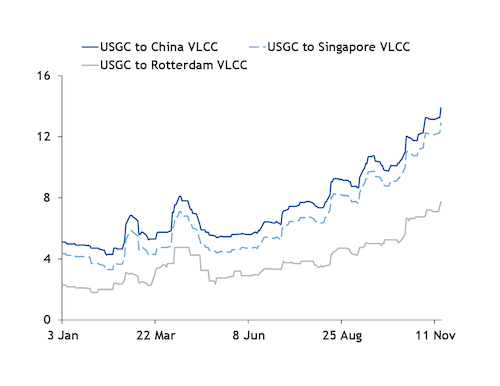

Freight rates for eastbound very large crude carriers (VLCCs) loading on the US Gulf coast climbed to their highest levels since April 2020 on the back of record US crude exports to Europe and China's five-month high of crude imports. And there are no signs of a letup in European demand as a ban on Russian crude imports takes effect next month.

The VLCC rate to ship WTI cargoes from the US Gulf coast to Europe on 16 November climbed to $7.75mn lumpsum, or $3.68/bl for WTI, including load-port fees of $250,000, a nearly 200pc increase from a year earlier. The increase comes after the US exported 1.47mn b/d of crude to Europe in the first nine months of 2022, according to the US Census Bureau, the highest rate on record since the US Congress lifted a 40-year ban on exporting crude in December 2015. With costs high, at least 40 VLCCs are at or heading to the US Gulf coast for loading within the next 30 days.

VLCC rates in the Mideast Gulf and west Africa are also at their highest levels since 2020 as the global fleet is stretched by shifting crude oil flows following Russia's invasion of Ukraine and a healthy appetite for crude imports into China.

The last time VLCC rates were this high was in mid-2020, when plummeting crude prices and a contango market structure sparked a dash to secure floating storage.

Heightened European demand for US crude likely will continue after the 5 December EU ban on Russian crude imports, and the final 15mn bl release from the Strategic Petroleum Reserve could help bolster crude exports in December, further adding upward pressure on VLCC rates.

With US-to-Europe crude demand high, VLCC owners could be reluctant to leave the Atlantic basin, helping them charge a premium for voyages from the US Gulf coast to Asia, which is almost three times as long as a US-Europe voyage. The freight rate for a China-bound VLCC on 17 November was $7.08/bl for WTI cargoes, the highest since April 2020 and up from $2.73/bl a year earlier.

Although China's domestic oil consumption has been reduced by Covid-19 lockdowns, the country's crude imports hit a five-month high of 10mn b/d in October as the Chinese government raised the country's refined product export quotas in a bid to benefit from a tight international diesel market.

Freight costs have pushed the time charter equivalent rate, which represents the daily earnings or loss for a shipowner, for a scrubber-fitted VLCC bound for China to $94,476/d on 17 November, up by 46pc from a month earlier. The non-scrubber TCE rate on the same route is $82,646/d, up by 76pc from a month prior.

It's been a long time

Shifting oil flows and limited tanker fleet growth are expected to support the crude tanker market, tanker owner DHT Holdings said.

More cargo in the market, compared with last year and the first half of this year, is combining with shifting European trade patterns toward non-Russian crude, which is increasing transportation distances, decreasing tanker productivity and pushing rates higher. Shipbuilding is limited despite an aging world fleet and growing demand for oil transportation, creating a "rewarding environment for large tankers," DHT said.

"It's been a long time since we've seen so many positive elements in structuring the market that we are entering into now," said Svein Moxnes Harfjeld, the chief executive of DHT.

With the looming EU ban on Russian seaborne crude imports, the continent will look elsewhere — and farther afield — for oil. Compared to seaborne imports from the Baltic region, imports from the US and west Africa must travel five times as far, DHT said. Voyages from the Mideast Gulf and China must travel seven times and 11 times as far, respectively.

Volatile Aframax and Suezmax markets have helped VLCCs increase their market share for transatlantic voyages to 20pc from almost nothing this year, according to Gibson Shipbrokers.

The freight rates on 14 November to ship WTI cargoes via Aframax and Suezmax from the US Gulf coast to Europe were $6.89/bl and $3.75/bl, respectively, compared with $3.37/bl for VLCCs.

"As long as VLCCs continue to offer a superior [per barrel rate] to the Aframax and Suezmax sector, they can expect to continue enjoying increased market share," the shipbroker said.

Though the US Gulf coast-Europe route is shorter than voyages to Asia, the shifting market share keeps the VLCC supply in the Atlantic and away from position lists in the Middle East.

Vortexa data show VLCCs carried only about 5,800 b/d of US crude to Europe in January, steadily rising to 448,000 b/d in July before falling to about 320,600 b/d in October. In 2021, VLCCs carried about 38,600 b/d of US crude to Europe.

Antwerp-based crude tanker owner Euronav said the crude tanker markets are well-positioned based on strong fundamentals including order books at 25-year lows. Construction will be hampered by high vessel prices and increased regulations, while shipbuilding capacity will be constrained until 2025-26 by LNG carrier and container ship contracts, the company said.

By Tray Swanson and Matthew Mitchell