With a new emphasis on renewables projects, refiners will likely opt to push back turnarounds rather than expand capacity to meet demand, writes Dylan Chase

US refiners are executing a few capital projects that will expand domestic crude processing capacity before the end of 2023, but expensive forays into renewable fuel production will likely limit future capacity expansions.

Three of the largest US refiners are working on capital projects in Texas that could add 350,000 b/d of crude processing capacity to the US refining portfolio by the end of next year, partially offsetting the effect of recent closures. The largest expansion under way is ExxonMobil's Blade (Beaumont Light Atmospheric Distillation Expansion) project at its 369,000 b/d refinery in Beaumont. This will add another 250,000 b/d crude distillation unit by next year, in conjunction with the company's plan to increase oil production from Texas' Permian basin.

Valero plans to start-up a 55,000 b/d delayed coker and sulphur recovery unit from the first half of next year at its 395,000 b/d Port Arthur refinery. And Marathon Petroleum is working on the $1.5bn South Texas Asset Repositioning (Star) project at its 593,000 b/d Galveston Bay refinery, which will integrate the Texas City refinery it purchased from BP in 2012 with another that the firm owns in the city. The project is intended to add 40,000 b/d of crude capacity and expand the residual oil processing capabilities when it is completed next year.

These projects, all announced prior to 2019 and delayed by Covid-19 restrictions, have taken on new importance in view of stressed US refining capacity. US refiners have invested relatively lightly in capacity expansions in recent years, with a dimming long-term outlook for road fuel demand running headlong into the short-term demand shocks of the pandemic. Around 1.5mn b/d of US refining capacity was shuttered in 2020-21 in response to the demand slump and it seemed to many observers that less — not more — capacity was needed in the short-term.

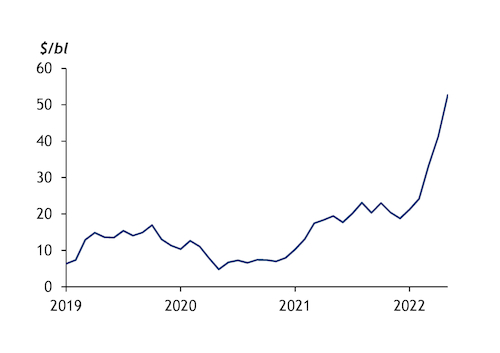

Recent events have reframed those assumptions. Stocks of refined product in the US and Europe have dwindled following sanctions on Russian energy. Refining margins have responded by surging in every key refining centre. There is not much slack in the US refining system to answer the call offered by these prices. The EIA estimates that US crude utilisation will average 93pc in the second quarter, increasing to 94pc in the third quarter — the highest rate in four years.

Green shift

But new US refinery expansion projects are unlikely in the short-term, with firms already managing cost-intensive projects to add renewable fuel infrastructure. These projects promise to bring on 208,000 b/d of renewable diesel (RD) processing capacity by 2024. Valero, Marathon, Phillips 66, PBF Energy and HF Sinclair have recently outlined around $5bn in such investments, with renewables projects absorbing most of some firms' capital expenditure plans.

Phillips 66 has earmarked around 45pc of all growth spending this year for an RD project in its $850mn conversion of the San Francisco refinery in California, as part of a "very constrained" capital approach. Marathon Petroleum has set aside 50pc of its $1.3bn capital outlay for 2022 for converting the shuttered Martinez refinery near San Francisco into a 48,000 b/d RD plant by 2023. Service companies specialising in refinery turnarounds have heralded this shift toward RD production as a new bread-and-butter business line. Matrix Service said late last year that refining sector investments are "moving toward carbon reduction and renewable fuels conversions" that will be a significant part of its future business.

Rather than investing in capacity expansions, refiners will walk the razor's edge by pushing back turnarounds to keep feedstocks — and cash — flowing this summer driving season. This practice is not without its risks, as some refiners have suggested that utilisation rates are unsustainable at current levels.