Biomass-fired power generation in northwest Europe (NWE) dropped to its lowest since at least 2018 this year, as utilities faced supply tightness, rising fuel costs and regulatory uncertainty.

Biomass burn for power in NWE dropped by 712MW on the year to 3.7GW on an average hourly basis in 2022, with output having fallen in all countries in the region except France (see table for assumptions and data sources). This implies an annual drop of 3.4mn t of wood pellet equivalent, assuming an average efficiency of 40pc at all generating units.

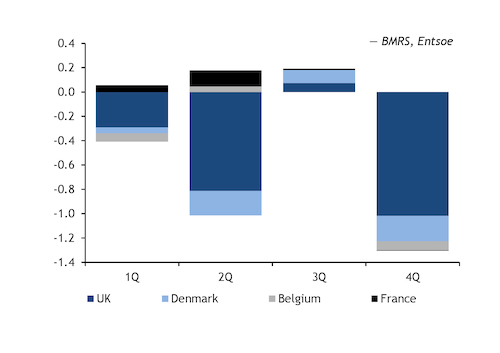

The drop in output was notably higher in the fourth quarter for all countries, as unusually mild weather for most of October-November, a sharp increase in spot wood pellet prices to record highs in September-October and uncertainty over how the EU and the UK would implement then-planned power price caps resulted in utilities cutting generation.

This was different to the market dynamic in the first half of 2022. Generation dropped in January-June because of delays to wood pellet deliveries in the first quarter and as many utilities brought maintenance forward to the second quarter following the start of the Russia-Ukraine war, in a bid to stock up for winter when supply was expected to tighten as a result of disruption to wood product trade with Russia and Belarus.

A halt in biomass burn at Danish firm Orsted's 380MW Studstrup 3 power plant following a fire at its silo in late September also weighed significantly on Danish output in the fourth quarter. Biomass-fired generation in the country dropped by 210MW in October-December to around 500MW, although output in December held 40MW higher than a year earlier. Danish biomass-fired generation had dropped by a similar 200MW in April-June to around 350MW, as some plants brought forward maintenance or switched to burning coal to save pellets for winter.

Biomass burn for power also dropped in Belgium in October-December, by 75MW to 170MW, similar to a drop of 68MW in the first quarter, while overall output increased during the summer. In contrast, biomass-fired generation in France fell by just 4MW on the year to around 350MW in the fourth quarter — as mild weather in October-November pared demand — having increased by an average of 65MW to over 420MW in the first nine months.

Dutch output in January-October, the latest period data are available for, also dropped significantly, by 130MW to 966MW, having fallen year on year in all months during the period except June and July.

UK sees largest drop in 2022

The largest decline in 2022 pellet-fired generation was in the UK, where it fell by around 520MW, or 23pc, from a year earlier. The drop was particularly prevalent at units that generate under the UK's contracts for difference (CfD) scheme — namely UK firm Drax's 645MW unit 1 and all three units at the 405MW Lynemouth plant. Output at these dropped by 187MW and 240MW on the year to 270MW and 135MW, respectively, in 2022. Lynemouth's unit 2 did not generate any power for seven months of 2022, with units 1 and 3 inactive for most days in the second half of the year.

The CfD units have had to pay back the Low Carbon Contracts Company — which operates the scheme — for any generation since April, as the base-load market reference price (BMRP) held above their respective strike prices — at £126.37/MWh for Drax and £132.48/MWh for Lynemouth in 2022. The BMRP, which is calculated based on forward power prices, was set at £168.25/MWh for the summer 2022 season and at £405.26/MWh for winter 2022-23.

Combined with rising generation costs — as spot industrial wood pellet prices rose to record-highs in 2022 — this offered an incentive for biomass-fired units under the CfD scheme to buy power from the spot market to meet contractual obligations and sell biomass back to the market, whenever spot prices for each commodity allowed.

Drax said earlier this month that it had bought back "certain existing forward-sold power sales for 2022 on its ROC [renewable obligation certificate] units" in October, when power and gas prices dropped as unusually mild weather pared demand.

| European biomass-fired slumps in 2022 | ||||||

| Power generation MW | mn t of wood pellet equivalent | |||||

| 2021 | 2022 | ± | 2021 | 2022 | ± | |

| Northwest Europe | ||||||

| UK, Drax | 1,806 | 1,527 | -279 | 8.4 | 7.1 | -1.3 |

| UK, Lynemouth | 375 | 135 | -240 | 1.7 | 0.6 | -1.1 |

| UK, Markinch | 42 | 43 | 1 | 0.2 | 0.2 | 0.0 |

| Denmark | 557 | 469 | -88 | 2.6 | 2.2 | -0.4 |

| Belgium | 215 | 192 | -23 | 1.0 | 0.9 | -0.1 |

| France | 357 | 403 | 47 | 1.7 | 1.9 | 0.2 |

| Netherlands (Jan-Oct) | 1,096 | 966 | -130 | 5.1 | 4.5 | -0.6 |

| Total NWE, excl Germany | 4,447 | 3,735 | -712 | 20.7 | 17.3 | -3.4 |

| Finland | 744 | 678 | -65 | 3.5 | 3.1 | -0.3 |

| Czech Republic | 284 | 277 | -7 | 1.3 | 1.3 | -0.0 |

| Poland | 219 | 184 | -35 | 1.0 | 0.9 | -0.2 |

| Italy | 690 | 647 | -43 | 3.2 | 3.0 | -0.2 |

| Portugal | 375 | 372 | -4 | 1.7 | 1.7 | -0.0 |

| Rest of Europe | 2,312 | 2,158 | -154 | 10.8 | 10.0 | -0.7 |

| Total Europe, excl Germany | 6,760 | 5,893 | -866 | 31.4 | 27.3 | -4.1 |

| Notes: Generation efficiency assumed at 40pc. 2022 data for until 29 December. Total NWE assumes Dutch generation in Nov-Dec flat from earlier for each year. Entsoe data is for units 100MW and over, and includes wood pellets and any other form of biomass. | ||||||

| —Argus, BMRS, Entsoe | ||||||