Australian resources firm BHP has reframed its sale of its Australian New South Wales Energy Coal (NSWEC) business as a review, opening the potential for it to close its 20mn t/yr Mount Arthur coal mine in New South Wales.

In August 2020 BHP gave itself two years to divest its NSWEC, Cerrejon thermal coal mine stake in Columbia and its 80pc stake in the BHP Mitsui Coal (BMC) low-grade Australian coking coal joint venture. It sold its stake in Cerrejon to joint venture partner Glencore and has agreed to sell its BMC stake to Australian mining firm Stanmore, but it has made no statements on the sale of NSWEC.

The process was framed as a review of NSWEC today, as BHP reported a turnaround in profit for the division based on record breaking prices during July-December. NSWEC made earnings before tax and interest of $404mn in July-December compared with a loss of $208mn in the same period last year, yet BHP did not reverse any of the $1.7bn that it wrote from its value in August. This impairment took the value of the NSWEC business negative to around the cost of rehabilitating the mine site, implying that BHP might decide to close the mine rather than sell it, allowing it to improve its environmental credentials.

The strong thermal coal price makes it more difficult for BHP to decide to close Mount Arthur while it is making a profit for shareholders, but BHP chief executive, Mike Henry maintains that the current price environment is not influencing its decision around the future of NSWEC.

"No decision has been made to hold on to assets based on market prices," Henry said. The firm will make further announcements when the two years are up, he added.

BHP has focused on increasing the quality of its thermal coal sales to take advantage of high premiums for lower ash content. This has cut production and pushed up costs but this has been offset by higher price realisation.

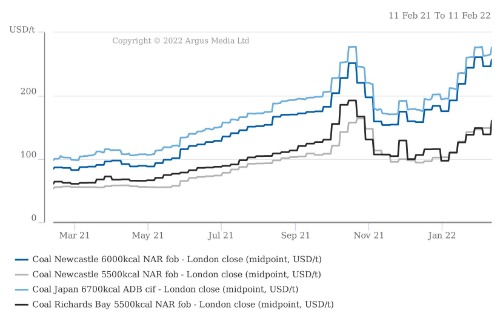

Argus assessed the high-grade thermal coal price at $257.17/t for 6,000 kcal/kg NAR on 11 February, up from $218.83/t on 14 January and from $153.99/t six months earlier. It assessed lower grade coal at $156.08/t fob Newcastle for NAR 5,500 kcal/kg on 11 February, up from $127.52/t on 14 January and from $97.83/t six months earlier.

The softer rebound in lower grade prices has seen the heat-adjusted premium on a NAR 6,000 basis for higher grade thermal coal pass $100/t for the first time in January, although it has eased since. It fell to $86.90/t on 11 February from a high of $100.82/t on 28 January, but was still up from $36.17/t on 28 October and from as low as $1.65/t in 2019 before Beijing's ban on Australian coal took full effect in 2020.