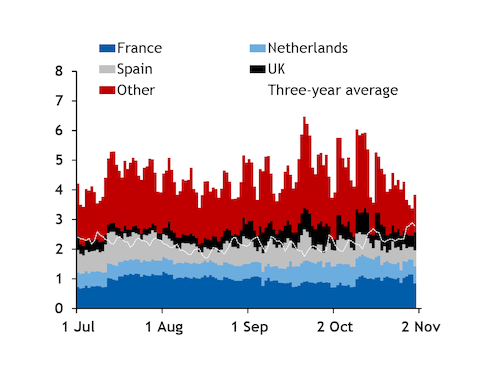

European LNG sendout reached a new monthly record for October over the past month, as regasification reached all-time records in Croatia and the Netherlands.

October regasification of 4 TWh/d still held below the all-time monthly high of 4.8 TWh/d in April but was well above the previous October record of 2.8 TWh/d in 2019 (see sendout graph).

Sendout reached a new all-time record in the Netherlands at 620 GWh/d in October, the first full month since the country's 6.2mn t/yr Eems Energy Terminal began operations in mid-September.

And regasification also rose to its highest for any month at Croatia's 2.25mn t/yr Krk facility at 81 GWh/d.

Sendout in Belgium, France, Italy, Lithuania and Poland also rose to their highest in October for the month (see data & download).

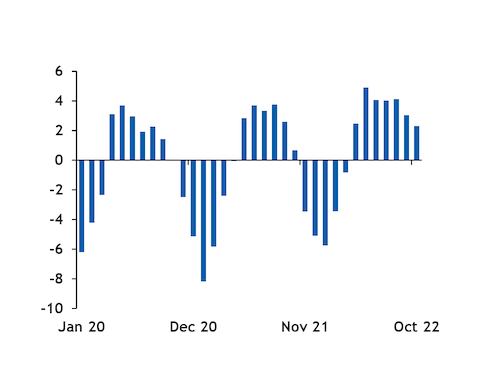

The strong regasification was spurred by unusually quick underground storage injections which averaged 2.3 TWh/d over the month in the EU and UK — according to the AGSI+ transparency platform. This was the highest for any October on record, even as the stockbuild slowed to its lowest for any month since April 2022 (see injections graph).

And while October UK regasification of 600 GWh/d was the highest for the month since 2019, it ticked down from September as high storage site levels and weak consumption muted the country's ability to absorb strong supply.

The UK's three LNG sites averaged 75pc full in October, the highest for any month since November 2021, and the country's underground sites had just 2GWh of spare space at the start of the month besides the Rough storage site where injection capacity is limited at 64 GWh/d. The UK's October gas consumption also fell to its lowest for the month since at least 2010, as high gas prices and mild weather reduced consumption.

Iberia bucks trend

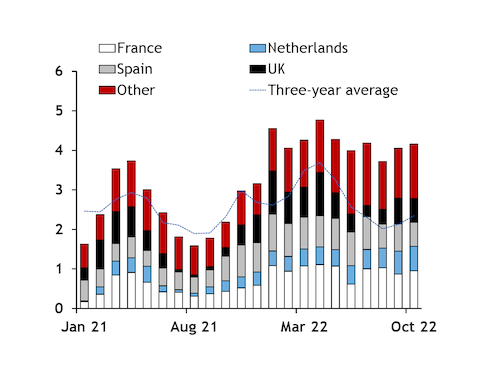

Sendout in Spain and Portugal was slow as weak consumption and high stocks also limited the peninsula's ability to absorb supply.

Spanish sendout was the second-lowest for 2022 so far at 610 GWh/d, 10 GWh/d below regasification a year earlier. And regasification at Portugal's 6.9mn t/yr Sines facility fell to its lowest for any month since June 2018.

Demand from households and small businesses fell to its lowest for any October since at least 2005 in Spain, and since at least 2013 in Portugal. This drove aggregate consumption in Spain and Portugal to its lowest for the month since 2018 and 2015, respectively. And Spanish LNG stocks averaged 84pc in October, the most for any month since November 2019.

And Spain continued to import consistently from France at the Pirineos point since late September, further reducing the country's ability to absorb additional supply.