US demand for southern Europe's surplus bitumen has sharply increased in the last few weeks as the economics to move product transatlantic have improved significantly.

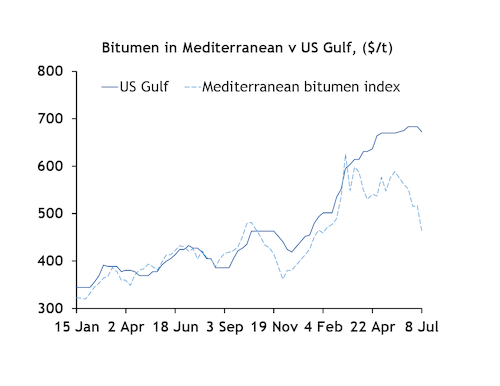

Argus price assessments show the spread between the Mediterranean bitumen index and US Gulf coast values widened to over $200/t on 8 July, compared with under $100/t at the start of May and around $30/t at the start of this year. Last year the US Gulf fob bitumen price averaged just $5/t above Mediterranean values, keeping the arbitrage almost entirely closed.

The transatlantic arbitrage was last a significant factor in the bitumen market between 2017 and 2020, when a series of refinery closures on the US east coast and strong demand for road paving helped soak up plentiful supplies in Europe — mostly from Spain but also from Greece, Turkey, Italy and Belgium. Now it is Turkey and Greece that have more surplus product to export.

Up until April the US had imported only around 18,000t of European bitumen this year, but recent shipments have substantially increased that to well above 100,000t. Imports were just 53,000t across the whole of 2021, according to data from the US EIA, compared with almost 228,000t in 2020 and around 445,000t in 2019. Mediterranean exporters face stiff competition for US market share from Canada, where bitumen production has increased. Canada exported around 325,000t of bitumen to the US in December, the highest since the EIA began tracking data in 1993.

In the US, below-average inventories, peak seasonal demand and relative tightness in residual refinery yields continue to support bitumen prices. But in the Mediterranean region, demand has been held back by delays to work in the key north African market and bitumen consumption in southern Europe also made a slow start to this year. Recent weakness in high-sulphur fuel oil (HSFO) prices in Europe has also helped to drag regional bitumen values lower, as bitumen typically trades as a differential to HSFO. Refineries in Europe are running as flat out as possible to meet strong demand for middle distillates, and in doing so they are also producing plenty of HSFO and bitumen, which are in less strong demand.

Recent shipments to the US from the Mediterranean include the 37,000 deadweight tonne (dwt) Star River from Turkey, which arrived in New Hampshire on 14 July. The 46,000 dwt Bitu Express went from Greece to make a partial delivery in west Africa before arriving in Maryland on 12 July. And the Judge, another 37,000 dwt vessel, moved from Turkey to New York then Florida around the start of July.

Latin America has also been on the radar of bitumen traders, with limited availability and high prices there attracting arbitrage suppliers from the Mediterranean, especially into Argentina. Despite the high cost of freight this year, bitumen moving longer distances is becoming more common. South Africa has become predominantly an import market as only one refinery in the country is still producing bitumen, and supplies from both the Mediterranean and Asia-Pacific, including Singapore and Malaysia, have arrived recently.