Argus Eurobob gasoline combined volumes fell to a four-month low of 246,000t in May, as liquidity on both grades stalled on tight prompt supply and difficult blending economics.

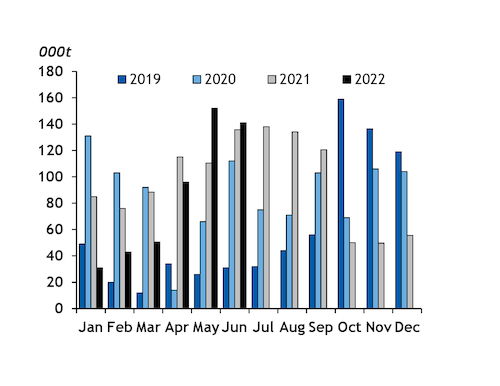

A total of 105,000t of Eurobob oxy barges traded on prompt Argus dates in June, the lowest monthly total since the start of the Covid-19 pandemic in March 2020. It marked a 21pc drop on the month, and was 62pc lower than a year ago.

Eurobob oxy volumes stand at 1.229mn t for the year to date, down from 1.552mn t in the first half of last year.

An extremely tight octane market has weighed on gasoline blending this summer, making it increasingly difficult to blend Eurobob gasoline into finished-grade cargoes. And export routes — especially to the US — have largely been closed since around May. Gasoline consumption in the world's largest market has struggled to pass 9mn b/d for much of the peak summer driving season so far this year, weighing on export demand from Europe.

A spate of unplanned shutdowns is keeping a lid on European run rates, just as the spring maintenance season ends. Fires at Mol's 161,000 b/d Szazhalombatta refinery and Equinor's 203,000 b/d Mongstad refinery, a lightning strike at Bayernoil's 207,000 b/d Neustadt-Vohburg refinery and damage at OMV's 193,700 b/d Schwechat refinery during maintenance, has added to the losses caused by strikes at ExxonMobil's 133,000 b/d Fos refinery in France.

The largest buyer of Eurobob oxy barges in June was BP, taking 39,000t — the firm's most since January. Shell purchased no oxy barges in June, after being the leading buyer in May with 44,000t. The second-largest oxy buyers in June were Gunvor and Varo, who each lifted 20,000t of barges. TotalEnergies and Mabanaft each purchased 10,000t, Hartree took 4,000t, and Vitol 2,000t.

Shell was the largest seller of oxy barges in June, offloading 44,000t last month after selling just 2,000t in May. The next largest seller was TotalEnergies with 23,000t, and then Varo with 21,000t. Hartree sold 12,000t of oxy barges in June, and Vitol sold 5,000t.

Non-oxy Eurobob volumes also fell in June, having reaching a 2.5 year high last month. A total of 141,000t of non-oxy traded in June, down by 7pc from May's 152,000t, but up by 4pc from June 2021. A total of 513,500t of non-oxy has changed hands since the start of the year, down by 16pc on 2021.

Varo remained the largest buyer of non-oxy gasoline, purchasing 104,000t in June, up from 99,000t in May. BP purchased 18,000t of non-oxy barges, while ExxonMobil purchased 6,000t. Other buyers included Gunvor with 4,000t, Shell 4,000t, Mabanaft 2,000t, TotalEnergies 2,000t, and BMW Mineraloel 1,000t.

The largest seller of non-oxy gasoline in June was TotalEnergies at 64,000t, followed closely by Shell, which sold 61,000t. Hartree sold 10,000t of non-oxy in June, and BP sold 6,000t. All of those firms were on the sell side in May, as was Glencore, which had sold 4,000t of non-oxy in May but did not sell in June.