Cold weather combined with gas supply disruptions and power plant outages could pose a risk to power supply security in some European countries this winter, in particular France, according to grid association Entso-E's winter 2022-23 outlook.

But measures to reduce demand and bring on line additional generation capacity, increased regional interconnector capacity and an improved supply outlook in Norway are offsetting the likelihood of system adequacy issues.

CWE

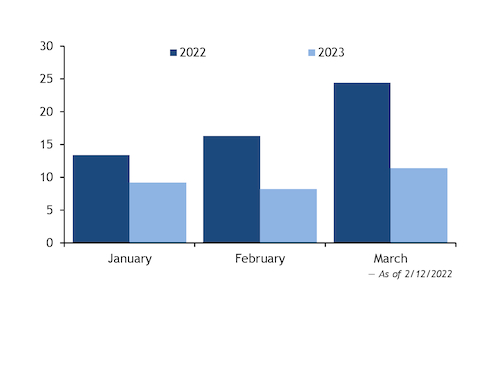

Supply risks in France are higher than in previous winters owing to low nuclear availability expected to be 5GW lower than normal scenarios, according to Entso-E.

Nuclear unavailability during January-March 2023 is scheduled at 9.6GW as of today, which compares with 18.1GW during the same period this year (see chart).

Considering France's reliance on electric heating, cold weather would also add pressure to supply. Overnight temperatures in Paris between December 2021-February 2022 were on average 0.6°C higher than historical norms, while they stood 1.5°C above norms across November.

Voluntary saving measures already led to a strong drop in demand during September, Entso-E said. French power demand in November was 50.5GW, more than 10GW lower on the year.

The reopening of coal-fired plants and close co-operation and exchange with neighbouring countries could mitigate adverse adequacy effects, Entso-E said.

Belgium and the Netherlands are not expected to experience supply problems.

Ireland

Ireland, alongside France, would still face notable adequacy risks even with demand reductions, Entso-E said, owing to its ageing fleet of power plants, which have been increasingly unreliable.

This echoes Irish grid operator EirGrid's assessment of winter that put derated margins at minus 9MW, or minus 0.2pc, in its base case scenario. Its low demand scenario would be 1.5pc but still well below the country's reliability standard.

Forced outage rates have risen over the past five years owing to the ageing of power plants. And tight margins over summer have led to planned maintenance being delayed at some units, which could increase the risk of forced outages this winter.

Northern Ireland also faces risks, largely around the fact that a single large failure could cause adequacy issues, echoing EirGrid's outlook. The Irish all-island system remains dependent on imports from Great Britain in most cases, Entso-E said.

Germany

None of the scenarios explored by Entso-E see adequacy concerns for Germany, but the stressed situations in France, Poland and Sweden mean increased risks for Germany compared with previous winters.

To strengthen security of supply, the country allowed the return of coal and oil-fired plants in the grid reserve to the market and the extended operation of coal-fired plants set to enter the grid reserve at the end of October under the country's third coal phase-out tender, and the extended operation of Germany's three remaining nuclear plants beyond scheduled decommissioning at the end of 2022 until 15 April.

But Entso-E said that while the extension of nuclear plants strengthens security of supply, the decline in efficiency as the fuel elements burn up will mean that only about 2.5GW of capacity will be available in March. The country's largest nuclear reactor, the 1.4GW Isar 2 plant, will go off line on 5 March, according to a Remit notice published this week.

The Entso-E study assumed an additional 6.7GW of coal and lignite-fired capacity would be available to the market, but this will reduce the available non-market resources. An additional 1.5GW of coal-fired capacity that was not assumed to be returning to the market in the input data will also be available to the market.

In the tensest situation explored for Germany in the winter outlook, which assumed low nuclear availability and constrains on fossil fuels, an increasing share of the country's power supply would be provided by gas, with about a 9pc increase in gas consumption. Potentially reduced gas availability at the end of a very cold winter would pose a more significant risk in this scenario as opposed to the "reference" scenario. Current forecasts suggest minimum temperatures in Essen will fall below long-term averages for most of 3-14 December, but then rise above the long-term average again. And German meteorological agency DWD has forecast the average temperature in the country at 2°C in December-February, above the long-term average.

Austria, Switzerland

Entso-E does not foresee adequacy concerns for Austria, in the case of "drastic" reductions of gas availability in the rest of Europe, but the country may not be able to ensure secure domestic supply of power.

And practical operational experience of transmission system operator (TSO) APG indicates that published values are underestimating the actual critical gas volume needed to ensure security of supply as heat volumes of combined heat and power plants, and gas supply for redispatch are not considered in the current approach.

Switzerland is not expected to face adequacy concerns throughout the winter. The country recently procured a 400GWh hydropower reserve, which will be held until 15 May, and is also establishing a 250MW reserve power plant which can operate with gas, oil or hydrogen.

Iberia

Spain and Portugal this year faced one of the worst droughts ever recorded in the Iberian Peninsula, with reservoirs only starting to recover in October with the wet season.

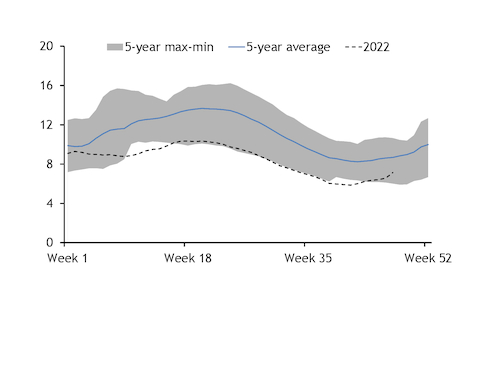

The latest data show that Spanish hydro stocks rose at the fastest rate in one year in week 47, but reserves were still at just 31pc of capacity, about 18pc below the five-year average and 26pc lower than the 10-year average.

Tight adequacy margins are forecast in the Spanish power system if hydro reservoirs remain low, according to Entso-E, as power exports from Spain to France and Portugal are expected to remain strong.

Spanish net exports to France reached 1.62GW in November, up from 1.18GW in October and the third highest for any month, just below 1.95GW in August and 2.43GW in September this year.

Gas-fired generation is expected to remain strong in the region and particularly in Spain, as export demand is mostly met by local gas-fired plants, but no risks were identified for gas supply, Entso-E added.

Italy

A severe cold spell, low import availability or higher-than-expected unplanned maintenance can lead to critical adequacy risks in Italy.

Up to 4GW of imports will be necessary for Italy to restore adequacy margins and to cover consumption in critical hours, Entso-E said. The 1.2GW Savoie-Piemont interconnector became operational in early November.

Italy has increased its renewable and conventional power-installed capacity to 58.5GW and 61.1GW, respectively. Moreover, increased coal-fired generation has been offsetting low hydropower output given hydro reservoirs standing at their lowest for this period in several years.

Both the last week of December and the first week of January are expected to be the most critical for adequacy purposes. TSO Terna could enhance co-ordination with neighbouring TSOs, postpone maintenance and promote voluntary curtailments in demand.

Nordics, Baltics

Supply security in the Nordics will come under greater risk if cold weather emerges with low wind, while supply has been constrained by a halt to Russia-Finland power flows this year.

Supply will gain a boost if the long-delayed 1.6GW Olkilutoto 3 nuclear unit starts up as planned on 22 January 2023.

Norwegian TSO Statnett has changed its assessment of the winter power situation to normal from tight owing to sufficient power supply in Norway and available imports from neighbouring countries.

Sweden's strategic reserve capacity remains unchanged from last year at 562MW.

No adequacy issues are expected in the Baltics over winter. From 1 January 2023, an additional 520MW of reserve capacity will be available to the Lithuanian grid.

CEE

The Czech Republic, Slovakia and Poland are not likely to experience system adequacy problems this winter.

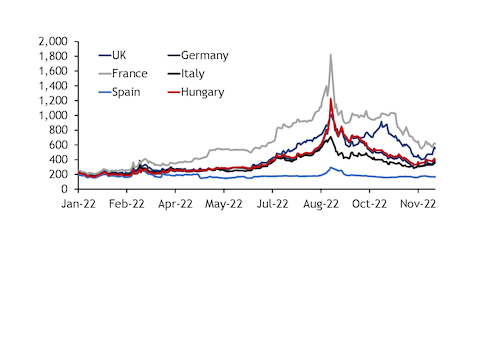

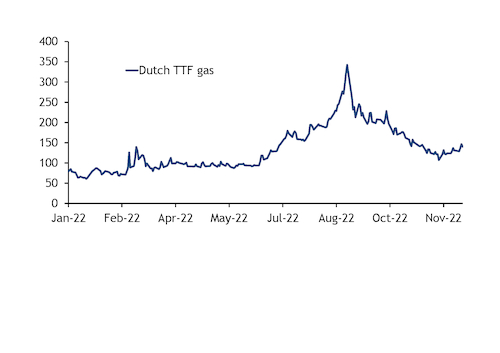

Czech gas-fired generation — which accounted for about 6.8pc of its generation mix so far this year — could come under pressure as gas forward prices remain high (see chart). Start-up tests at the 471MW Mochovce 3 nuclear reactor in Slovakia started in October and full commercial production is expected in early 2023. Polish TSO PSE expects no limitation in coal stocks, supporting the outlook for coal-fired generation.

Hungary is only likely to face difficulties under severe weather conditions or in the event of a continued gas disruption. But Hungary expects no significant disruption owing to low levels of plant maintenance this winter despite a possible new peak load demand record being reached this winter. Cold, dry weather could limit Serbia's ability to cover its own demand over the winter. Most plant maintenance has finished — the 200MW of hydropower capacity set to be off line during winter will not disrupt the grid system, according to Serbian grid operator EMS.

Neither Croatia nor Slovenia expect adequacy issues in winter, while the latter market has implemented several measures to reduce demand this winter, such as turning off lights in public buildings, which, along with limiting power consumption earlier this year, has supported stocks of coal and other primary energy sources, Entso-E said. The recently completed interconnector between Slovenia and Hungary will help to shore up regional power supply.

SEE

Romania could face adequacy issues in the peak-load period in the event of low wind and solar power production.

The country needs to import 1.5-3.0GW from neighbouring countries to cover demand, and it is uncertain that there will be available power to import during winter. Unforeseen outages in production units can pose critical issues. Higher demand during peak load, a lack of energy storage facilities and demand-side response increase the adequacy risk. The halt of Ukrainian exports to Moldova is also heightening the risk, as Romania is covering for a big share of Moldova's power demand through exports. TSO Transelectrica expects lignite-fired generation to increase during winter to limit inadequacies. The country postponed the decommissioning of the 330MW Rovinari 3 and Turceni 7 lignite-fired units that were originally scheduled to close at the end of this year.

Bulgaria has completed maintenance at all of its thermal power plants. The country may face adequacy risks only as a result of severe weather conditions and unplanned outages at its thermal and nuclear units. Hydropower generation is not able to offset these risks, as Bulgaria has limited hydro stocks as a result of restoration works at the largest Bulgarian hydro cascade, while the country's 864MW Chaira pumped-storage hydro plant is also off line.

No adequacy issues are expected in other southeast European markets.