UK-Australian mining firm Rio Tinto has set an unambitious 2022 iron ore shipment target of 320mn-335mn t from its mines in Western Australia (WA) amid warnings that Covid-19-related skills shortages and greater attention to heritage issues may disrupt production.

Rio Tinto shipped 321.59mn t of iron ore last year on a 100pc basis from its WA operations, down from 330.57mn t in 2020 and near the bottom of its 320mn-321mn t 2021 guidance, which it revised down from 325mn-340mn t in October.

The firm warned that the 2022 guidance was subject to the successful commissioning and ramp up of new iron ore projects, with its 43mn t/yr Gudai-Darri mine further delayed. The guidance is also subject to the impact of new cultural heritage laws, which have been instigated in response to its destruction of the Juukan gorge in June 2020 that forced a major management restructure at Rio Tinto.

Rio Tinto has pushed first production from its main plant at Gudai-Darri, formerly known as Koodaideri, back into the April-June quarter from January-March this year, warning that labour shortages in WA and Covid-19 restrictions could further delay the project. These issues have also delayed the ramp up of the Robe Valley brownfield mine replacement projects at West Angelas C and D, and the Western Turner Syncline phase two projects.

The delays to these projects forced Rio Tinto to ship more of its low-grade SP10 ore in both October-December and full-year 2021 than in the same periods of 2020. This increased stocks at its Chinese port operations to 8.8mn t at the end of December 2021 from 1.7mn t a year earlier as it was unable to secure sufficient high-grade ore to blend out the lower-grade material. The firm expects its shipments of SP10 to gradually decrease as the new mines ramp up in the first half of this year and to settle around 6pc of total production in the medium term, down from 18.5pc in October-December.

Chinese portside sales rose to 14mn t in 2021 from 5.5mn t in 2020. Rio Tinto sells blends of its WA, Canadian and third-party ores at its Chinese portside operations.

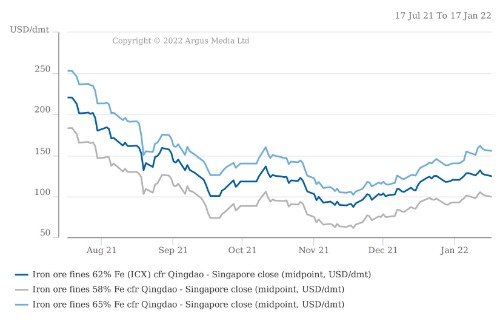

Rio Tinto received an average price of $121.20/dry metric tonne (dmt) fob Pilbara ports in July-December, down from $168.40/dmt in January-June. Around 11pc of shipments in 2021 were priced based on the prior quarter's average lagged by one month. The remainder are sold on current quarter, current month or spot pricing, with 28pc of the total sold as fob.

Argus last assessed the ICX iron ore price yesterday at $124.60/dmt cfr Qingdao on a 62pc Fe basis, up from $90.71/dmt on 17 November.

The Iron ore Company of Canada (IOC), in which Rio Tinto has a 58.7pc interest, produced 16.56mn t of pellet and concentrate in 2021 on a 100pc basis, which was down by 6pc from the previous year. Rio Tinto expects IOC to produce 17mn-18.7mn t in 2022 on a 100pc basis.

| Rio Tinto iron ore shipments | mn t | ||||

| Ore type | Oct-Dec '21 | Jul-Sep '21 | Oct-Dec '20 | FY2021 | FY2020 |

| Pilbara Blend Lump | 16.62 | 16.71 | 20.15 | 64.7 | 77.12 |

| Pilbara Blend Fines | 31.62 | 36.2 | 42.73 | 138.2 | 155.53 |

| Robe Valley Lump | 2 | 1.81 | 2.35 | 7.51 | 8.69 |

| Robe Valley Fines | 4.22 | 4.84 | 5.78 | 17.73 | 21.65 |

| Yandicoogina Fines | 14.12 | 14.91 | 15.05 | 56.89 | 57.75 |

| SP10 Lump | 4.84 | 4.83 | 1.04 | 16.08 | 3.88 |

| SP10 Fines | 10.68 | 4.06 | 1.77 | 20.49 | 5.95 |

| Total shipments | 84.1 | 83.36 | 88.87 | 321.59 | 330.57 |

| Source: Rio Tinto | |||||

| On a 100pc ownership basis | |||||