US president Joe Biden's administration is trying to neuter criticism that its policies are standing in the way of the oil and gas industry, as Republicans seize on high fuel prices in hope of making gains in mid-term elections in November.

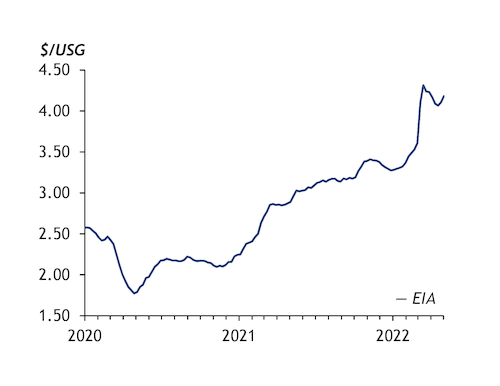

Biden has given oil and gas companies at least some of what they wanted in recent months, offering his administration the chance to deflect blame for US retail regular gasoline prices hitting a record $4.22/USG in March, according to US government agency the EIA. The administration last month announced plans for its first onshore oil and gas lease sale since Biden took office, offering 580km² in nine states with a planned 18.75pc royalty rate instead of the previous rate of 12.5pc. The administration issued export licences for 3.3mn t/yr of US LNG from two projects last month, clearing out a backlog. "There are no permits that are waiting that are on US soil that I am responsible for. We have permitted everything," US energy secretary Jennifer Granholm says.

The actions come after Biden negotiated a deal in March under which EU members pledged to sign long-term deals that are expected to support the construction of a new round of US LNG facilities. Trading firm Gunvor and French gas and power firm Engie last week signed long-term contracts for 3.75mn t/yr of US LNG from two projects proposed along the US Gulf coast. And US energy regulator Ferc suspended plans to put more climate-related scrutiny on new gas infrastructure last month, while signing off on a permit change that would support the completion of the 19.6bn m³/yr Mountain Valley gas pipeline.

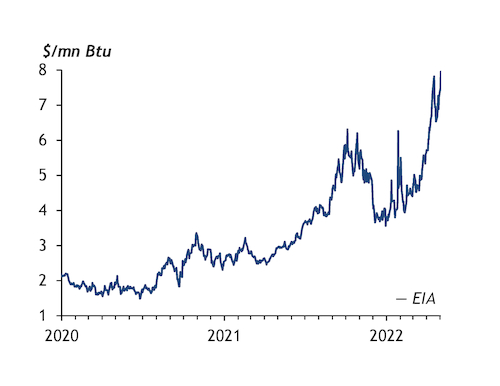

Russia's invasion of Ukraine led the Biden administration to adopt a "war footing" in the need to boost US oil and gas firms' output growth, but "Wall Street is constricting their ability to invest in increased production", Granholm says. US upstream independents enjoying a surge in profitability from higher oil and gas prices continue to prioritise shareholder returns while restraining investment in new drilling. The surge in US LNG exports, which in March neared 12bn ft³/d (340mn m³/d) of natural gas equivalent, poses its own political risk in the form of rising US natural gas prices. Henry Hub futures contracts for June delivery settled at $8.78/mn Btu on 5 May, from less than $4/mn Btu at the start of this year.

The oil industry still sees "mixed messages" from the administration, the American Petroleum Institute's regulatory affairs senior vice-president, Frank Macchiarola, says. For one, the administration intends to charge higher royalty rates for new onshore leases and accept bids on just 20pc of the land initially offered. Another problem is the lack of progress on a plan to sell offshore leases once a 2017-22 plan expires on 30 June, critics say. The US has not scheduled an offshore sale before then and finalising a new one is likely to take at least a year.

Picking sides

Republicans see no reason to give the administration credit for recent steps supporting the oil and gas industry. They say it is too little and too late, after Biden's initial actions last year — such as blocking the 830,000 b/d Keystone XL pipeline — and recent comments from White House officials that they are only resuming leasing because of a court order. "I think that the Biden administration hates fossil fuels," Republican US senator John Kennedy of Louisiana says.

Democrats are looking for a chance to change the narrative around gasoline prices. They plan to hold a floor vote soon on a bill that would give trade regulator the FTC more authority to investigate the possibility of price gouging and price manipulation by the oil sector. "Republicans will face a dilemma," US Senate Democratic leader Chuck Schumer says. "Are they on [the side] of the consumer and lowering gas prices or are they on the side of Big Oil?"