The electric vehicle sector has been making slow progress in Latin America but various tax breaks are stirring wider interest

Electric vehicle (EV) growth is lagging in Latin America compared with the US and Europe, but governments are starting to implement ambitious initiatives to promote the sector and transition to cleaner transport.

Last year saw a strong increase in some countries. A total of 345 EVs were sold in Ecuador, up by 225pc on a year earlier and by 235pc from 2019, data provided by domestic automobile association Aeade show. More than 4,225 plug-in hybrid vehicles were also sold last year, a record, boosted by tax reductions and higher supply. But these sales still represented only 3.8pc of the nearly 120,000 vehicles sold in Ecuador last year.

These kinds of vehicle have in the past been subject to three types of tax in Ecuador — a value-added tax of 12pc, a special consumption tax of 3-32pc depending on the price of the car, and an import tariff of around 35pc. In 2010, when hybrid vehicles entered the local market, they were exempt from the first two levies. But subsequent tax reforms left them subject to both, in addition to the import tariff, reducing the incentive for customers to buy these types of vehicle.

The penetration of EVs into the market has been slow despite the fact that they have not been subject to the value-added tax or import tariffs since 2019, while the consumption tax was included in the final price. The government late last year approved a tax reform that exempted all hybrid and EVs from the special consumption tax.

Colombian progress

Colombian sales of EVs and plug-in hybrid vehicles have increased significantly. Sales were just over 17,700 hybrid and EVs in 2021, up by close to 200pc compared with a year earlier, preliminary data from national sustainable mobility association Andemos show. The country sold 1,114 EVs in January-November 2021, 62pc up on the year, figures from Colombian industrialists group Andi and the country's national federation of traders Fenalco show. The country plans to have 6,600 EVs on its roads this year.

Colombia usually establishes an import quota for hybrids and EVs that sees them subject to a 5pc value-added tax, compared with the 35pc that they would pay if the quota was exceeded. But the commerce ministry in September last year suspended the import quota, supporting growth.

Colombia has implemented other incentives to boost EV demand. Owners do not pay a tax of more than 1pc of the car's value, while they also obtain a discount on the value of the technical-mechanical review and pollutant emissions tax, and in their mandatory accident insurance premiums.

Peru is considering a reduction in the import tax for EVs to boost the sector. Environment minister Ruben Ramirez said on 6 January that the government is considering a lower duty on EVs as part of a new tax reform. Congress at the end of 2021 gave President Pedro Castillo's administration power to reform the tax code until the end of March.

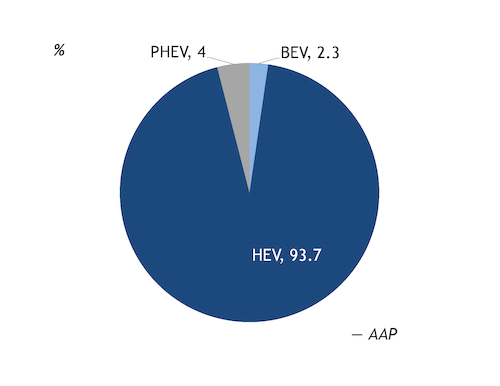

The previous government approved legislation allowing for the accelerated depreciation of EVs, but stopped short of cutting the 18pc tax on new vehicles. Lowering the tax would create a better environment for EVs, which saw significant growth in 2021, but which still account for only a fraction of all vehicles sold in the country. Sales in Peru of the three kinds of EVs — battery (BEV), hybrid (HEV) and plug-in hybrid (PHEV) — reached 1,455 in 2021, up by 160pc compared with a year earlier. But that represents less than 1pc of the 157,100 new vehicles sold last year, data from local automobile association AAP show. EVs represented 0.46pc of the total number of vehicles sold in Peru in 2020 and just 0.22pc a year earlier.

Peru would be following in the footsteps of neighbouring Bolivia, which in July eliminated taxes on battery and hybrid EVs, as well as on the components required to assemble them.

Chile plans

Chile plans to end sales of most internal combustion engine vehicles in 2035 under an electric transport strategy unveiled in October, and is promoting a new bill aimed at achieving this. EVs would be exempt from annual circulation permit fees for two years, dropping to 75pc in years three and four, 50pc in years five and six, and 25pc in years seven and eight. Circulation fees are currently on average 65pc lower for internal combustion engine vehicles than for EVs, as the latter cost more.

Sales of zero and low-emissions light and medium-sized vehicles in Chile jumped by 230.8pc in 2021 from the previous year, according to Chile's national automotive chamber. December sales of EVs alone repeated a monthly peak of 85 already registered in November.

Despite having one of the cleanest power grids in the continent, Brazil still lacks the policies needed to encourage solely EV consumption. EV sales reached record levels in 2021 but that was thanks to solid demand for hybrid-ethanol vehicles, which are expected to continue to dominate the local market.

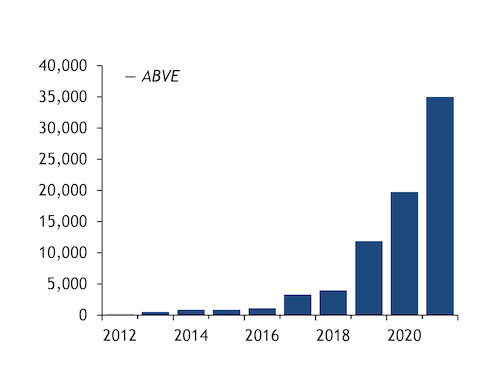

Total EV sales in Brazil reached nearly 35,000 last year, up by 77pc from 2020, according to electric vehicle association ABVE.

Hybrid-ethanol EVs remain the clear market leader, representing roughly two-thirds of sales, although PHEVs are making some inroads, with sales more than doubling in 2021 from a year earlier.

Electric dreams

Brazil's government has expressed its commitment to a biofuels-based decarbonisation plan rather than pushing for plug-in EVs, and is unlikely to give tax incentives to the sector.

This is partly because the government employs a full life-cycle approach to analysing the overall carbon footprint of EVs. This means that it analyses and quantifies the carbon footprint left by the feedstock used in the electricity generation that powers plug-in EVs, rather than just recording the emissions produced by operating the vehicles.

According to government estimates, a flex-hybrid vehicle fuelled by ethanol, such as a Toyota Corolla, emits 29 grams of CO2/km, while an average plug-in EV in Europe, for example, emits 54g CO2/km, taking into account the feedstock needed to generate the power used to charge the car.

In Latin America as a whole, carmakers and importers are offering more EVs at lower costs, but a lack of knowledge of these cars among potential consumers and an absence of charging facilities in the continent remain hindrances. There are only 63 EV charging stations in Ecuador, while Peru had 47 charging stations at the end of 2021. EV sales are also hampered by government incentives for vehicles that run on other, more polluting fossil fuels.

12012022025835.jpg)