Stronger demand for coal burn in South Korea combined with tighter supply fundamentals across Asia-Pacific continued to support the northeast Asia des coal market this week.

Argus assessed NAR 5,800 kcal/kg coal at $195.13/t fob Newcastle and $195.75/t cfr South Korea this week, up by $17.83/t and $8.46/t, respectively.

More favourable generation economics for coal burn owing to Kogas' January tariff jumping to a record high have prompted the government to pause a seasonal suspension plan for Kepco's state-owned coal-fired units running on bituminous coal, the latest schedule shows. There will still be eight units off for maintenance, however, which has been planned since earlier this year.

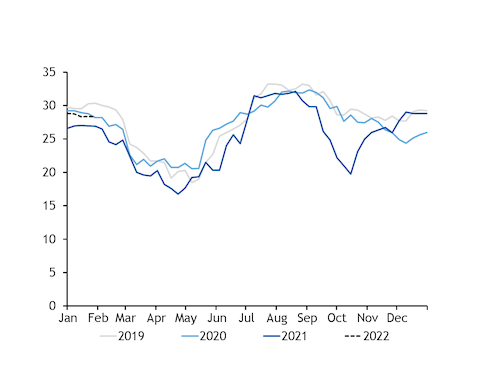

Kepco's coal availability is scheduled to average 27.8GW for this month, compared with availability of 26.9GW and coal-fired output of 21.2GW a year earlier.

In the tender market this week, state-owned Korea Western Power (Kowepo) awarded on 20 January a Capesize of minimum NAR 5,500 kcal/kg coal for delivery in April-May to a Czech Republic-based trading company at fob Taman $147/t on a NAR 6,080 kcal/kg basis.

Fellow utility Korea Southern Power (Kospo) also procured a Philippines-loading Panamax size of NAR 4,400 kcal/kg coal for February delivery at fob $185/t on a NAR 6,080 kcal/kg basis.

A source also told Argus that an Australian February-loading cargo was being negotiated at around fob $205/t NAR 6,080 kcal/kg level this week, although there were no further details at time of writing.

Firmer demand comes despite a tighter supply outlook. The Indonesian government has eased its coal export ban this week, allowing at least 139 miners to resume their exporting activities. But there are still 400-500 miners impacted by the ban which are likely to remain sanctioned in the longer term to meet domestic market needs, sources said.

A weaker production outlook in Australia and China caused in part by the forecast of a La Nina weather event is further boosting seaborne coal prices, while brisk LNG deliveries to Europe and liquidity provided by China's Unipec, which is offering up to 45 LNG cargoes, are exerting downward pressure on global gas and LNG hubs.

Rising coal and falling gas prices are slowly narrowing the solid fuel's economic advantage against gas burn in South Korea, although margins for gas generators remain significantly below those of coal.

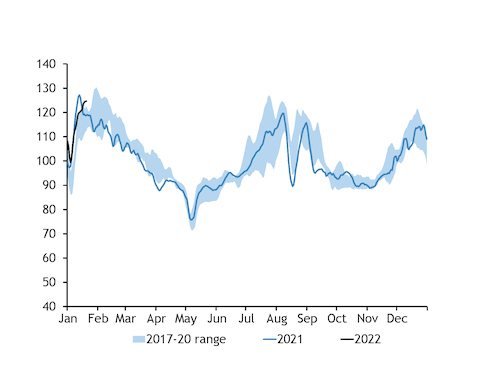

Theoretical tax-inclusive costs for 55pc-efficient gas units running on spot LNG contracts decreased to $140.19/MWh this week from $170.98/MWh last week and $230.55/MWh in December, based on Argus' northeast Asia des spot LNG assessment.

The equivalent cost for 38pc-efficient coal-fired units increased to $93.43/MWh, compared with $90.14/MWh and $81.57/MWh a week and month earlier, respectively.

Similar market developments in Japan

Stronger power prices owing to tighter supply continued to improve margins for thermal generators this week in Japan, while diverging spot LNG and coal price movements significantly narrowed the spread between generators' margins.

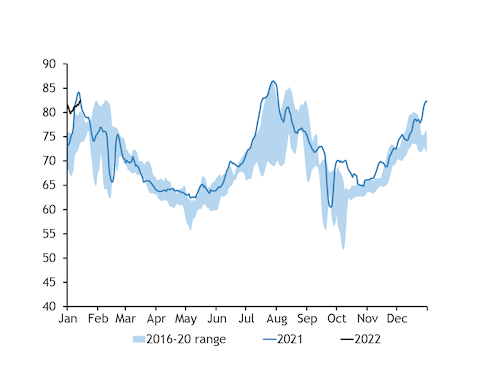

Power supply on the Japan Electric Power Exchange (Jepx) fell by 2.2pc from a week earlier, supporting average system-wide baseload-power prices for day-ahead delivery to increase by 28.7pc to ¥27.97/kWh ($246/MWh) during 15-21 January.

This, combined with weaker regional LNG prices, improved theoretical margins for 58pc-efficient gas-fired units using spot LNG as a feedstock to average ¥11,831/MWh ($104.07/MWh) over 14-20 January, compared with ¥1,303/MWh a week earlier.

Margins for coal generators also rose but at a slower rate, owing to firmer seaborne coal prices making high-efficiency gas units running on oil-linked LNG contracts more profitable to run for spot delivery.

The clean-dark-spread for 44pc-efficient coal-fired units averaged ¥18,881/MWh on 14-20 January, compared with an average margin of ¥20,061/MWh from a 58pc oil-linked LNG power plant.

Improved gas margins are likely to lift Japanese demand for gas-fired generation, with Japan's biggest utility Jera shutting down a number of coal plants in recent weeks. Jera reportedly suspended two of its 600MW coal-fired units at Hirono power plant in Fukushima prefecture to reserve fuel stocks, as adverse weather events has disrupted the firm's coal unloading since the middle of December. This follows Jera's decision to shut down its 1GW Hekinan coal unit 5 in Aichi prefecture from 14-26 January because of a boiler issue.

Meanwhile, temperatures in Japan are forecast to drop over the next fortnight, further tightening the power market balance. Temperatures in Tokyo are set to range between 1.7°C and 2.3°C w below the seasonal norm over the next two weeks, Speedwell weather data show.