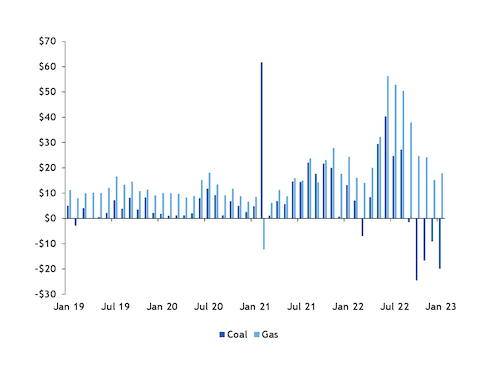

Profit margins for coal-fired generation in much of the US were at their lowest level for any January in at least 11 years earlier this month despite recent coal price declines.

Since the end of December, generators may be losing money dispatching coal power into the midcontinent and eastern US, Argus' day-ahead spark spreads show. That is counter to typical patterns, where power prices and coal profit margins rise during the height of winter heating demand.

The greatest pressure on profit margins was at the start of the year, when power prices were lower and coal prices were higher. The peak day-ahead spark spread for 10,000 Btu/kWh coal units at the Indiana power hub — a reference point for generation in the Midcontinent Independent System Operator (MISO) — was -$30.69/MWh on 3 January, the lowest for any January day since Argus began assessing the market in 2012. Peak coal sparks since then have remained negative and averaged -$19.86/MWh for the month through 20 January, also the lowest January in Argus records.

Peak day-ahead coal spark spreads in the PJM Interconnection West and Southern Company's power grid have had a similar pattern as those at the Indiana power hub. The records for PJM West and Southern go back to January 2005.

The Electric Reliability Council of Texas (ERCOT) and the Northern Illinois power hub are the only midcontinent locations assessed by Argus where this month's average day-ahead coal spark spread is not a record low for January. The average day-ahead margin in ERCOT was -$4.85/MWh in the month through 20 January, a three-year low for the month.

The day-ahead spark spread for coal dispatch at the Northern Illinois basin has averaged $12.67/MWh so far this month. That is down from January 2022's average of $19.65/MWh but well above the averages for January 2019-2021.

Coal generation dispatch in the western US also has been profitable. But there are fewer coal-fired power plants there than there are around the Indiana power hub, PJM West, Southern Company and ERCOT.

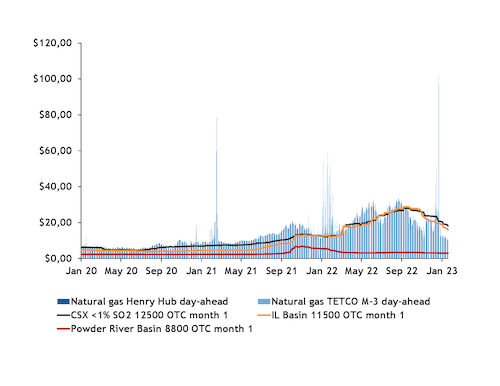

Coal prices have mostly declined so far this year. Prompt month CSX rail-originated coal with 12,500 Btu/lb and Powder River basin (PRB) 8,800 Btu/lb coal were assessed at $133/short ton and $15.45/st on 20 January, compared with $150/st and $15.60/st at the end of 2022. PRB coal also is lower than it had been in January 2022, which could support coal profitability in some regions. But CSX coal is still well-above where it had been a year ago, putting stress on coal generation dispatch margins in the eastern US.

In addition, natural gas prices are well below where they had been in January 2022. That has helped natural gas generation dispatch maintain profitability even during recent periods of lower power prices.

And while coal-fired generation is lagging year-earlier levels in most of the US, natural gas is mostly flat to higher than in January 2022. In MISO, coal power averaged 570,292 MW/d 1-22 January, while natural gas was 566,543 MW/d. A year earlier, coal was 681,404 MW/d and natural gas was 564,733 MW/d.