France met rising first-quarter demand for 10ppm diesel with particularly large stock draws, as import levels were disrupted by the Russia-Ukraine war and the country's refinery system failed to respond.

Customs data show diesel imports of 310,000 b/d in March, down from 355,000 b/d in February and lower by 1pc year on year. Moscow's invasion of Ukraine in late February led some European buyers to refuse cargoes from Russia, which is the region's biggest single provider of diesel and gasoil.

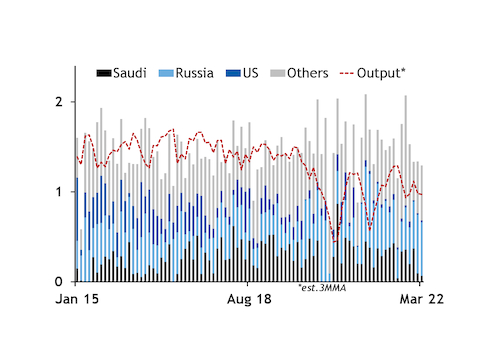

Still, Russia was by far France's largest supplier in the January-March period with 145,000 b/d, albeit this was down from 195,000 b/d a year earlier. Imports from Saudi Arabia fell to 45,000 b/d from 80,000 b/d, with a particularly low 15,000 b/d in March.

The fall in March led French imports to average below 330,000 b/d in the first quarter, down by 22pc year on year and well below 435,000 b/d in the first quarter of 2020. Apparent output — assessed by Argus using import, export, demand and stocks data — was 235,000 b/d in March, down from 260,000 b/d in February and a five month low.

France was short of refining capacity in the first quarter, when TotalEnergies' 219,000 b/d Donges plant failed to hit a planned restart after a prolonged shutdown and the company's 109,300 b/d Feyzin unit tempered crude distillation after a fire.

On top of falling imports and a lack of refining capacity, diesel demand rose by 3pc year on year to 625,000 b/d in the January-March period. This combination of factors led to diesel stocks being drawn by 5.7mn bl in February and March combined, according to Eurostat. The first-quarter stock draw was 6.1mn bl, which Argus calculates left diesel inventories at around 48mn bl — below 10 weeks of forward cover at present levels of demand. Stocks had been around 55mn bl since the start of 2016, when the government boosted storage following strikes and related panic buying.

Refinery utilisation has not improved since the end of the first quarter. Donges is still not at capacity, UK-Chinese Petroineos had works at its 207,100 b/d Lavera unit and planned works at Feyzin has crimped products output. Unions plan a 24-hour all-out strike at all TotalEnergies' domestic refineries, depots and subsidiaries on 24 June.