71,000t a year earlier. This is broadly in line with a 352,000t yearly decrease in January-October, mostly as a result of the closure of French utility Engie's 80MW Les Awirs plant in Belgium in August 2020. Engie still operates the 205MW Rodenhuize biomass-fired plant in the country.

Canadian exports to Asia jump

Total Canadian wood pellet exports rose to 307,000t in November from 244,000t a year earlier, mostly supported by a jump in shipments to Japan and South Korea that more than offset the dip in UK exports.

Canadian shipments to Japan and South Korea rose to 171,000t and 60,000t from 21,000t and close to zero a year earlier, respectively, as long-term contractual agreements with both countries kicked in in 2021. The jump was despite disruptions at the port of Vancouver from mid-November. Combined Canadian deliveries to both countries had almost doubled to 1mn t earlier in the year.