Global prices for palm oil and soybean oil have increased to unprecedented levels, supported by continued strong demand, adverse weather conditions in South America, tightening palm oil export availability in Indonesia and labour shortages in Malaysia.

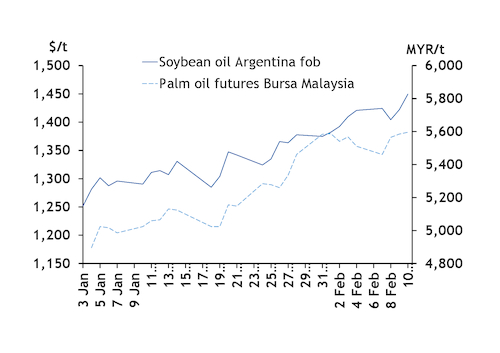

Bursa Malaysia-listed crude palm oil (CPO) futures peaked at a new record high of 5,596 ringgit/t ($1,336/t) today, while the Argus-assessed outright price for Argentinian soybean oil for April shipment have increased by $227.54/t since the start of the year to close at $1,449.54/t fob upriver yesterday.

Palm oil

The global palm oil market saw sharp gains in January, spurred by the Indonesian government's decision to curb palm oil exports from the country to ensure supply and lower prices domestically.

According to the government's decision, Indonesian CPO-based products and used cooking oil — including CPO, olein, used cooking oil and residues — suppliers must obtain licences to export their products for six months starting from 24 January. Previously, no form of export approval was required for palm oil products. And, starting from 15 February, Indonesian exporters would require export permits for all palm oil products.

Indonesia — which covers nearly 58pc of global palm oil supplies — has also obliged exporters to sell 20pc of their planned shipments to the domestic market at a fixed price to obtain the export permits.

As a result, the pace of the country's palm oil exports is expected to slow as some refineries without domestic distribution channels will struggle to adapt to these new policies, according to the US Department of Agriculture's (USDA) Foreign Agricultural Service. The USDA has revised Indonesia's 2021-22 palm oil exports forecast to 28mn t — down by 1.5mn t from its January estimate but still up by 1.1mn t on the year.

India — the world's largest palm oil buyer — is likely to be the most affected by the restrictions, with Indonesia having supplied about 67pc of its total 2020-21 CPO imports.

Meanwhile, Malaysia — the world's second-largest producer and exporter — is struggling to increase CPO production to pre-Covid levels amid the ongoing labour shortage and lower input of fertilizers, owing to their high cost. Malaysia's CPO production is projected at 18.7mn t in 2021-22, up from 17.85mn t in 2020-21 but still down from 19.26mn t in 2019-20, according to the USDA.

Soybean oil

Rising palm oil prices pushed up prices for other vegetable oils, especially soybean oil, which also was supported by a worsening outlook for 2021-22 soybean production in South America.

Argentina and Brazil — the two biggest exporters of soybean oil on the global market — have faced dry weather conditions in January, which affected soybean yield potential in key producing regions.

Soybean production in Argentina — accounting for about 47pc of global soybean oil exports — is now forecast at 45mn t in the 2021-22 marketing season, according to the USDA. This is down by 1.5mn t from the department's previous estimate.

The USDA also cut its forecast for 2021-22 soybean crop in Brazil — covering 12pc of global soybean oil exports — to 134mn t in its latest monthly World Agricultural Supply and Demand Estimates report from 139mn t projected in January. Meanwhile, Brazil's national supply company Conab trimmed its forecast for Brazilian soybean production sharply by 15mn t from its previous projection to 125.5mn t.

The tightening outlook of the global soybean market supported US soybean oil futures on the Chicago Board of Trade, with the March contract hitting 65.98¢/lb on 2 February, the highest since 29 July 2021.

The US — the world's second-largest soybean oil producer — is unlikely to offset a possible reduction in soybean oil shipments from Argentina and Brazil this season, as soybean oil is currently the most used feedstock in US biofuel production. US domestic soybean oil consumption is projected to rise to a record 11.47mn t in 2021-22, according to the USDA.

Given expectations of strong demand for palm oil and soybean oil from India, China and southeast Asia, at least during first quarter, tightening supply of both oils, as well as possible disruptions of sunflower oil exports from the Black Sea region because of rising tension between Russia-Ukraine, global prices for palm oil and soybean oil are likely to remain high in the upcoming months.