Shipments from the four largest iron ore producers in Western Australia's (WA) Pilbara eased in the week to 2 July, as Australian producer Fortescue reduced shipments after a seven-week push brought it close to the top of its guidance for 2021-22.

Rio Tinto, BHP, Fortescue and Roy Hill loaded vessels with a combined 17.3mn deadweight tonnes (dwt) of capacity, down from 19.69mn dwt in the week to 25 June and 1pc above 12-month average levels, according to initial shipping data collated by Argus. The dwt tonnage is the maximum capacity of the vessel and overestimates actual shipments by around 5pc.

The return to near-average shipping levels followed three weeks of consecutive 18-month highs, driven by strong performance by BHP and Fortescue ahead of the end of their financial years on 30 June and by Rio Tinto following the start up its 43mn t/yr Gudai Darri mine.

Fortescue is set to come in close to the top of its shipment guidance of 185mn-188mn t for the year to 30 June, despite its exports in the week to 2 July slipping below average for the first time since late April. The firm loaded vessels with 3.58mn dwt of capacity, down from 4.2mn dwt in the previous week and 3.5pc below its rolling average of 3.71mn dwt/week.

BHP is likely to come in the middle of its 278mn-288mn t target on a 100pc basis, after it shipped 6.09mn dwt in latest week, down from 6.27mn dwt the prior week but 5pc above its rolling average. BHP has been less consistent in shipping above average in the past two months than Fortescue.

Rio Tinto's exports returned to average levels after three weeks of strong shipping figures since the opening of Gudai Darri. It loaded 6.41mn dwt in the latest week, down from 7.98mn t a week earlier and 0.5pc below its average of 6.44mn dwt. Roy Hill loaded 1.22mn dwt in the latest week, down from 1.35mn dwt and 1pc above its rolling average of 1.21mn dwt/week.

China was listed as the destination for 86pc of shipments in the latest week, up from 80pc a week earlier. After including shipments with unconfirmed destinations, most of which are probably headed to China, the percentage was 87pc, up from 81pc a week earlier and above the average of 82pc.

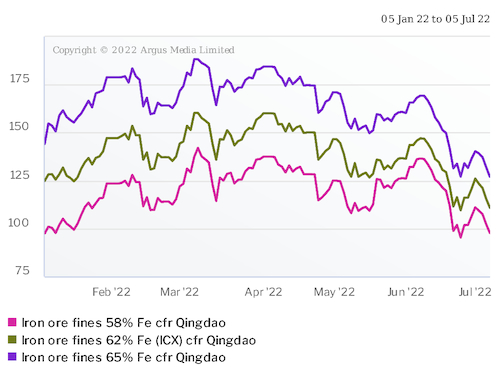

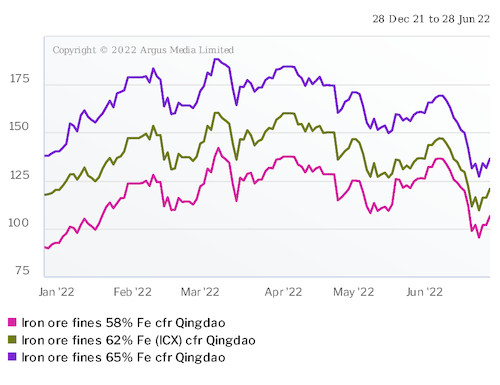

Argus ICX iron ore was last assessed at $110.85/dry metric tonne (dmt) cfr Qingdao on a 62pc Fe basis on 27 June, down from $136.20/dmt on 13 June and $160.20/dmt on 7 March.