A more positive demand outlook has spurred a flurry of activity, after the government dropped its zero-Covid policy in December

China's state-controlled Sinopec has significantly increased its purchases of crude to arrive in the first quarter — signalling renewed confidence in the domestic oil demand outlook.

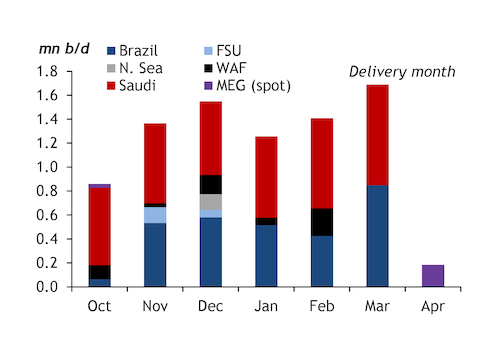

Sinopec's crude receipts are on course to rise by around 15pc in the first quarter compared with October-December (see graph). Brazilian and Saudi crude imports represent the bulk of the increase, with Sinopec taking as much as 840,000 b/d from each country for March arrival.

Sinopec's receipts of Saudi crude in March will hit a 10-month high, Argus surveys indicate. The oil giant bought 870,000 b/d for arrival in May 2022, little anticipating that a punitive lockdown would be under way in Shanghai when the cargoes arrived. The company subsequently cut Saudi imports sharply for the second half of 2022.

President Xi Jinping's zero-Covid policy caused economic growth to slow to 3pc last year and oil demand to contract by around 700,000 b/d. China is likely to reverse those demand losses this year, as the government turns its focus back to economic growth. Mobility indicators, and domestic gasoline margins, have raced up following China's reopening. Sinopec is the world's largest refiner, operating around 6.3mn b/d of crude distillation capacity, and it has an outsize role in guaranteeing Chinese fuel supply.

The refiner appears to have halted around 240,000 b/d of ESPO Blend imports in response to a ban on the provision of western financial and logistical services for Russian crude from 5 December. It took no ESPO Blend from the January or February loading programmes, Argus surveys indicate.

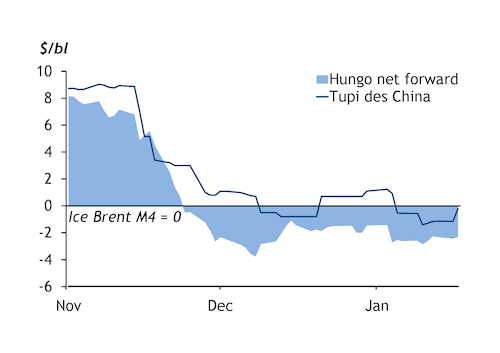

But its renewed thirst for Brazilian crude will more than offset lower purchases from Russia. Brazilian Tupi has, historically, competed with ESPO Blend in the Chinese market. Sinopec's December buying spree coincided with a sharp drop in premiums for Brazilian Tupi to Ice Brent, as weak European demand for west African grades led to an overhang of competing sweet crude being available in the Atlantic basin (see graph).

INE impact

Europe's desire to replace Russian crude boosted its purchases of Norwegian medium sour Johan Sverdrup, pushing up prices and making it unprofitable to ship the grade to China for much of last year. But Johan Sverdrup prices fell in late summer, making it cheaper to send the grade to China than medium sour Oman. Sinopec, the largest physical buyer of Omani crude through Dubai's DME exchange, bought at least 4mn bl of December-arriving Johan Sverdrup and reduced purchases of Oman, causing DME prices to slip. The Norwegian grade is heavier than Oman, but sweeter.

This helped trigger a slide in DME values relative to Ice Brent futures as well as to China's Shanghai INE crude futures exchange — the latter is seldom used to meet physical crude requirements and unused for hedging. But Oman is one of seven grades accepted for physical settlement of short positions by INE, and an arbitrage to deliver the grade opened in September even as lockdowns intensified. INE crude stocks fell to 2mn bl in late September before rising by 70,000 b/d in the fourth quarter to 10.1mn bl.

The DME-INE arbitrage is now closing again, even as Chinese oil demand rallies, because Sinopec has returned to the Mideast Gulf spot market to meet expected physical crude requirements. The state-controlled refiner bought a hefty 5.5mn bl of UAE medium sour Upper Zakum this month on the Mideast Gulf spot market for April arrival.